This report tracked headlines printed in the Detroit Free Press from Jan. 1, 2000, to Dec. 31, 2020, to find stories about subsidized job deals that made the front page. Front page news stories in Michigan’s largest newspaper announced the creation of a total of 123,060 new jobs during this period. State reports show these deals created just 10,889 jobs in the end, a success rate of just 9%. Only one in 11 of the announced jobs in these front page stories ever came to fruition. The report details the results of the deals covered in these stories and explains why politicians continue to subsidize companies to create jobs despite this long track record of failure.

A one-page summary of the report is available here.

It’s a regular story on the front page of the newspaper. A big business chooses Michigan to locate its next project, spurred by a deal for tax breaks, a government subsidy or some other fiscal favor from the state or local government. The company says it plans to create hundreds or even thousands of jobs. Everyone agrees this is going to be a good thing for the state economy.

That’s typically where the story ends. Whether these announced deals deliver the jobs and economic impact they promise is a different story, and one that rarely makes the papers. This report reviews big job announcements made in Michigan and tracks what became of them.

Success is rare. Front page news stories in Michigan’s largest newspaper from 2000 to 2020 announced the creation of a total of 123,060 new jobs. State reports show these deals created just 10,889 jobs in the end, a success rate of just 9%. Only one in 11 of the announced jobs in these front page stories ever came to fruition.

People should know that the stories about government subsidy programs that make it into the news rarely work out as planned. Reporters who cover these economic development deals should recognize that the certainty that their sources portray about these deals is an illusion.

Economists have studied state economic development programs with sophisticated statistical methods to isolate their economic effects. They tend to find that these programs are ineffective tools to improve state job growth, distortionary to other economic activity and expensive to the governments that offer them.[1]

Even when the companies do create the jobs they promised, there are reasons to be skeptical that the taxpayer-financed favors were necessary. Businesses need to earn a profit to survive. If it is more profitable for a company to move to or expand in a certain location compared to another, it is likely to choose the most profitable site. In other words, there might not really be much competition over where companies involved in these deals decide to set up shop.

Some of the state’s assistance programs do not require companies to do anything they weren’t already planning to do. In other words, state deals can result in extra taxpayer expense but no extra job creation beyond what would have happened anyway.

It might be unfair to expect reporters to express skepticism about whether the deals might happen without state favors and whether they will create the jobs announced. Both the administrators of state deals and the companies receiving them agree on these projections and are clearly planning to expand. Reporters rarely get access to the internal company information upon which these projections are based. It would be strange to see an outsider, a third party to the negotiations, declare that these deals are not going to do what both the public officials and company leaders say they are going to do.

The claims made in these stories are also incontrovertible; they cannot be denied or refuted at the time they are made. A company spokesman says that the company will create jobs. The pledges about what the company will do in the future cannot be fact-checked as they involve something that has not yet occurred. Unless the company involved in a deal does something illegal that warrants further attention — which happens on occasion — there is nothing in the story that can be contradicted.[2]

The news stories about these deals thus take on a tone of certainty. A front page story in the Detroit Free Press from 2000 about an online grocery store called Webvan provides a good example. The article states, “Webvan’s Livonia center would employ 900 people within three years, with an average salary of $550 per week ($1,000 per week adjusted for inflation). About 180 to 200 of the jobs would be managerial and professional positions paying an average of $50,000 a year (around $91,000 adjusted for inflation).”[3]

Yet this certainty should be questioned and doubted. Similar pronouncements from lawmakers and elected officials have a poor record of delivering on their announcements. In the case of Webvan, no one received a $50,000 annual salary. State reports show that no jobs were ever created as a result of this deal.

In addition to implying these job projections are guaranteed outcomes, the stories carry an implicit assumption. They presume the deals will result in new employment opportunities to people in the communities where the companies choose to locate or expand. But companies with more than one plant or facility may transfer jobs from one place to another. Unionized workforces shift around employees based on union contract rules and seniority. Companies opening an office or a factory in one area do not necessarily create new opportunities for the people in the area where it opens.

This also means that some of these deals, even if they add jobs for the subsidized project, do not grow the economy from a statewide perspective. If companies simply transfer jobs from one Michigan facility to another to meet the requirements of the deal, the benefit of one community comes at the direct cost of another. Taxpayers lose out when this occurs, as the costs of these deals will exceed the benefits.

Furthermore, businesses in Michigan compete with each other. If one company receives special taxpayer-funded favors and expands its operations, it likely will take business away from another Michigan company. Auto parts manufacturers, for example, are frequent recipients of state deals, and suppliers win contracts from their clients and invest to serve those clients. The success of one supplier in the state often results in losses for another.

These deals could result in fewer jobs overall if the companies that lose market share are forced to shed more jobs than the subsidized business creates. In other words, rather than create new jobs, these deals may simply shift jobs from some businesses to others or even reduce employment in the state overall.

Stories about creating jobs through subsidy deals always sound promising for Michigan’s economy. Yet companies and politicians rarely deliver on their pledges. And even if they do, there are reasons to be skeptical that taxpayers benefit in the end from this spending.

In light of the reasons to doubt the economic benefits of these deals, why do business subsidies remain popular? Because these deals serve an important political purpose. The state’s business subsidy programs are created by politicians through the political process to serve political ends. Despite the label, they are not economic development programs designed to improve the economy. This is established in the academic literature, as well.[4]

The fact that these deals make the front page of the state’s largest newspapers is a significant part of their political benefit. Politicians and other state officials get their names in print associated with a feel-good story of a growing economy. Elected officials can point to these projects as proof that they are doing something to create jobs in Michigan.

The deals likely wouldn’t make the news at all except that the state got involved and offered the companies select favors. Companies can and do create jobs in Michigan without any assistance from the state or elected officials. Michigan added 207,857 private sector jobs in the first quarter of 2024, the most recent data available from the Bureau of Labor Statistics.[5] The state also lost 198,797 private sector jobs over the period. The Michigan Economic Development Corporation, the state’s administrator of its business subsidy programs, issued press releases announcing that the businesses receiving state deals would create 4,863 jobs over that same period.[6] Even if all those jobs were created, those deals would have increased the number of jobs created in the state in that quarter by about 2.3%. These subsidy deals are simply too meagre to impact statewide job trends.

A headline and story from July 2008 present a good example of how useful these deals are from a political perspective. Here’s the headline:

The lede of the story demonstrates the political benefit. It reads, “On a day when Michigan’s industrial future took a hit — more job cuts planned for General Motors and no new Volkswagen plant for the state — Gov. Jennifer Granholm’s economic team served up 4,800 new, disparate jobs Tuesday to soften the blow.”[7]

The economic data showed that Michigan’s economy was losing thousands of jobs at the time. The state shed 286,500 jobs in 2008, according to the Bureau of Labor Statistics. That’s one out of every 15 jobs. As the article suggests, the state economy reflects poorly on the state’s political leaders.

This is where these subsidized deals demonstrate political value. They provide something for government officials, Gov. Granholm in this case, to do about the job losses. She can announce state deals to create new jobs. The rest of the economy might be losing jobs, but she is doing something to add them, the story goes. Announcing deals to create jobs gives the impression that politicians are doing something about what is often the most important issue to voters: the economy.[8]

Subsidy stories allow politicians to deliver a message to voters who care about the economy. It’s an opportunity to remind voters that they are actively trying to improve the state’s economic conditions. For instance, Gov. Granholm gave this quote for a story about a new subsidy deal: “We’ve got the talent. We’ve got the business case. And we are ready to make a good case for anybody who wants to come here and provide jobs.”[9]

But these headlined deals often fail to fulfill their promises, let alone improve the state economy. The aforementioned article, headlined “State Reels in New Jobs,” highlights deals with 14 companies to create 4,800 jobs. Nothing happened with eight of the deals — the companies never expanded and never collected cash from the state. Another five created some jobs and received state subsidies for a few years, but later cut jobs and closed or otherwise stopped reporting to the state that there were any jobs related to these deals. Only one company lived up to its deal, and the state reported 112 jobs at the project.

The state did not, in fact, reel in the jobs as the headline claimed. Yet, these announcements gave the governor a political benefit. She got to show that she was doing something about job losses, without facing any questions about whether she could deliver what she promised.

Because the headline stories treat these announcements as a fait accompli, politicians can use them to produce “a victory for Michigan’s battered economy,” as one reporter put it.[10] Governors can claim victory regardless of whether the company does what it promises it will do. Which, in this case, the companies, by and large, failed.

