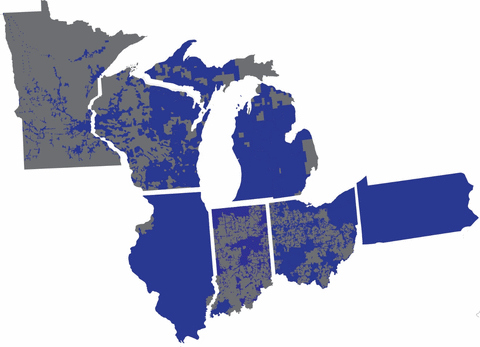

This report explains why electricity consumers and policymakers should be concerned about their electricity becoming more unreliable in the future. It analyzes the electricity plans of the large, investor-owned utilities in seven Great Lakes states: Michigan, Indiana, Wisconsin, Minnesota, Ohio, Illinois and Pennsylvania. Many states and utilities are ignoring the warnings from grid operators and forging ahead with unworkable net zero plans.

Reliable and affordable electricity makes modern society possible. Every second of every day, enough electricity is generated to meet our demands. The hasty transition to so-called net-zero energy production, however, threatens the reliability of our electric grids. The people who operate and regulate these grids increasingly warn of future shortages and blackouts if net-zero goals are pursued. Yet, state governments and utility companies keep marching toward the edge of the electricity reliability cliff.

This report explains why electricity consumers and policymakers should be concerned about their electricity becoming more unreliable in the future. It analyzes the electricity plans of the large, investor-owned utilities in seven Great Lakes states: Michigan, Indiana, Wisconsin, Minnesota, Ohio, Illinois and Pennsylvania. Many states and utilities are ignoring the warnings from grid operators and forging ahead with unworkable net zero plans.

Of the 38 major investor-owned utilities spanning the Great Lakes region, 32 are pledged to net zero by 2050 or sooner. Of the seven states analyzed in this report, three have net zero mandates by law, one has net zero mandates through regulation and the other three have no net zero mandates at the state level.

