When I was 25 years old, I was married with a newborn and a total annual household income of less than $35,000 (or $48,000 in 2024). But my wife and I managed to pay monthly college loans, cover our expenses, tithe and save and invest more than 25% of our money. And in the years since, we’ve never spent even half our income on essential living expenses (housing, food, transportation, technology, etc.).

Not everyone is as fortunate as we were. We bought a house heading for foreclosure at a low cost when interest rates were low, and we had the know-how and ability to fix it up ourselves. Neither of us had any health issues. We were blessed.

Still, our budget was extremely tight. And I think there are lessons we learned along the way that others – especially young people – might appreciate.

General principles

Over the years, I’ve given a presentation to church, community and youth groups I call, “How To Get Rich In 1,000 Simple Steps.” It’s a tongue-in-cheek title, exaggerating the key point: For most people, the way to get rich is by doing lots and lots of little things right.

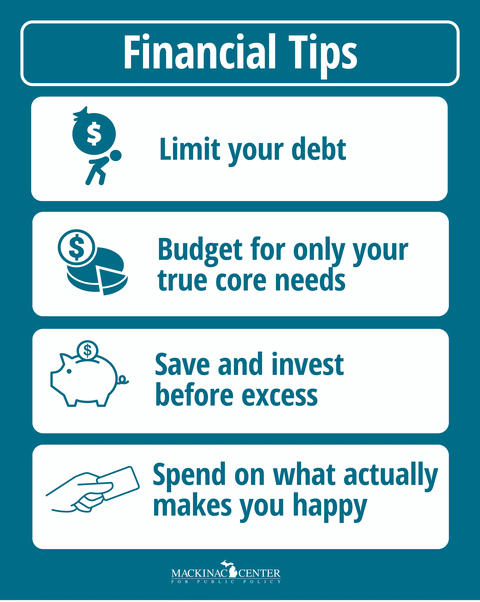

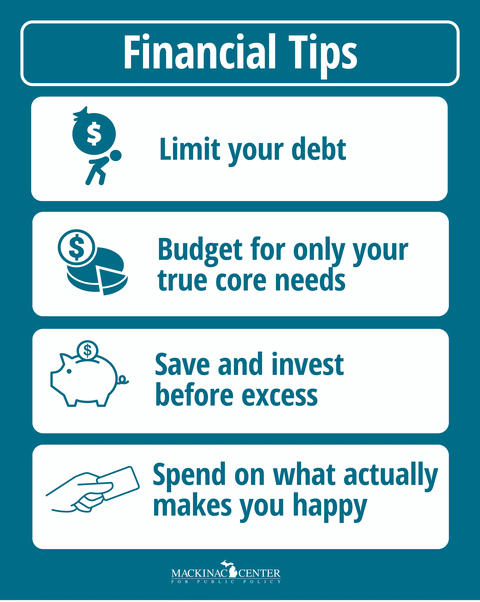

The most important of these are:

- Limit your debt. Don’t ever owe money on something you no longer use or value. In fact, you should probably only borrow to afford a house and an education, and even then, be vigilant. Don’t ever carry a balance of credit card debt; treat it like a debit card.

- Budget for only your truly core needs. Obviously, you must pay for the necessities first – housing, food and transportation. But budget to spend only the minimum of what you truly need for these areas. After saving and investing, if you have money left over, you can pay for eating out, a larger home and a better car. Going above and beyond what you need is what I call “excess spending.”

- Save and invest before excess. After paying for the necessities, the next item of spending should be paying down debt, saving and investing. Paying down debt has the same effect on your balance sheet as investing (when you pay down debt, your savings compound based on whatever the interest rate is). Ideally, money is being directly deposited from your paycheck into paying down debt or a savings or investment account before you ever see it and are tempted to spend it on excess.

- Spend on what actually makes you happy. After spending for your necessities, debt payments and investing, it’s time to spend on what you want. Make sure it’s for things that make you happy! Evaluate accordingly and regularly. Is it video games? Cable TV? Coffee shops? Eating out? Gifts for kids and friends? Understanding your Love Language and that of those close to you can help. But here’s one suggestion, especially if you are a family with kids: Invest in experiences, not stuff.

So, how do you get rich? Budget and save, be careful with credit cards, avoid consumption traps and let your money work for you.

Spending on the necessities

By definition, people need to pay for necessities. But what we all feel we “need” is often different than the reality. My wife and I needed to do some hard work to figure out what we could give up to make sure we were hitting our saving and investing goals. Here’s what we did:

- Housing: As of this writing, it is a tough time for current renters, recent homeowners or those looking to buy a house. Supply is limited and interest rates are high, so housing costs are up. A general piece of advice is to buy or rent a place smaller than you think you need. Home sizes have skyrocketed for decades (more than doubling in the past 40 years). Buying a place larger than you need is an excess you should only pay for if you are debt-free and investing.

- Food: Buy what you need but figure out generic food that you like. Shop in bulk. Pick chicken over beef. Familiarize yourself with Aldi. Eating out and buying organic or brand name is excess spending.

- Transportation: Never buy a new car. Don’t finance a vehicle. Research to find the most reliable and affordable used vehicle you can fit in your budget. Search online for used vehicles at local auto dealerships and bargain hard for them – in fact, email the salesperson with your final offer price and say, “Here’s what I’m willing to pay. I want you to agree to it before I come out, look and test drive the vehicle.” You will save yourself time and money, and another bonus is that you do the haggling over email.

- Technology: If your cell phone plan is from a major carrier, you’re probably paying too much. Explore discount phone companies or third-party resellers whose plans cost less but still use the same networks and provide the same coverage.