The stories about subsidy deals give governors a platform to tell people that they are doing a good job and having a positive impact on the state economy. For example, former Gov. Rick Snyder once said when announcing a new subsidy deal, “Our reinvention of Michigan is all about more and better jobs for families and bright futures for our children. That’s what this announcement really means.”[11] That particular deal did better than most but still only delivered 46% of the jobs it promised.

It’s not just governors who bluster about deals. Officials working at local government development organizations also benefit from hyping these handouts. “I cannot overstate the impact Switch will have on both the greater Grand Rapids area as well as the entire state of Michigan,” said one local organization CEO in response to a 2015 subsidy deal.[12] The company, Switch, employs 26 people, according to the latest state reports. There are nearly 600,000 people employed in the Grand Rapids area.[13] Their economic effects were clearly overstated.

Handing out favors to select companies results in major political benefits, regardless of whether deals do what lawmakers say they will do. These benefits rely in part on the soft treatment these stories receive from news outlets and other media. They rarely probe or question the reliability of the promises made in these deals. Politicians face no pushback from skeptics or even difficult questions from reporters. So, these subsidy deals provide politicians with positive publicity. Splashy deals draw the attention of the media, and politicians and other officials get their names associated with one-sided, feel-good stories in major media outlets.

There are political costs to business subsidies. Some voters are skeptical of state job creation deals. They can have a negative reaction when they read stories about the state handing out money to handpicked corporations. Some of that disapproval is expressed by legislators themselves. There has been some bipartisan opposition to business subsidy programs when they are taken up in the Legislature.[14]

There may also be political costs if lawmakers’ job creation claims are investigated and compared to what ended up happening. Voters may feel misled when, say, a subsidized company only creates 63 jobs after lawmakers told them that it would create 1,000 jobs. There is also a political risk that voters hold lawmakers accountable for their statements.

None of this skepticism expressed by voters and elected officials, however, winds up in the news articles about deals for jobs. Stories informing readers that the jobs previously announced on the newspaper’s front page fail to materialize are rare. As this report shows, more people should do more of this type of research because the jobs from subsidy deals analyzed for this project show them overstated by a factor of 11.

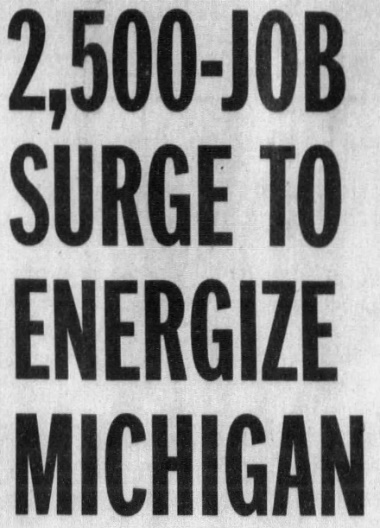

The headlines that cover job announcement stories do not mention the likelihood that the jobs will fail to materialize. Headlines are all most readers of the newspaper will read, but they are meant to attract attention and cannot provide important nuance, such as that the announced jobs are only hypothetical. The story below from 2010 in the Detroit Free Press provides a prime example.[15] Here’s the headline:

People should know that the certainty of this proclamation is unwarranted and misleading. It is speculation, based on secret information and projections, about an uncertain future. Similar efforts have a poor track record. It does not come as a surprise, then, that the companies involved in this front page announcement did not create 2,500 jobs — only a quarter of what was announced ever came into existence. This calls into question the justification of calling 600 jobs a “surge” that has the power to “energize” the state economy, as the headline asserts. In the end, the headline writer was likely misled, and subsequently, readers as well.

Analyzing the frequency of when these job announcements are most likely to be made also supports the idea that they are mainly used for political purposes. Politicians and public officials are most eager to place subsidy deal announcements in major newspapers when the economy is struggling the most.

For instance, the 2007-2009 recession sparked a flurry of new business subsidy deals. Michigan lost 410,800 jobs, a 9.7% decline that was second only to Nevada.[16] Michigan lawmakers authorized $6.3 billion in subsidies from 2007 to 2009, 27% of the total authorized since 2001. (Michigan lawmakers have approved $23.2 billion in select business subsidies since 2001.[17]) People want their elected representatives to stop the job losses, and politicians turn to business subsidies to tell stories about their job creation efforts even as the state sheds jobs.

If instead it was economic factors that determined when these subsidy deals were made, more of them would be announced when the economy was growing. If the promises and declarations in these announcements were true, they would be followed by job growth and improved economic conditions. But because these announcements are primarily a political tool used during economic downturns, what is most likely to follow them is the continued economic stagnation that gave rise to their use.

An example from 2009 captures this phenomenon well. After enduring year after year of Michigan’s unique one-state recession, or Lost Decade, from 2000 to 2009, Gov. Granholm held a press conference alongside Vice President Joe Biden announcing $1.36 billion in federal grants to battery manufacturers and electric vehicle production Michigan. The article credits politicians for making this happen: “Michigan lawmakers had pressed hard for the money to be included as part of the economic stimulus plan.”[18]

The political promises flowed freely, with Sen. Carl Levin predicting that “Michigan will be the epicenter of a new automotive technological whirlwind.” Gov. Granholm, more modestly, declared, “This is a really important step for Michigan and our key industries.” The state would also be stepping up with its own subsidies for the manufacturers. Here’s the headline:

“For an economy suffering a multiyear slide, the grants are a key victory,” the article says. It quotes Vice President Joe Biden. “We’re building a new platform for the American economy that will allow us to grow like we did in the ‘40s, ‘50s and ‘60s,” he said.[19]

The article announced that the companies receiving state and federal subsidies would create 6,800 jobs within the next 18 months and 40,000 jobs in total. This was the largest job announcement on the front page of Detroit Free Press between 2000 and 2020. And it was all but a complete failure: These billions in subsidies only created 1,296 jobs, according to state reports.

If a football analyst proclaimed in 2000 that the Detroit Lions would win the Super Bowl that season, fans would have to wait a few months to see whether his prediction was correct. The Lions did not win the Super Bowl that year, of course. If that analyst predicted a Super Bowl victory for the Lions the following year, and the year after that, and so on, fans would stop taking his predictions seriously. They would take what he says with a grain of salt, recognizing that there is only a small chance of his prediction being correct. Fans might surmise that the commenter’s belief in the Lions succeeding makes him an unreliable predictor of the team’s actual performance on the field.

Fans would also question or dismiss this analyst’s expertise. His lack of knowledge about the real chances of the Lions winning the Super Bowl is obvious since he is repeatedly wrong. Fans would realize his predictions are little more than wishful thinking and treat them accordingly.

Public officials lauding these job creation deals are like the football analyst who always predicts a Lions Super Bowl victory. Policymakers proclaim without reservation that their dealmaking will create jobs. But we have the receipts. These deals fail to achieve their objectives time and time again, just like the Lions fail to win the Super Bowl year after year. This year may be different for the Lions, but that doesn’t erase the wrongness of previous predictions. Lawmakers’ pronouncements about job creation should be treated the same as the football forecaster who is rarely right.

In short, people ought to be more skeptical of job announcements in state subsidy deals.

I tracked headlines printed in the Detroit Free Press, the largest newspaper in the state. I reviewed every edition, from Jan. 1, 2000, to Dec. 31, 2020, to find stories about subsidized job deals that made the front page.

The stories identified all include an announcement of how many jobs the deal will create. When the state hands out taxpayer cash, it requires companies to report on the number of jobs created as a result of the project. I checked the state’s latest reports to see how many jobs were created at the projects that made front page news.

There are a number of corporate handout programs covered in these headlines. One is the Michigan Economic Growth Authority, which provided companies with refundable tax credits based on the number of new jobs at a project and how much the employer paid those workers each year for up to 20 years. The state made deals through this program from 1995 to 2012.[20] Annual reports from the state about these tax credit deals include how many jobs each subsidized company created. A 2017 state auditor general report was also useful in identifying deals that the state dismissed and would no longer report on.[21] Companies only received credits after creating jobs. When the state does not report about a deal during the period when a company is eligible for subsidies, I assume there are no jobs associated with the project.

Another program, the Michigan Business Development Program, provided cash and loans to select companies. It began offering deals in 2012 and operates to the present.[22] Companies report back to the state until the end of their subsidy agreement, and typically a few years after collecting taxpayer cash. For instance, of the 35 companies that received deals in fiscal year 2011-12, 11 were still being monitored as of the fiscal 2016-17 report.[23] The rest of the deals had ended by then. These companies either met their contractual obligations or the deal was terminated, presumably, because they failed to meet the requirements of the agreement within the five years after the deals had been made. Thus, there are no reports on current employment conditions for some projects funded by the Michigan Business Development Program. I use the most recent job creation figure available for tracking these deals in this report.