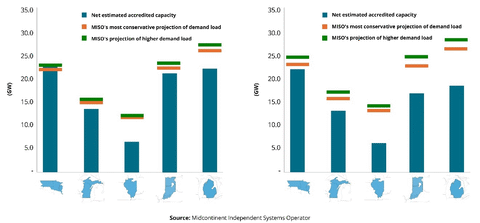

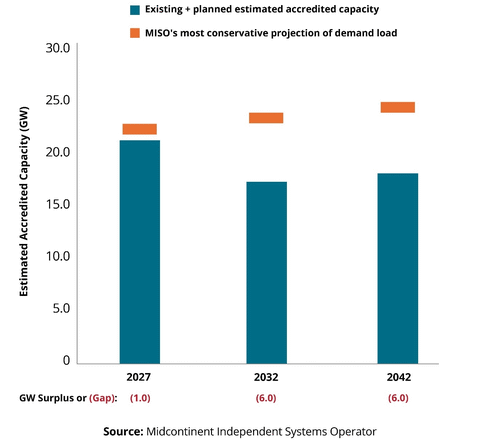

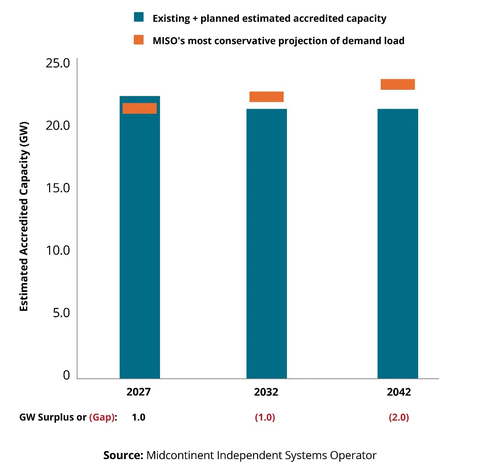

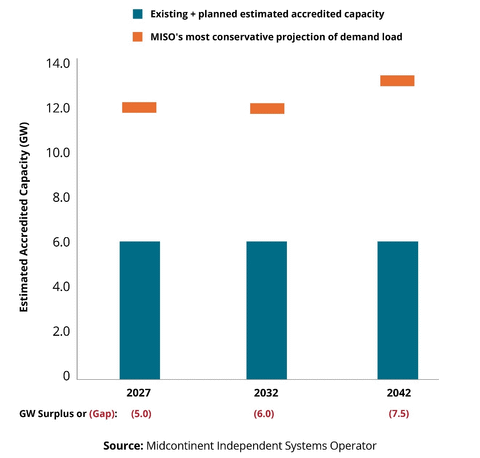

The Midcontinent Independent Systems Operator, the grid operator for much of the Midwest, projects that by 2032, none of the five Great Lakes states in its territory will have enough electricity capacity to meet even the most conservative projection of demand load.

The main element of net-zero plans is to build massive amounts of new wind and solar generation. Despite these additions, MISO expects overall grid capacity to decrease. That’s because states and utilities are simultaneously closing coal plants and some natural gas and nuclear facilities. How much electricity wind and solar generate, however, depends on the weather, so reliability will suffer.

The situation is coming to a head. “Are the lights going to stay on? We’re really at a point where that’s coming into serious question,” Federal Energy Regulatory Commissioner Mark Christie testified last year at a congressional committee hearing. “Are the lights going to stay on?”

The problem is compounded by the fact that most states are moving in the same direction. When Michigan’s utilities find that they do not have enough supply to meet demand, they will be unable to rely on buying surplus from neighboring states because those states will likely be in the same boat. Hastily closing reliable electricity generators and replacing them with weather-dependent wind and solar risks shorting the Great Lakes grid.

Electricity powers every aspect of modern life. From food production to telecommunications to industrial manufacturing, electricity is a necessary component at every step. Access to affordable and reliable electricity is a clear distinction between developed countries and less developed ones.

Abundant electricity empowers people to produce goods and services at scale, making a larger array of goods and services available to more people. As such, we should view reliable and affordable electricity as the tip of the spear in the battle against poverty.

The modern electric grid is essential. Every second of every day, the typical American relies on it to illuminate a space, to keep food refrigerated and to control the temperature at home. It makes possible modern hospitals, public water utilities, recycling, traffic signals, infrastructure and services we rely on daily. The grid also powers the digital devices we spend hours on every day working, shopping, playing, socializing and entertaining ourselves.

In short, modern life is impossible without the electric grid. In the words of Emmet Penney, editor-in-chief of Grid Brief:

[The grid] is a commons; a tapestry of infrastructure and institutions that comprise the largest machine on earth. We inherit the grid and we must conserve it so that it may be passed on to our posterity so that they may make use of the wealth it provides. And there is no such thing as a wealthy society with a weak electrical grid.[1]

Indeed, a stable society and a growing economy require a reliable electric grid. These conditions create more opportunities for people to improve their lives, to overcome poverty or to improve conditions for future generations. Grid reliability should be of paramount concern to the public and to policymakers.

Policymakers at the federal and state levels are increasingly supporting policies that damage or threaten grid reliability. Most are aimed at reducing carbon dioxide emissions to “net zero,” where electricity generation will theoretically have no impact on the composition of atmospheric gases. These efforts are part of a broader movement within wealthy countries to slow the changing of the climate by transitioning from using fossil fuels to generate electricity to using wind turbines, solar photovoltaic panels and grid-scale batteries. An increasing number of state legislatures and regulated utility companies are falling in line.

Wind turbines and solar panels have received taxpayer dollars for half a century or longer and receive more subsidies than all other forms of electricity generation combined.[2] Yet, they remained small contributors to the grid until state governments began mandating their use. But wind and solar have major shortcomings: They have low energy density and are wholly dependent on weather-related factors.