- Cricket uses AT&T networks and has plans available for half the cost of buying directly from one of the big companies. Page Plus has basic plans for $10 per month (great if you have a kid who just needs to call and text you and doesn’t need much data). Mint Mobile is $15 per month for a plan with unlimited talk and text and plenty of data for someone who isn’t regularly watching videos outside of Wi-Fi range.

- There are also lots of TV options. Few people, if any, should pay for cable TV or satellite TV. The best option is a good TV antenna, which can be bought for a one-time cost of $25-$35 and gives you up to 100 channels. Anything above that is excess, but, if you’re a sports or movie fan, you can combine that with SlingTV for $30-$40 per month. Explore streaming services if you choose, but make sure you don’t keep paying for them if they aren’t making you happy!

- Subscriptions: Some of this is streaming service for TV and movies (Netflix, Disney+, HBO Max). But people are increasingly setting up automatic subscription renewals for drinks, razors, social media and much more.. A large percentage of consumers are paying billions for services they aren’t using at all. Find out all the subscriptions you are paying for and cancel automatic renewals as much as possible. Some services that can help you do both include the apps Bobby or Billbot or the programs TrackMySubs or Trim.

- Children: If you have kids, you know they cost money. But a lot of people end up spending money they don’t have to buy things their kids don’t need and won’t enjoy for very long. Create experiences with your kids rather than paying for stuff. Get clothes and shoes worn or as hand-me-downs (they won’t notice until they’re older). And here’s something my family does – when it’s a kid’s birthday, we tell family and friends not to buy gifts, but rather put the money into a Roth retirement savings account or college fund we’ve set up in our children’s names. If your kids are like mine, they go through clothes and toys quickly and could not care less if those items are new or used, bought or borrowed.

The most important point is to make sure your money is buying happiness. Regularly evaluate all your normal spending and make sure it is worth it. Always consider the trade-offs. Would you rather pay for cable TV or have a larger home? Buy new shoes each year or go out to eat an extra time each month?

Investing advice

Albert Einstein said that “The most powerful force in the universe is compound interest.” The younger you are, the more benefits you can accumulate from investing – both for reasons of compound interest but also to build good habits. Squirreling away just $100 per month (or $3 per day) from age 20 onward translates, conservatively estimating, to about $350,000 in retirement. This doesn’t even require giving something up completely; $100 per month is switching to a different cell phone carrier, TV provider or making coffee at home rather than going out. And, hey, even if you’re not young – you’re as young as you’ll ever be. So start investing.

Here is my best, most fundamental investing advice:

- Match all 401k, 403(b) or other options that your employer offers. This is literally (to you) free money. Don’t leave it on the table.

- Invest in retirement funds with low expense ratios, preferably an index mutual fund. Index funds try to match a full set of stocks – like the entire stock market – meaning there is no person picking winners and losers. Passively managed accounts cost less because no one is actively trying to pick high-performing stocks. The research shows that index funds outperform active managers, especially when you consider the higher fees actively managed funds charge. Almost every major investment company now offers index funds.

- Costs matter more than anything else. Morningstar found that, “Expense ratios are strong predictors of performance. In every asset class over every time period, the cheapest quintile produced higher total returns than the most expensive quintile.” In other words, all fees and costs considered, the mutual funds costing the least to manage came out the most ahead.

- Use multiple investment accounts. There are two types of individual retirement accounts – Roth and traditional. For Roth, you pay taxes now and invest your leftover funds. For traditional, your investments are not taxed now but will be when you retire. Both are capped at set amounts you can invest per year ($7,000 for 2024). Generally speaking, you want to max your Roth when you are younger and your traditional IRA as you get older and earn more money.

- Have a second source of income by investing your time in a second skill or project, preferably something you really enjoy. For example, I love sports and referee in my spare time. I also enjoy construction work and do some handyman projects on the side. My wife works part-time at a tennis center, enjoying the sport she’s played since a child. I have several friends who drive for ridesharing companies. Another buddy taught himself through YouTube to install toilets and faucets and lists his availability on Facebook Marketplace and Angie’s List. A side gig teaches skills and time management. And maybe you can do the work with a friend or spouse.

Conclusion

Saving and investing sounds obvious and easy. But for most people, it is extremely difficult. And it isn’t just about how much you earn. Research shows that people of all income levels – even the extremely wealthy – struggle with saving money. You have to choose again and again to save and invest, train yourself to be prudent and frugal. But there is a reason why it’s a good idea to focus on long-term growth.

Money buys freedom. The old saying – “Money can’t buy happiness” – is true in that having more money doesn’t necessarily make you happy. But money can buy freedom.

There’s a misunderstanding by many on the political left, and even some conservatives, that our market-based, capitalist system runs on greed and ever-increasing levels of spending. But this isn’t the case. Savings and investments are what truly create broad levels of prosperity. When you’re saving for yourself, you’re also helping the economy grow for everyone. But few people care only about money. (Almost no one picks their career based strictly on how much it pays.) They care about prosperity, yes, but not just money. Rather, the prosperity that comes from choosing a career you love (including raising your children at home), having quality time with family and friends and taking part in leisure activities that bring you joy.

Markets help people get what they want and make us all better off. But that’s more than just a bigger number on a balance sheet. It’s real prosperity in terms of freedom of choice in our careers, what we consume and how we spend our time.

Use the prosperity you earn or are given to buy things that make you and your family happy – but prioritize experiences that you can share together. That could be a family road trip or a parent staying home with young children. Use your money wisely by paying for what you value the most.

Permission to reprint this blog post in whole or in part is hereby granted, provided that the author (or authors) and the Mackinac Center for Public Policy are properly cited.