Those are just two of the largest state subsidy programs. Companies often receive tax breaks, credits and other assistance from multiple government programs. For instance, film producers were offered deals for tax credits from the state and property tax exemptions to build film studios.[24] That was in addition to taxpayers covering up to 42% of a film’s production expenses. Deals can include subsidies from the federal government in addition to state and local assistance.

Projects tend to report their jobs over the life of their deal with the state. If a project ends, the last number of jobs they reported is used. If an agreement is dismissed prior to the end of the contract, the state stops reporting on the number of jobs at the facility as a result of the subsidy. Without a state record of the number of jobs created by these subsidy deals, there is no evidence of any jobs resulting from the deal. Some companies may indeed still have jobs, but that would be a success outside the scope of the deals that made headlines.

Ford, GM and Stellantis (formerly Fiat-Chrysler) often make front-page news when they announce changes to existing plants or shifting product lines. Companies often receive state subsidies for these moves.

These are not included in this analysis for a few reasons. The state does not report the information necessary to check up on these projects. It combined the major refundable tax credit deals it made with the Big 3 and stopped reporting on previous projects. For instance, a Nov. 3, 2000, front page story titled, “Tax break to help Rouge plant,” said that Ford would get a deal for refundable tax credits for 20 years to keep 3,800 jobs at its plant in Dearborn.[25] The state stopped reporting on the number of jobs retained at this plant in 2010.

While the Detroit automakers have been the beneficiaries of many deals to create and retain jobs in the state during the period of this study, it is unlikely that they resulted in net job creation over the period. Motor vehicle and motor vehicle parts manufacturing decreased from 315,000 jobs in 2000 to 108,500 jobs in 2009. That number later increased to 172,100 jobs prior to pandemic shutdowns. This is a 45% reduction in jobs in the industry.[26] Even if lawmakers provided the information needed to determine whether their deals worked as expected, it is unlikely these numbers would demonstrate the effectiveness of lawmakers’ ability to create and retain jobs among automakers in Michigan through favoritism.

Projects to give preferences for jobs that already exist are different from deals that claim to be creating new jobs. The former provides special treatment for politically favored existing Michigan companies and jobs, while the latter is aimed at luring companies to move to or expand in Michigan. As such, it’s rare for deals meant to preserve the status quo to be used as evidence that Michigan is growing and adding jobs. The triumphalist rationale for these subsidy agreements is an important consideration behind these deals. All deals for job retention are excluded from this list.

This list does not include headlines about subsidies to build or renovate office, retail and other buildings — another type of business subsidy that is different from stories about the state inducing job creation through subsidies. Sometimes news reports announce that real estate developments will create jobs. However, the goal of state favors related to buildings is to construct and improve facilities, not necessarily to create new jobs. The state tends not to report on the number of jobs associated with these construction projects that receive state favors.

There are occasional stories of companies opening without special deals from the state. For instance, an Oct. 26, 2004, story headlined “Ikea picks Canton for store, 300 jobs” mentions no state involvement.[27] No state favors designed to create jobs are involved, and so there is no expectation that a lawmaker ought to be held accountable to ensure that stated expectations are met. While the accuracy of these announcements is difficult to impossible to track, the jobs announced by businesses that make the front page without taxpayer favors are more likely to be created than their subsidized counterparts. That’s mostly because the success rate for state subsidy programs is so low: only one of every 11 jobs announced ever appears to have been created.

It is possible that despite failing to meet the expectations of these subsidy deals, some companies adapted and succeeded without state assistance. If that is the case, their success cannot be tied back to the state’s subsidy deals. The state does not report on job creation that happens at companies outside of its deals.

The following table contains brief descriptions of front page stories that appeared in the Detroit Free Press between Jan. 1, 2000, and Dec. 31, 2020. Provided are the number of jobs announced through the deal, the latest or final number of the jobs resulting from the subsidy as reported by the state, and a quick summary of the project.

| Jan. 12, 2000: “On-line grocer wants to deliver” |

|---|

| Jobs announced: 900 |

| Jobs reported: 0 |

| The article says that Webvan will employ 900 people at its 300,000 to 400,000 square-foot facility in Livonia. The state offered the company a $23.4 million tax credit. The company never built the facility and created no jobs.[28] |

| June 17, 2000: “Michigan wants big e-trade company” |

| Jobs announced: 500 |

| Jobs reported: 0 |

| The article says that a number of states are trying to get Covisint to locate its headquarters in their state. It reports that the company has 200 employees in temporary offices and that a new facility would employ 500 people. State officials say they are likely going to give the company tax breaks and other assistance.[29] Altogether, the company was offered tax breaks and a refundable tax credit from the state to create 1,000 jobs.[30] The company never claimed the credits nor reported creating any jobs.[31] |

| March 18, 2004: “2 big tax breaks aim to keep jobs” |

| Jobs announced: 350 |

| Jobs reported: 0 |

| Dr. Schneider Automotive systems was offered a $3.1 million refundable tax credit deal to create 350 jobs by 2011.[32] (The article also says that GM will get $10.4 million in refundable tax credits to retain 518 jobs at its Warren transmission plant, but these are not included in this analysis. The GM plant closed in 2018.[*]) The Dr. Schneider plant never claimed any state credits.[33] |

| Aug. 19, 2004: “Granholm turns to Toyota for a boost” |

| Jobs announced: 500 |

| Jobs reported: 0 |

| The article says that Toyota would like to open a 500-employee technical center and wants Michigan to sell it the land the state owns around a former psychiatric hospital.[†] However, a developer offered the state more for the site than what Toyota did.[34] The state sold its property to Toyota and offered the company additional tax breaks and refundable tax credits for 20 years.[35] The company did not report creating any jobs from this deal until 2009. It reported creating 360 jobs at the facility in 2012, but did not file for credits after that year, despite remaining eligible.[36] This is likely because the company was not able to maintain the minimum job levels required to qualify for the credits. Toyota still operates at this location but does not report its current job levels. Thus, the company did not deliver the jobs as announced, and the state reports no jobs at the facility. |

| May 16, 2006: “Whirlpool adding 400 Michigan jobs” |

| Jobs announced: 400 |

| Jobs reported: 0 |

| The article says that Whirlpool’s merger with Maytag led it to expand its current headquarters in Benton Harbor. This would create 400 jobs. It reports that the state offered $10.4 million of refundable tax credits to Whirlpool. These tax breaks and refundable tax credits could be claimed for up to 13 years by the company. Whirlpool began collecting credits in 2008 and last claimed 552 jobs in 2013.[37] The company requested and received another refundable tax credit deal in 2010 to keep 868 jobs. As part of the deal, the company agreed to stop taking credits on its older deals.[38] The state ceased to report on whether the 2006 deal met job expectations. |

| July 11, 2006: “Google coming to Ann Arbor” |

| Jobs announced:1,000 |

| Jobs reported: 0 |

| The article says that Google will open an office in Ann Arbor for its AdWords unit and expects to add 1,000 jobs. It says that the state expects to offer a deal for refundable tax credits to the company.[39] The state offered a deal for a 20-year refundable tax credit to the company. Google claimed credits for 134 jobs at the project in 2007 and for 224 jobs in 2008. It did not claim credits afterward.[40] The state dismissed the agreement.[41] The company does have a number of locations in Michigan but does not report on its current job levels and did not do what the article announced. |

| May 3, 2007: “500 jobs to be created in Hemlock” |

| Jobs announced: 500 |

| Jobs reported: 190 |

| The article says that Hemlock Semiconductor is considering a 500-job expansion in operations in Michigan or Kentucky. It reports that company expects to receive $250 million in tax breaks, credits and other assistance.[42] The company received deals for refundable tax credits and other tax breaks from the state.[43] It collected tax credits every year for the 15 years of its tax credit agreement, with annual reports ranging between 76 jobs and 270 jobs, the maximum number of jobs it could claim credits for. The latest report, from 2023, says that there are 190 jobs at the facility as a result of this deal.[44] |

| Aug. 14, 2007: “Detroit pill maker plans to expand, creating 600 jobs” |

| Jobs announced: 600 |

| Jobs reported: 0 |

| The article says that the company, Caraco Pharmaceutical Laboratories, will expand current operations and was given a $6.8 million tax credit. It says that North Carolina and South Carolina had offered deals for this project.[45] The company was awarded a tax credit agreement to expand its Detroit operations but never reported back to the state that it had created any jobs.[46] The company announced that it was closing its operations at the location in 2014.[47] |