The low energy density of wind and solar means they require huge amounts of land and resources to produce the same amount of electricity as conventional power plants. As energy expert Alex Epstein points out, “The energy in fossil fuels was originally energy from ancient sunlight, which was stored in plants (or in organisms that ate plants) via photosynthesis and then concentrated through natural processes (involving large amounts of heat and pressure over time).”[3] Fossil fuels are, at their core, Jurassic sunlight — incredibly dense forms of stored solar energy. Thus, a shift to using the solar energy that strikes the Earth’s surface at a just one moment in time is simply less productive.[*]

How much electricity wind and solar generate depends on uncontrollable factors, like the weather and time of day. This makes them undependable. Wind and solar can vary from producing at full capacity when weather conditions are ideal to less than 1% of capacity under the worst conditions.

For example, a representative of Southwest Power Pool, the electric grid operator for the Great Plains region, told a U.S. House Subcommittee that weather conditions in 2023 reduced wind generation to less than 1% of its capacity. The wind turbines in that grid are rated to generate up to 32,000 megawatts of electricity but produced only 110 megawatts — that is, wind production fell to about one-third of 1% of its capacity. Fortunately, Southwest Power Pool had other generation sources on standby and was able to make up for wind’s shortfall.[4]

Wind and solar cannot be relied on as a one-for-one replacement of existing generation sources, like coal, natural gas and nuclear. If the grid relies on forms of generation that are uncontrollable and unreliable, it must also maintain backup sources that are controllable and reliable. Because wind and solar production can fall to near zero at times, utilities may need to maintain up to another grid’s worth of generation capacity.[†]

This point was articulated well in front of the same U.S. House Committee that heard about how wind generation can drastically drop to near zero. A senior vice president of a large grid operator testified:

Also due to policy actions, both on the governmental and private-sector levels, replacement generation is made up of primarily intermittent and limited-duration resources, such as wind, solar and battery storage. These resources do not replace “1 for 1,” but rather require multiple megawatts to replace one megawatt of dispatchable generation [coal, natural gas, nuclear] due to their limited availability in certain hours of the day and seasons of the year.[5]

[*] Likewise, solar energy is just the radiation from the nuclear energy created by the sun that has traveled to Earth. That’s why the nuclear power created in a plant will always be orders of magnitude more energy dense and efficient than solar energy.

[†] Battery backup is unlikely to provide a bailout for wind and solar. The amounts of backup being built typically only store enough electricity to cover inadequate wind and solar production for a few hours. As of now, batteries’ primary function is merely to keep the grid going long enough for reliable generation sources like natural gas to start up and supply the grid.

Despite these significant deficiencies, policymakers and public utility companies continue down the net-zero path: building more and more wind and solar generation while shutting down traditional power plants such as coal, natural gas and nuclear. The reasons for this are complex, but a large part of the explanation is the incentives regulated utilities face.

Public utility companies are often organized as regulated monopolies. State law grants them a monopoly privilege to generate, transmit or distribute electricity. In exchange, the state tightly regulates these companies, including the prices they charge consumers and the profits they produce for shareholders.

State regulators often guarantee profits for monopoly utilities by allowing them to charge prices high enough to cover all their costs and more.[*] Public utilities can also earn guaranteed profits by building more generation capacity, such as wind turbines and solar panels. This incentive compels utilities to support policies requiring them to build ever-more generation infrastructure.[6] To paraphrase energy expert Meredith Angwin, the way for a monopoly utility to make more money is to spend more money, not necessarily to better serve ratepayers.[7]

Public utility commissions ostensibly exist to protect ratepayers from the abuses made possible by state-imposed monopolies. But with state mandates and increasing pressure from politicians and state officials to enforce climate policies, there is little commissions can do but approve new construction of massive wind and solar projects.

Wind and solar projects are favored because of federal, and often state, subsidies. From 2010 to 2019, wind and solar received more federal energy subsidies than oil, natural gas, nuclear, coal, hydropower and geothermal combined.[8] They are receiving even more as of late, given the 2022 Inflation Reduction Act’s extensions and increases on various subsidies.[9]

To see the effect of such incentives on utility behavior, look no further than the refurbishing, or so-called repowering, of wind turbines a decade or more before they are likely to break down. The shelf life of wind turbines should be around 25 years, yet utilities partially repower them every 10 years to prevent the Production Tax Credit, a federal subsidy, from expiring. In the words of the U.S. Department of Energy, “[T]he ability of partially repowered wind projects to access the PTC has been the primary motivator for the growth in partial repowering in recent years.”[10] Warren Buffett put it bluntly back in 2014: “[W]e get a tax credit if we build a lot of wind farms. That’s the only reason to build them. They don’t make sense without the tax credit.”[11] In other words, utilities build wind and solar generation not because they are reliable or efficient or an improvement to the status quo. They build them because they align with net-zero goals, and they profit handsomely from it.