| Sept. 19, 2007: “Spanish firm to bring in 400 jobs” |

| Jobs announced: 1,386 |

| Jobs reported: 0 |

| The article says that the company, Grupo Aernnova, would create 400 jobs in a new facility in Pittsfield Township, near Ann Arbor, and was given a 15-year, $18.5 million refundable tax credit deal plus other tax breaks. The article also covers five other companies awarded refundable tax credit deals.[48] The Grupo Aernnova temporarily collected on that tax credit from 2009 to 2014, receiving credit for creating at most 37 jobs at the facility.[49] The auditor general reports that officials were still monitoring the deal as of 2017, but the company stopped claiming credits for creating jobs since 2014.[50] Three of the other companies never reported creating any jobs and sought no tax credits afterwards. Two others had their credits dismissed before they expired. |

| July 16, 2008: “State reels in new jobs” |

| Jobs announced: 4,800 |

| Jobs reported: 112 |

| The article covers the projects that were approved in the July 2008 meeting of the Michigan Economic Growth Authority board, which made 13 deals in the month. It also covers a proposed joint project between Dow Chemical and a Kuwaiti oil company, which would receive tax breaks when the location in Michigan was settled.[51] The Kuwaiti company pulled out of the Dow deal before it happened, so no jobs were created at the project.[52] Of the 13 other deals, seven companies never reported creating any jobs, five stopped reporting jobs before their agreements expired, and one finished its agreement reporting 112 jobs as its final job creation number.[53] The article had listed that that company would create 275 jobs. |

| Jan. 14, 2009: “Another jobs boost for the state: IBM to develop center at MSU” |

| Jobs announced: 1,500 |

| Jobs reported: 0 |

| The article reports that the company would create “1,500 direct and indirect jobs over five years.”[54] It was going to apply to the state for $1.5 million in grants, and state administrators say that it had not applied for tax credits. The article notes that any more details are hard to come by: “Specifics of IBM’s plans for the MSU facility were limited Tuesday to those contained in a news release from the company[.]”[55] The company never built the center that made headlines.[56] |

| Feb. 3, 2009: “Pontiac lands film studio” |

| Jobs announced: 3,500 |

| Jobs reported: 0 |

| Gov. Jennifer Granholm announces that Motown Motion Pictures is going to build a new film studio in Pontiac that will employ 3,500 people. According to the article, this is in part due to the film subsidies that were approved by Michigan lawmakers.[57] This studio was built but was shut down and later sold to a defense contractor.[58] |

| Feb. 4, 2009: “Michigan manufactures movie magic” |

| Jobs announced: 413 |

| Jobs reported: 0 |

| The article reports that Wonderstruck Studios would open in Detroit.[59] It was approved a 12-year refundable tax credit deal worth $16.9 million, in addition to state film studio subsidies worth $11.7 million. The state of Michigan was also offering to pay up-to 42% of a film production’s expenses through film subsidies. It also mentions that the City of Detroit may give the company additional tax breaks. The article claims the studio picked Detroit over “competing sites in India, China and Korea.”[60] The company never reported creating any jobs and the state eventually dismissed the tax credit deal.[61] |

| April 14, 2009: “It’s showtime in Allen Park” |

| Jobs announced: 3,500 |

| Jobs reported: 0 |

| The article says that Unity Studios will be creating a 750,000 square-foot studio in the closed Visteon technical center in Allen Park. It says that the company will be looking for refundable tax credits and that film producers would be looking to take advantage of state film subsidies.[62] No job announcements made it into the initial story. Commentary later in the month reported that officials from the project expected to employ 3,500 people.[63] The company was awarded a 12-year refundable tax credit deal but never reported back that it had created jobs, and the state dismissed its agreement.[64] |

| April 15, 2009: “Michigan, you’re hired” |

| Jobs announced: 6,600 |

| Jobs reported: 1,296 |

| The article covers four battery producers that received state credits: A123 Systems, Compact Power, Johnson Control-Saft and KD Advanced Battery group. It announces that the companies would create 6,600 jobs.[65] A123 reported some jobs for a few years but declared bankruptcy and had its refundable tax credit dismissed.[66] The state refused to disclose the number of jobs resulting from this deal at the Johnson Controls-Saft battery facility.[‡] The KD Advanced Battery group reported creating some jobs but never more than half of the 885 announced in the deal.[67] The Compact Power facility — later operating as LG Chem Michigan Inc. — did get online and met job expectations. However, federal auditors checking on the use of federal grants for the facility in 2013 found that many of the workers who had been hired were not building batteries, but rather doing volunteer work outside of the company, or playing games and watching movies while at the office.[68] |

| June 25, 2009: “GE bringing jobs to the state” |

| Jobs announced: 1,200 |

| Jobs reported: 0 |

| The article says that GE will build a new research and development center in metro Detroit.[69] An additional article, with a front page blurb two days later, mentions that the facility was given a refundable tax credit deal that would last 12 years.[70] The company claimed credits for just two years, never reported creating more than a third of the jobs that were announced and stopped reporting jobs associated with this deal in 2011.[71] |

| July 21, 2009: “Former Chrysler HQ gets 400 jobs” |

| Jobs announced: 400 |

| Jobs reported: 595 |

| The article reports that Magna International will produce automotive seating at a facility in Highland Park and is expected to get refundable state tax credits. “The plant will create 400 jobs,” the article says.[72] The state offered the company a deal for seven years of refundable tax credits. The company received credits for all seven years and last reported in 2016 that it had 595 jobs as a result of this deal.[73] |

| Aug. 6, 2009: “A billion-dollar jolt for the state” |

| Jobs announced: 40,000 |

| Jobs reported: 1,296 |

| The article covers the selection of companies for a federal grant program to subsidize electric vehicle production. It lists 12 companies that were selected for projects and said that these would create 40,000 jobs in Michigan.[74] In addition to federal grants, a number of the companies received deals from the state. (These were featured in the April 15 story reported above.) The federal government reported that total job creation from these grant programs is 1,677 jobs, but that is for the entire nation.[75] The state did not give awards to all of the companies listed in the story, but it reports 1,296 jobs at the projects mentioned.[76] |

| Aug. 26, 2009: “New life at Wixom plant” |

| Jobs announced: 4,300 |

| Jobs reported: 0 |

| The article covers a proposal from Xtreme Power and Clairvoyant Energy to jointly purchase a shuttered auto plant.[77] The article says that the companies would employ 4,300 people and generate a further 10,000 jobs in businesses that supply the companies.[78] The article notes that company officials were discussing tax breaks and other state assistance with the Granholm administration. The companies did receive deals from the state for refundable tax credits to be awarded over 15 years for Clairvoyant Energy and 20 years for Xtreme Power. The companies never reported back to the state that they had created any jobs, and the state dismissed their agreements.[79] |

| Sept. 23, 2009: “Tech firm to create 1,085 jobs in area” |

| Jobs announced: 1,085 |

| Jobs reported: 217 |

| The article begins, “A California company, Systems In Motion, plans to create an estimated 1,085 jobs in the Ann Arbor area over the next five years with the help of tax incentives approved Tuesday by the Michigan Economic Growth Authority.”[80] The company was awarded a deal for seven years of refundable tax credits. It reported jobs for six of those years, with the highest being 217 in 2016, the last year it reported to the state.[81] |

| Sept. 23, 2009: “Hummer to invest $9.4M in new HQ” |

| Jobs announced: 300 |

| Jobs reported: 0 |

| The article says that Hummer’s new owners were going to build new headquarters, creating 300 jobs.[82] The state was awarding the company refundable tax credits for the project. The company did receive a deal for 10 years of refundable tax credits but never reported creating any jobs, and the state dismissed the deal.[83] |

| Dec. 9, 2009: “Ford considers building hybrids, batteries in state” |

| Jobs announced: 1,000 |

| Jobs reported: 0 |

| The article begins, “Ford Motor Co. said Tuesday it might invest between $300 million and $500 million to assemble hybrid and plug-in hybrid vehicles and lithium-ion batteries in Michigan if it receives tax credits from the state. Up to 1,000 jobs could be created.” The company received a credit deal from the state to produce battery packs in an existing plant in Washtenaw County.[84] However, the project has never been included in state reports on battery credits. Still, the company reported in 2021 that it employed 170 people between this plant and another in Sterling Heights.[85] |

| Dec. 16, 2009: “Tax breaks aim to boost hiring” |

| Jobs announced: 2,236 |

| Jobs reported: 912 |

| The article highlights the 18 projects that were awarded refundable tax credit deals in the December 2009 Michigan Economic Growth Authority board meeting and summarized that they would create a combined 2,236 jobs.[86] Of the 18 projects, eight were not required to create jobs and four were for job retention rather than job creation. Of the six remaining projects, two never reported creating any jobs, one was dismissed in 2011, another in 2015, and yet another in 2016. The remaining company in this group exceeded its job creation expectations, though it was not mentioned by name in the article.[87] |