[*] This rate of return is calculated based on a utility’s total assets and is called the rate base. Alexandra Aznar and Joyce McClaren, “Phrase of the Day: Rate Base” (National Renewable Energy Laboratory, September 16, 2015), https://perma.cc

Given these circumstances, it is not surprising that the electric grids we rely on every second of every day are becoming less reliable. Electricity shortages — brownouts and blackouts — are more common.[12] Unlike shortfall events in the past, the causes of more recent ones appear connected to attempts to power the grid with unreliable sources of generation, such as wind and solar.[*]

Grid instability is not a technical problem but a self-inflicted, political one. Management errors or insufficient maintenance of transmission and distribution networks caused the shortfalls of the past, but the generation side of the equation has been largely solved for about a century. The push to shoehorn wind and solar generation onto the grid, coupled with the shuttering or overburdening of reliable sources of generation, is threatening the stability of today’s grid.

No one knows this better than the people who operate the regional electric grids throughout the country. These organizations — Regional Transmission Organizations and Independent Systems Operators — perform the job of balancing the flow of electricity on the grid. Like air traffic controllers, these operators direct the interchange of electricity, determining in real time which generators will feed the grid and how the energy is priced. Representatives of these organizations consistently express concerns for the future reliability of the grids they manage. Below are a few examples.

From John Bear, CEO of the Midcontinent Independent Systems Operator:

[T]he transition that is underway to get to a decarbonized end state is posing material, adverse challenges to electric reliability.

A key risk is that many existing “dispatchable” resources that can be turned on and off and adjusted as needed are being replaced with weather-dependent resources such as wind and solar that have materially different characteristics and capabilities. … [T]hey lack certain key reliability attributes that are needed to keep the grid reliable every hour of the year.[13] (Emphases in original.)

From Manu Asthana, CEO of PJM, the regional transmissions operator of parts of the Mid-Atlantic and Midwest:

When you do the math — when you look at the rate of retirements, you look at the rate of growth, and you add in the current rate of throughput for our queue — we are headed for some trouble. And that trouble is likely to find us later in this decade.[14]

From the North American Electric Reliability Corporation, or NERC:

The reliability of the BPS [Bulk Power System, effectively synonymous with the electric grid] depends on the operating characteristics of the replacement resources. Merely having available generation capacity does not equate to having the necessary reliability services or ramping capability to balance generation and load. It is essential for the BPS to have resources not only with the capability to respond to frequency and voltage changes, but to actively provide those services.[15]

From Commissioner Mark Christie of the Federal Energy Regulatory Commission, or FERC:

I think the United States is heading for a very catastrophic situation in terms of reliability. […] The core of the problem is actually very simple. We are retiring dispatchable generating resources at a pace and in an amount that is far too fast and far too great, and it is threatening our ability to keep the lights on. The problem is not the addition of wind and solar and other renewable resources. The problem is the subtraction of dispatchable resources such as coal and gas. […] A nameplate megawatt of wind or solar is simply not equal in terms of capacity value to a nameplate megawatt of coal or gas or nuclear.[16]

From a joint comment made by four major grid operators:

As the penetration of renewable resources continues to increase, the grid will need to rely even more on generation capable of providing critical reliability attributes. With continued and potentially accelerated retirements of dispatchable generation, supply of these reliability attributes will dwindle to concerning levels. […] [Wind, solar and battery] resources do not, at present, provide the same levels of essential reliability services — or attributes — as their thermal (coal, natural gas and nuclear) counterparts.[17]

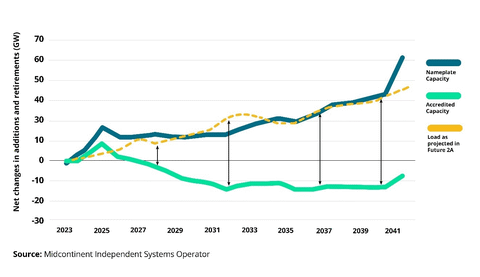

The concerns raised by these organizations center around the important difference between “nameplate capacity” and “accredited capacity,” two measures of a power plant’s production capability. Nameplate capacity is the total amount of electricity that could be generated at a given time. For wind, it’s the maximum amount when the wind is blowing steadiest, from an ideal direction and at the perfect height. For solar, nameplate capacity is when the sun is shining brightest, with an optimal temperature and at the right angle. Accredited capacity is the amount of electricity that can be realistically relied on to be generated at any given time.

While wind and solar can replace the nameplate capacity of existing generators on paper, the problem is that they will fall short of replacing the needed accredited capacity due to their inherent intermittentness and dependency on the weather. To prevent shortfalls, public utilities would either have to build significantly more nameplate capacity of wind and solar or maintain backup sources of reliable electricity generation that can be switched on when there is not enough sun or wind.

A generator’s capacity factor is a measure of how much electricity is produced given its nameplate capacity. Over the last decade, the average capacity factor of wind turbines was about 35%, meaning they produced less than half their nameplate capacity. This means that a wind power facility with a nameplate capacity of 300 megawatts will produce only 105 megawatts on average. Solar panels’ average capacity factor is even worse: hovering about 25% for most of the last decade and falling below 15% in winter months.[18]

Meanwhile, natural gas plants (combined-cycle) have an average capacity factor ranging from 50-60%. Coal plants’ capacity factors are similar, typically between 40% and 60%. Nuclear plants are the most efficient, with a capacity factor of around 92%.[†]