| Feb. 25, 2010: “2,500-job surge to energize Michigan” |

| Jobs announced: 2,500 |

| Jobs reported: 598 |

| The article covers tax credit proposals for Dow Chemical and Dow Kokam that were up for state board approval. The article says that they were to create 2,500 jobs. The deal was “a promising reversal of fortune for a hurting Saginaw-Midland region.”[88] The state reports that the projects have created 598 jobs.[89] An accompanying article identifies three new solar panel businesses as part of this deal: GlobalWatt, Suniva and Evergreen Solar.[90] GlobalWatt never reported creating any new jobs.[91] Suniva did not open until 2014, did not hire the 350 employees it promised and closed in 2017.[92] Evergreen Solar went bankrupt in 2011, ceased operations and never reported creating new jobs.[93] |

| March 17, 2010: “Saab gets tax break to bring HQ to Royal Oak” |

| Jobs announced: 60 |

| Jobs reported: 0 |

| The article covers the state’s offer to provide a five-year refundable tax credit deal to Saab to create a new North American headquarters, along with a property tax break. The project was to create 60 jobs.[94] The company never reported creating any jobs, and the credit agreement was dismissed.[95] |

| April 11, 2010: “More battery work comes to Michigan” |

| Jobs announced: 16,000 |

| Jobs reported: 1,296 |

| The headline summarizes the findings of a series of stories about electric vehicles and battery manufacturers in Michigan. One story was about four projects that received government assistance in Michigan. Another involved a Ford battery assembly project, and others included interviews with two CEOs of the companies involved and state administrators. “In all, Michigan officials say the state has commitments for 16,000 electric car-related jobs as a new electric car industry takes shape,” it states.[96] Of the companies and projects that were mentioned, the state reports just 1,296 jobs created as a result of these deals.[97] |

| April 12, 2010: “Michigan’s bet on batteries: Will it pay sooner or later?” |

| Jobs announced: 4,000 |

| Jobs reported: 1,296 |

| The article covers five different battery makers that have received federal and state support, which would create 4,000 jobs by 2014.[98] Four of the five projects had been mentioned above in previous front page stories. The other, Fortu PowerCell, is slated to open in 2012 and create 126 jobs, according to the article.[99] Two of the companies report creating jobs, as covered earlier in this report. Fortu PowerCell did not create any jobs and never received tax credits.[100] |

| Dec. 7, 2010: “New plant to generate hope and jobs” |

| Jobs announced: 137 |

| Jobs reported: 0 |

| The article covers Gov. Granholm’s announcement that Northern Power Systems would be building wind turbine components with an existing manufacturer in Saginaw.[101] The plant would be using money it got through federal stimulus programs.[102] While the article did not say how many jobs would be created, other news outlets reported a projected 137 jobs at the site.[103] I was unable to find any reports on jobs from this deal from the state or federal government. |

| Jan. 11, 2012: “Snyder offers peek at how state will lure businesses” |

| Jobs announced: 50 |

| Jobs reported: 59 |

| The article says that the state will pay for an electric substation at the Hyundai technical center and that this will create 50 jobs.[104] The state reports that there were 59 jobs at the facility when its state grant reporting ended in 2020.[105] |

| Feb. 13, 2012: “Controversial biorefinery to finally be built in U.P.” |

| Jobs announced: 60 |

| Jobs reported: 0 |

| The article says that Mascoma would be building a wood ethanol plant in Kinross, creating 60 jobs. It reports that it received money from the federal government.[106] The company also received $20 million from the state’s 21st Century Jobs Fund and other tax breaks and assistance. The project was never completed, and no jobs were created. The company paid back only $6.4 million of the $20 million the state gave it.[107] |

| Jan. 16, 2013: “Supplier Denso considers adding 400 Mich. Jobs” |

| Jobs announced: 400 |

| Jobs reported: 458 |

| The article covers an expansion of Denso facilities in Battle Creek and Southfield. It reports that the company is seeking a deal from the state and local governments and expects to hire 400 more people. The state reports that there were 458 jobs at these facilities when grant reporting ended in 2019.[108] |

| Jan. 24, 2013: “State paves way for 4,500 jobs, $1B investments” |

| Jobs announced: 4,500 |

| Jobs created: 2,049 |

| The article reviews the 10 projects that were approved for state subsidies at the Michigan Strategic Fund board meeting in January 2013. The article says that the companies will create 4,500 jobs.[109] The state reports that there were 2,049 jobs at the projects that were listed, as of their most recent reports.[110] |

| Feb. 24, 2014: “Research institute will bring 10,000 new jobs” |

| Jobs announced: 10,000[§] |

| Jobs reported: 0 |

| The article covers a federal government announcement that it was starting a lightweight materials research institute in Canton. State government money would also be used to launch the program. The article says that there will be 10,000 jobs working with lightweight materials.[111] This announcement is a bit unusual as it does not include deals for specific companies to employ people directly. Rather, it is about the creation of a nonprofit institute in the hopes of growing an entire industry. Still, the claim that this will create 10,000 jobs is made four times in the article. The institute did open, but in Detroit, not Canton.[112] The state does not report how many jobs the institute created, nor does the Michigan Economic Development Corporation report on how many jobs were created in the industry as a result of this funding. |

| Nov. 17, 2015: “Should state tweak tax law to lure $5B data center?” |

| Jobs announced: 1,000 |

| Jobs reported: 26 |

| The article covers a data center company that wanted to buy the Steelcase pyramid in Grand Rapids. However, it wanted a change in state law and tax breaks. It promised to employ 1,000 people.[113] Lawmakers did change state law to exempt its equipment purchases from sales and use taxes.[114] The company received additional tax breaks from the state and local government.[115] The state says that there are 26 jobs at the facility, according to its most recent report.[116] |

| May 25, 2016: “Plant could bring 750 jobs to Detroit” |

| Jobs announced: 750 |

| Jobs reported: 652 |

| The article says the Flex-N-Gate plans to open a new factory in Detroit that would employ 750 people. Company officials are seeking tax breaks and other assistance for this project.[117] The state reports 652 jobs at the facility.[118] |

| Dec. 21, 2016: “Amazon to expand into Livonia, hire 1,000 workers” |

| Jobs announced: 1,000 |

| Jobs reported: 1,000 |

| The article says that Amazon will build a new distribution center in Livonia that will create 1,000 jobs. The state said that this may go up to 1,500 jobs during the busy season. The state offered the company $7.5 million for the facility.[119] The state reported 1,000 jobs at the project.[120] |

| May 17, 2017: “Auto supplier bringing 430 jobs to Macomb County” |

| Jobs announced: 430 |

| Jobs reported: 631 |

| The article says that Grupo Antolin will expand its Shelby Township plant to create 430 jobs and receive a $3.6 million deal with the state.[121] The company later amended its deal with the state to receive more handouts for creating even more jobs, a total of 640. The state reports the company created 631 jobs, more than the original deal but less than the amended one. As a result, the company had to make a small repayment of the state’s money.[122] |

| June 27, 2017: “1,600 Jobs: Amazon hopes to build distribution site in Romulus” |

| Jobs announced: 1,600 |

| Jobs reported: 1,737 |

| The article says that Amazon is looking for a $5 million grant from the state to build a distribution center in Romulus.[123] The company was offered the grant and the state reports that there are 1,737 jobs at the facility.[124] |

| June 28, 2017: “2,800 new jobs on the horizon” |

| Jobs announced: 2,800 |

| Jobs reported: 2,163 |

| The article covers Amazon’s project in Romulus mentioned above and three other deals. Kroger was offered $2 million for a 377 job distribution center. Williams International was offered $4 million to change the film studio in Pontiac, a failed deal from 2009 covered above, into a 400-job manufacturing plant. Autoliv was offered $2.6 million to build a factory that would create 384 jobs. The state reports 2,163 jobs at the projects.[125] |

| Aug. 23, 2017: “Penske: $100M facility, 403 jobs” |

| Jobs announced: 403 |

| Jobs reported: 0 |

| The article covers a $2.5 million deal from the state for Penske Logistics to build a distribution center in Romulus.[126] The state terminated its agreement with the company in 2022 for not keeping enough jobs at the facility.[127] |

| April 24, 2019: “Waymo to assemble in Detroit facility” |

| Jobs announced: 400 |

| Jobs reported: 188 |

| The article says that Waymo will assemble its vehicles at a facility in Detroit. The company received a deal for $8 million from the state and expects to create “at least 100 jobs with a potential for 400 jobs.”[128] The state reports that the company has created 188 jobs and is in default of its agreement.[129] |

The table below summarizes the results of the subsidy deals that appears in headlines on the front page of the Detroit Free Press from 2000 to 2020.

| Date of newspaper | Jobs announced | Jobs reported |

|---|---|---|

| 1/12/2000 | 900 | 0 |

| 6/17/2000 | 500 | 0 |

| 3/18/2004 | 350 | 0 |

| 8/19/2004 | 500 | 0 |

| 5/16/2006 | 400 | 0 |

| 7/11/2006 | 1,000 | 0 |

| 5/3/2007 | 500 | 190 |

| 8/14/2007 | 600 | 0 |

| 9/19/2007 | 1,386 | 0 |

| 7/16/2008 | 4,800 | 112 |

| 1/14/2009 | 1,500 | 0 |

| 02/3/2009 | 3,500 | 0 |

| 2/4/2009 | 413 | 0 |

| 4/14/2009 | 3,500 | 0 |

| 4/15/2009 | 6,600 | 1,296* |

| 6/25/2009 | 1,200 | 0 |

| 7/21/2009 | 400 | 595 |

| 7/21/2009 | 40,000 | 1,296* |

| 8/26/2009 | 4,300 | 0 |

| 9/23/2009 | 1,085 | 217 |

| 9/23/2009 | 300 | 0 |

| 12/9/2009 | 1,000 | 0 |

| 12/16/2009 | 2,236 | 912 |

| 2/25/2010 | 2,500 | 598* |

| 3/17/2010 | 60 | 0 |

| 4/11/2010 | 16,000 | 1,296* |

| 4/12/2010 | 4,000 | 1,296* |

| 12/7/2010 | 137 | 0 |

| 1/11/2012 | 50 | 59 |

| 2/13/2012 | 60 | 0 |

| 1/16/2013 | 400 | 458 |

| 1/24/2013 | 4,500 | 2,049 |

| 2/24/2014 | 10,000 | 0 |

| 11/17/2015 | 1,000 | 26 |

| 5/25/2016 | 750 | 652 |

| 12/21/2016 | 1,000 | 1,000 |

| 5/17/2017 | 430 | 631 |

| 6/27/2017 | 1,600 | 1,737* |

| 6/28/2017 | 2,800 | 2,163* |

| 8/23/2017 | 403 | 0 |

| 4/24/2019 | 400 | 188 |

| Totals | 123,060 | 10,889 |

*Job creation from these projects is only included once in the total job claims to avoid double counting.

[*] As a retention project the job totals here are excluded from the assessment. JC Reindl, “Old GM Warren Transmission Plant Sold, to Be Demolished,” Detroit Free Press, January 21, 2022, https://perma.cc

[†] The announced jobs for this facility varied. The article said some experts expected the company to create 3,000 job, while a spokesperson for the governor said they expect “thousands of jobs if this project comes together.” Jamie Butters, “Granholm Turns to Toyota for a Boost,” Detroit Free Press, August 19, 2004, https://www.newspapers.com

[‡] The state is required to report on the jobs created at the facilities that received battery credits, according to MCL § 208.1434(15). The state’s report on battery credits does not report on jobs at this facility. “Battery Cell Manufacturing Credits: Report to the Legislature” (Michigan Strategic Fund, December 20, 2019), https://perma.cc

[§] The article specifies that these jobs may not all be in Michigan: “Most of the anticipated 10,000 jobs are expected to be concentrated in Michigan and Ohio.” Christina Hall and Todd Spangler, “Research Institute Will Bring 10,000 New Jobs,” Detroit Free Press, February 24, 2014, https://www.newspapers.com

There were 41 stories of state business subsidy deals promising to create jobs that made the front page of the Detroit Free Press between Jan. 1, 2000, and Dec. 31, 2020 — two a year on average. Only in six stories did the companies involved create the number of jobs announced on the front page, a 15% success rate. The subsidy deals announced in 21 of these stories were complete failures and produced no jobs.

The stories promised a total of 123,060 jobs would be created in the state. The companies in these stories only created 10,889 jobs, however, according to state and federal reports. Only one job materialized for every 11 jobs that were announced.

This overstates the success of these business subsidy programs. Of the six job announcements that met or exceeded expectations, five of them were for a program that does not require the receiving companies to do anything that they would not have done without state support. In other words, there is no way to know if these companies would have created these jobs anyway, without taxpayer subsidies.

For instance, two of the successful deals involved Amazon distribution centers. Amazon has other distribution centers in the state besides the two that received taxpayer subsidies and wound up on the front page of the Detroit Free Press. The state made deals for four Amazon distribution centers, according to state reports, but there are at least 20 facilities in the state.[*] Amazon built most of these centers without state support, which raises the question of whether taxpayer money was needed in these deals.

A few other projects that met expectations were in the auto industry. These projects did not do enough to prevent the rapid decline of this industry over the period when these stories appeared. As noted, Michigan lost 45% of its motor vehicle and motor vehicle parts manufacturing jobs from 2000 to 2020. The industry was marked by job loss regardless of whether a few lucky companies received special state subsidies and created some jobs.

The jobs reported by the state are also likely overstated. Deals for a Compact Power plant and a Dow Kokam facility were covered by four different stories, and these account for 31% of the jobs reported to have been created. These are included in the summary table above, but the jobs created by these projects are not double counted in the total job creation figures.

The articles include one story where the headline writer asks, “Michigan's bet on batteries: Will it pay sooner or later?” It paid off neither sooner nor later. Billions were spent on a small industry that failed to live up to expectations. Yet new electric vehicle and battery manufacturing plants keep receiving further subsidies.

Political dealmaking is a newsworthy subject. Newspaper editors want to tell people stories that interest them. But stories about state subsidy deals deserve extra scrutiny because of how rarely they deliver on their pledges. A look at the effects demonstrates that the state has been unable to land the new employers or boost the industries that state officials say will revitalize the state. This is important because it is what the headlines promise, or at least, imply. “New plant to generate hope and jobs,” as one headline read. Another was about “sprouting a new industry.”

There are compelling political considerations that encourage dealmaking. This should be paired with compelling accountability. The state reports creating just one out of 11 jobs announced in front page stories. Michigan residents have been misled by state officials and the reporters who reiterate their claims, and this ought to trigger more skepticism the next time lawmakers pledge to lead the way with select business subsidies.

[*] A query of “Amazon distribution centers in Michigan” in Google Maps returns more than 20 facilities in Michigan: https://t.ly

[1] See, for instance, Nathan M. Jensen and Edmund J. Malesky, Incentives to Pander: How Politicians Use Corporate Welfare for Political Gain (Cambridge, United Kingdom New York, NY: Cambridge University Press, 2018); Alan Peters and Peter Fisher, “The Failures of Economic Development Incentives,” Journal of the American Planning Association 70, no. 1 (March 31, 2004): 27–37.

[2] See, for instance, “Hangar42 in Court” (Mackinac Center for Public Policy, August 4, 2010), accessed November 1, 2024, https://www.mackinac.org

[3] Daniel G. Fricker, “On-Line Grocer Wants to Deliver,” Detroit Free Press, January 12, 2000, https://www.newspapers.com

[4] For instance, Russell S. Sobel, Gary A. Wagner, and Peter Calcagno, “The Political Economy of State Economic Development Incentives: A Case of Rent Extraction,” SSRN Scholarly Paper (Rochester, NY: Social Science Research Network, December 23, 2021), https://perma.cc

[5] “Business Employment Dynamics - First Quarter 2024” (U.S. Bureau of Labor Statistics, October 30, 2024), https://perma.cc

[6] “MEDC Press Releases” (Michigan Economic Development Corporation, 2024), https://www.michiganbusiness.org

[7] Chris Christoff, “State Reels in New Jobs,” Detroit Free Press, July 16, 2008, https://www.newspapers.com

[8] See, for instance, Megan Brenan, “Economy Most Important Issue to 2024 Presidential Vote” (Gallup, October 9, 2024), https://perma.cc

[9] John Gallagher, “GE to Create 1,200 Jobs in Michigan,” Detroit Free Press, June 27, 2009, https://www.newspapers.com

[10] Jewel Gopwani and Alejandro Bodipo-Memba, “Spanish Firm to Bring in 400 Jobs,” Detroit Free Press, September 19, 2007, https://www.newspapers.com

[11] John Gallagher and Paul Egan, “State Paves Way for 4,500 Jobs, $1b Investments,” Detroit Free Press, January 24, 2013, https://www.newspapers.com

[12] Matthew Dolan, “Should State Tweak Tax Law to Lure $5b Data Center?,” Detroit Free Press, November 17, 2015, https://www.newspapers.com

[13] “Local Area Unemployment Statistics” (U.S. Bureau of Labor Statistics, November 6, 2024), https://perma.cc

[14] “Business Subsidy Scorecard” (Mackinac Center for Public Policy, 2024), https://www.mackinac.org

[15] Tom Walsh, “2,500 Job Surge to Energize Michigan,” Detroit Free Press, February 25, 2010, https://www.newspapers.com

[16] Author’s calculations based on data from the “State and Metro Area Employment, Hours, & Earnings” (U.S. Bureau of Labor Statistics), http://www.bls.gov

[17] Author’s calculation based on ”Business Subsidy Scorecard” (Mackinac Center for Public Policy, September 27, 2023), https://www.mackinac.org

[18] Justin Hyde and Kathleen Gray, “A Billion-Dollar Jolt for State,” Detroit Free Press, August 6, 2009, https://www.newspapers.com

[19] Justin Hyde and Kathleen Gray, “A Billion-Dollar Jolt for State,” Detroit Free Press, August 6, 2009, https://www.newspapers.com

[20] See MCL § 207.801-10.

[21] “Performance Audit Report: Michigan Economic Growth Authority Tax Credit Program” (Michigan Office of the Auditor General, September 2017), https://perma.cc

[22] MCL § 125.2088r.

[23] “Annual Report to the Legislature, Fiscal Year 2017” (Michigan Economic Development Corporation, March 15, 2008), https://perma.cc

[24] Amy Deprez and Greg West, “Briefing Memo - Unity Studios, Inc” (Michigan Economic Growth Authority, April 14, 2009), accessed November 6, 2024, https://perma.cc

[25] Jeffey McCracken, “Tax Break to Help Rouge Plant,” Detroit Free Press, November 3, 2000, https://www.newspapers.com

[26] Author’s calculations based on data from the “State and Metro Area Employment, Hours, & Earnings” (U.S. Bureau of Labor Statistics), http://www.bls.gov

[27] Jewel Gopwani and Naomi R. Patton, “Ikea Picks Canton for Store, 300 Jobs,” Detroit Free Press, October 26, 2004, https://www.newspapers.com

[28] Daniel G. Fricker, “On-Line Grocer Wants to Deliver,” Detroit Free Press, January 12, 2000, https://www.newspapers.com

[29] Jeffey McCracken, “Michigan Wants Big E-Trade Company,” Detroit Free Press, June 17, 2000, https://www.newspapers.com

[30] “MEGA and MBDP transparency Project” (Mackinac Center for Public Policy), https://www.mackinac.org

[31] “Performance Audit Report: Michigan Economic Growth Authority Tax Credit Program” (Michigan Office of the Auditor General, September 2017), https://perma.cc

[32] Jennifer Bott, “2 Big Tax Breaks Aim to Keep Jobs,” Detroit Free Press, March 18, 2004, https://www.newspapers.com

[33] “Performance Audit Report: Michigan Economic Growth Authority Tax Credit Program” (Michigan Office of the Auditor General, September 2017), https://perma.cc

[34] Jamie Butters, “Granholm Turns to Toyota for a Boost,” Detroit Free Press, August 19, 2004, https://www.newspapers.com

[35] “MEGA and MBDP transparency Project” (Mackinac Center for Public Policy), https://www.mackinac.org

[36] “FY 2024 Report to the Michigan Legislature” (Michigan Strategic Fund, October 1, 2024), https://perma.cc

[37] “FY 2024 Report to the Michigan Legislature” (Michigan Strategic Fund, October 1, 2024), https://perma.cc

[38] “MEGA and MBDP transparency Project” (Mackinac Center for Public Policy), https://www.mackinac.org

[39] Tom Walsh, “Google Coming to Ann Arbor,” Detroit Free Press, July 11, 2006, https://www.newspapers.com

[40] “FY 2024 Report to the Michigan Legislature” (Michigan Strategic Fund, October 1, 2024), https://perma.cc

[41] “Performance Audit Report: Michigan Economic Growth Authority Tax Credit Program” (Michigan Office of the Auditor General, September 2017), https://perma.cc

[42] Jewel Gopwani, “500 Jobs to Be Created in Hemlock,” Detroit Free Press, May 3, 2007, https://www.newspapers.com

[43] “MEGA and MBDP transparency Project” (Mackinac Center for Public Policy), https://www.mackinac.org

[44] “MEGA and MBDP transparency Project” (Mackinac Center for Public Policy), https://www.mackinac.org

[45] Tom Walsh, “Detroit Pill Maker Plans to Expand, Creating 600 Jobs,” Detroit Free Press, August 14, 2007, https://www.newspapers.com

[46] “Performance Audit Report: Michigan Economic Growth Authority Tax Credit Program” (Michigan Office of the Auditor General, September 2017), https://perma.cc

[47] “Sun Pharmaceuticals to Shut Unit Caraco’s Detroit Facility,” The Economic Times, May 5, 2014, https://perma.cc

[48] Jewel Gopwani and Alejandro Bodipo-Memba, “Spanish Firm to Bring in 400 Jobs,” Detroit Free Press, September 19, 2007, https://www.newspapers.com

[49] “FY 2024 Report to the Michigan Legislature” (Michigan Strategic Fund, October 1, 2024), https://perma.cc

[50] “Performance Audit Report: Michigan Economic Growth Authority Tax Credit Program” (Michigan Office of the Auditor General, September 2017), https://perma.cc

[51] Chris Christoff, “State Reels in New Jobs,” Detroit Free Press, July 16, 2008, https://www.newspapers.com

[52] Tony Lascarti, “K-Dow Closes with $2.48B Award,” Midland Daily News, March 4, 2013, https://perma.cc

[53] “FY 2024 Report to the Michigan Legislature” (Michigan Strategic Fund, October 1, 2024), https://perma.cc

[54] Robin Erb and Dawson Bell, “Another Jobs Boost for the State: IBM to Develop Center at MSU,” Detroit Free Press, January 14, 2009, https://www.newspapers.com

[55] Robin Erb and Dawson Bell, “Another Jobs Boost for the State: IBM to Develop Center at MSU,” Detroit Free Press, January 14, 2009, https://www.newspapers.com

[56] Author email correspondence with Michigan State University spokesmen, October 3, 2024.

[57] John Gallagher, Kathleen Gray, and Chris Christoff, “Pontiac Lands Film Studio,” Detroit Free Press, February 3, 2009, https://www.newspapers.com

[58] Kirk Pinho, “Michigan Motion Picture Studios Building and Land, Pontiac,” Crain’s Detroit Business, June 22, 2018, https://perma.cc

[59] John Gallagher, Katherine Yung, and Kathleen Gray, “Michigan Manufactures Movie Magic,” Detroit Free Press, February 4, 2009, https://www.newspapers.com

[60] John Gallagher, Katherine Yung, and Kathleen Gray, “Michigan Manufactures Movie Magic,” Detroit Free Press, February 4, 2009, https://www.newspapers.com

[61] “FY 2024 Report to the Michigan Legislature” (Michigan Strategic Fund, October 1, 2024), https://perma.cc

[62] John Gallagher, “It’s Showtime in Allen Park,” Detroit Free Press, April 14, 2009, https://www.newspapers.com

[63] Carol Cain, “Do Film Breaks Bypass Small Firms?,” Detroit Free Press, May 26, 2009, https://www.newspapers.com

[64] “FY 2024 Report to the Michigan Legislature” (Michigan Strategic Fund, October 1, 2024), https://perma.cc

[65] John Gallagher, “Michigan, You’re Hired!,” Detroit Free Press, April 15, 2009, https://www.newspapers.com

https://www.newspapers.com

[66] “FY 2024 Report to the Michigan Legislature” (Michigan Strategic Fund, October 1, 2024), https://perma.cc

[67] “FY 2024 Report to the Michigan Legislature” (Michigan Strategic Fund, October 1, 2024), https://perma.cc

[68] “Special Report: The Department of Energy’s Management of the Award of a $150 Million Recovery Act Grant to LG Chem Michigan Inc.” (U.S. Department of Energy, February 2013), https://perma.cc

[69] John Gallagher, “GE Bringing Jobs to State,” Detroit Free Press, June 25, 2009, https://www.newspapers.com

[70] John Gallagher, “GE to Create 1,200 Jobs in Michigan,” Detroit Free Press, June 27, 2009, https://www.newspapers.com

[71] “FY 2024 Report to the Michigan Legislature” (Michigan Strategic Fund, October 1, 2024), https://perma.cc

[72] Tom Walsh, “Former Chrysler HQ Gets 400 Jobs,” Detroit Free Press, July 21, 2009, https://www.newspapers.com

[73] “FY 2024 Report to the Michigan Legislature” (Michigan Strategic Fund, October 1, 2024), https://perma.cc

[74] Justin Hyde and Kathleen Gray, “A Billion-Dollar Jolt for State,” Detroit Free Press, August 6, 2009, https://www.newspapers.com

[75] Email correspondence with U.S. Department of Energy Deputy Press Secretary Samah Shaiq, Oct. 16, 2024.

[76] “FY 2024 Report to the Michigan Legislature” (Michigan Strategic Fund, October 1, 2024), https://perma.cc

[77] Tom Walsh, “New Life at Wixom Plant,” Detroit Free Press, August 26, 2009, https://www.newspapers.com

[78] Tom Walsh, “New Life at Wixom Plant,” Detroit Free Press, August 26, 2009, https://www.newspapers.com

[79] “Performance Audit Report: Michigan Economic Growth Authority Tax Credit Program” (Michigan Office of the Auditor General, September 2017), https://perma.cc

[80] John Gallagher, “Firm to Make 1,085 Mich. IT Jobs,” Detroit Free Press, September 23, 2009, https://www.newspapers.com

[81] “FY 2024 Report to the Michigan Legislature” (Michigan Strategic Fund, October 1, 2024), https://perma.cc

[82] Tim Higgins, “Hummer to Invest $9.4 Million in Michigan Offices,” Detroit Free Press, September 23, 2009, https://www.newspapers.com

[83] “Performance Audit Report: Michigan Economic Growth Authority Tax Credit Program” (Michigan Office of the Auditor General, September 2017), https://perma.cc

[84] “Year-End Report to the Legislature” (Michigan Economic Development Corporation, 2010), https://perma.cc

[85] “Ford Commits to Manufacturing Batteries, To Form New Joint Venture With SK Innovation to Scale North America Battery Deliveries” (Ford Motor Company), https://perma.cc

[86] Chris Christoff and Brent Snavely, “Tax Breaks Aim to Boost Hiring,” Detroit Free Press, December 16, 2009, https://www.newspapers.com

[87] Chris Christoff and Brent Snavely, “Credits to Revive Auto, Newspaper Sites,” Detroit Free Press, December 16, 2009, https://www.newspapers.com

[88] Tom Walsh, “2,500 Job Surge to Energize Michigan,” Detroit Free Press, February 25, 2010, https://www.newspapers.com

[89] “FY 2024 Report to the Michigan Legislature” (Michigan Strategic Fund, October 1, 2024), https://perma.cc

[90] Tom Walsh, “Wind, Solar Firms Boom near Midland, Saginaw,” Detroit Free Press, February 25, 2010, https://www.newspapers.com

[91] Michael D. LaFaive, “GlobalWatt: How Corporate Welfare Hurts Real People” (Mackinac Center for Public Policy, January 6, 2012), https://www.mackinac.org

[92] Heather Jordan, “Suniva Owes Saginaw Township Money If Closure Is Permanent,” MLive.Com, March 30, 2017, https://perma.cc

[93] Andrew Dodson, “Breaking: Evergreen Solar Files for Bankruptcy, Plans to Sell Midland Facility,” MLive.Com, August 15, 2011, https://perma.cc

[94] Chris Christoff and Tim Higgins, “Saab Gets Tax Break for HQ in Royal Oak,” Detroit Free Press, March 17, 2010, https://www.newspapers.com

[95] “Performance Audit Report: Michigan Economic Growth Authority Tax Credit Program” (Michigan Office of the Auditor General, September 2017), https://perma.cc

[96] Brent Snavely and Jewel Gopwani, “More Battery Work Comes to Michigan,” Detroit Free Press, April 11, 2010, https://www.newspapers.com

[97] “FY 2024 Report to the Michigan Legislature” (Michigan Strategic Fund, October 1, 2024), https://perma.cc

[98] Jewel Gopwani and Brent Snavely, “Michigan’s Bet on Batteries: Will It Pay Sooner or Later?,” Detroit Free Press, April 12, 2010, https://www.newspapers.com

[99] Jewel Gopwani and Brent Snavely, “Battery Producers Charge Ahead despite Uncertainty,” Detroit Free Press, April 12, 2010, https://www.newspapers.com

[100] “Battery Cell Manufacturing Credits: Report to the Legislature” (Michigan Strategic Fund, December 20, 2019), https://perma.cc

[101] “New Plant to Generate Hope and Jobs,” Detroit Free Press, December 7, 2010, https://www.newspapers.com

[102] “Governor Announces First Large-Scale Michigan Wind Turbine Manufacturing” (State of Michigan, December 7, 2010), https://perma.cc

[103] Kathryn Lynch-Morin, “Saginaw Wind Turbine Manufacturing to Create More than 100 Jobs,” MLive.Com, December 7, 2010, https://perma.cc

[104] Kathleen Gray, “Snyder Offers Peek at How State Will Lure Businesses,” Detroit Free Press, January 11, 2012, https://www.newspapers.com

[105] “FY 2023 MSF/MEDC Annual Report” (Michigan Strategic Fund, March 15, 2024), https://perma.cc

[106] Katherine Yung, “Controversial Biorefinery to Finally Be Built in U.P.,” Detroit Free Press, February 13, 2012, https://www.newspapers.com

[107] “21st Century Jobs Trust Fund - Year-End Report to the Legislature” (Michigan Strategic Fund, March 31, 2014), https://perma.cc

[108] “FY 2019 MSF-MEDC Annual Report” (Michigan Economic Development Corporation, March 16, 2020), https://perma.cc

[109] John Gallagher and Paul Egan, “State Paves Way for 4,500 Jobs, $1b Investments,” Detroit Free Press, January 24, 2013, https://www.newspapers.com

[110] “FY 2023 MSF/MEDC Annual Report” (Michigan Strategic Fund, March 15, 2024), https://perma.cc

[111] Christina Hall and Todd Spangler, “Research Institute Will Bring 10,000 New Jobs,” Detroit Free Press, February 24, 2014, https://www.newspapers.com

[112] “About Us” (LIFT, 2024), https://lift.technology

[113] Matthew Dolan, “Should State Tweak Tax Law to Lure $5b Data Center?,” Detroit Free Press, November 17, 2015, https://www.newspapers.com

[114] Matt Vande Bunte, “Gov. Snyder Signs Tax Breaks for $5B Switch Data Center,” MLive.Com, December 23, 2015, https://perma.cc

[115] Stacy Bowerman, “Memorandum: Kent County (the ‘Applicant’) – Switch, Ltd. (the ‘Company’) MSF Designated Renaissance Zone” (Michigan Economic Development Corporation, July 16, 2016), https://perma.cc

[116] “Michigan Renaissance Zone Act 2021 Legislative Report” (Michigan Strategic Fund, June 27, 2023), https://perma.cc

[117] John Gallagher, “Plant Could Bring 750 Jobs to Detroit,” Detroit Free Press, May 25, 2016, https://www.newspapers.com

[118] “FY 2023 MSF/MEDC Annual Report” (Michigan Strategic Fund, March 15, 2024), https://perma.cc

[119] Matthew Dolan, “Amazon to Expand into Livonia, Hire 1,000 Workers,” Detroit Free Press, December 21, 2016, https://www.newspapers.com

[120] “FY 2023 MSF/MEDC Annual Report” (Michigan Strategic Fund, March 15, 2024), https://perma.cc

[121] Eric D. Lawrence, “Supplier Bringing 430 Jobs to Macomb Co.,” Detroit Free Press, May 17, 2017, https://www.newspapers.com

[122] “FY 2023 MSF/MEDC Annual Report” (Michigan Strategic Fund, March 15, 2024), https://perma.cc

[123] Frank Witsil, “Amazon Seeks to Hire 1,600 in Romulus,” Detroit Free Press, June 27, 2017, https://www.newspapers.com

[124] “FY 2023 MSF/MEDC Annual Report” (Michigan Strategic Fund, March 15, 2024), https://perma.cc

[125] “FY 2023 MSF/MEDC Annual Report” (Michigan Strategic Fund, March 15, 2024), https://perma.cc

[126] John Gallagher, “Penske: $100M Facility, 403 Jobs,” Detroit Free Press, August 23, 2017, https://www.newspapers.com

[127] “FY 2023 MSF/MEDC Annual Report” (Michigan Strategic Fund, March 15, 2024), https://perma.cc

[128] Eric D. Lawrence, “Waymo to Assemble in Detroit Facility,” Detroit Free Press, April 24, 2019, https://www.newspapers.com

[129] “FY 2023 MSF/MEDC Annual Report” (Michigan Strategic Fund, March 15, 2024), https://perma.cc