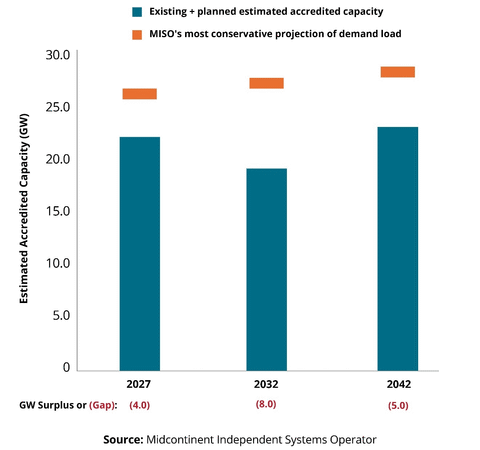

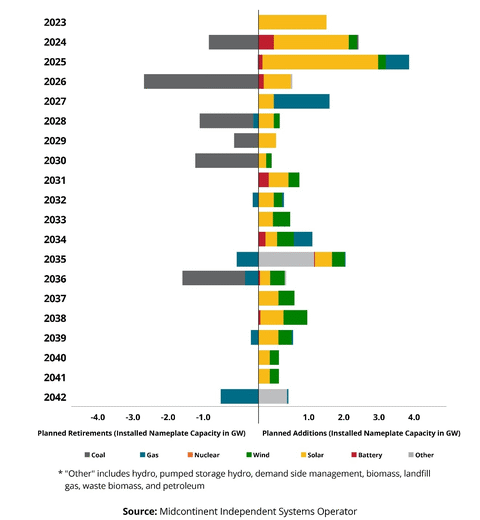

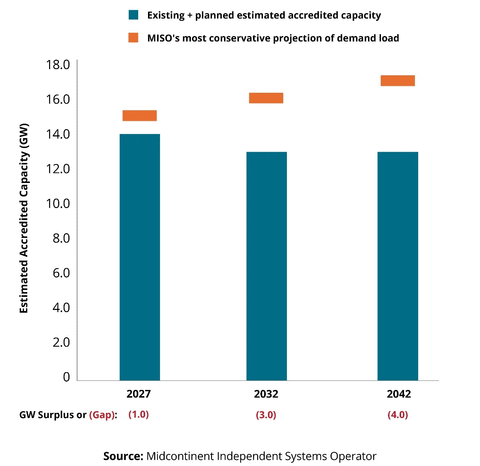

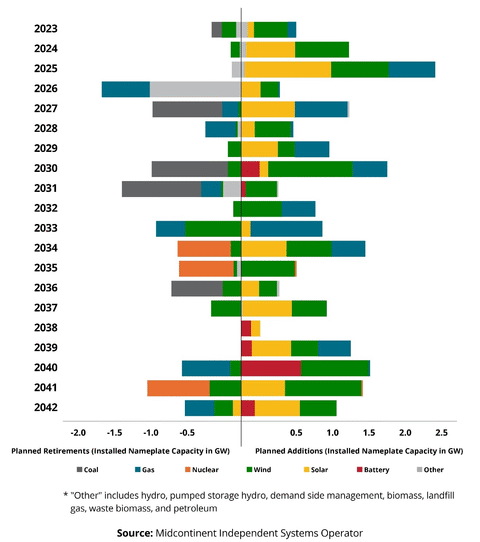

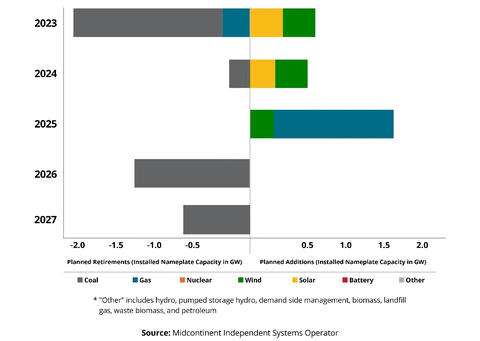

Graphic 1 provides a clear image of the problem of transitioning to wind and solar. It shows the cumulative nameplate capacity, projected electricity demand and accredited capacity for the Midcontinent Independent Systems Operator. MISO is one of the largest regional electric grids in the U.S. and covers a majority of five of the seven states analyzed in this report.

The graph shows a projected increase in nameplate generation capacity and electricity demand through 2042. But the accredited generation capacity, the amount of generation that can be relied on to meet the grid’s demand, declines over time. This is a result of states and utilities transitioning from traditional sources of generation to wind and solar, which add nameplate capacity but significantly less accredited capacity. The consequence for the MISO grid will be electricity shortfalls or blackouts, as the gap between supply and demand grows.

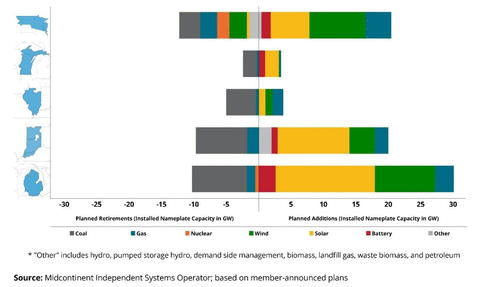

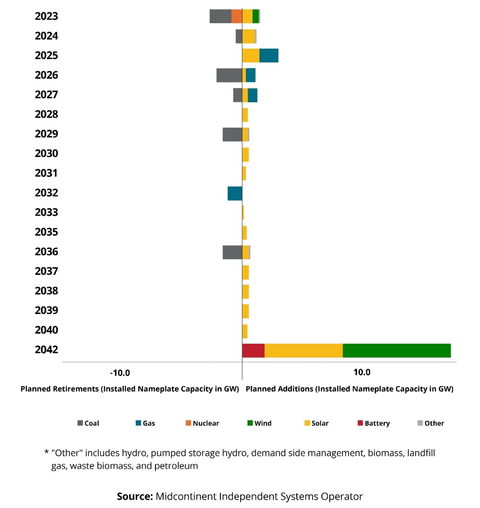

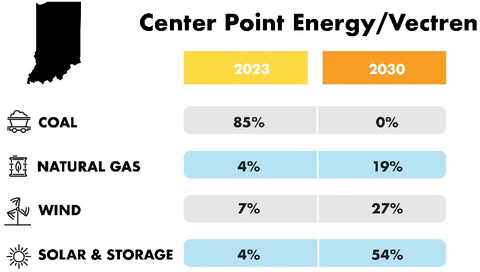

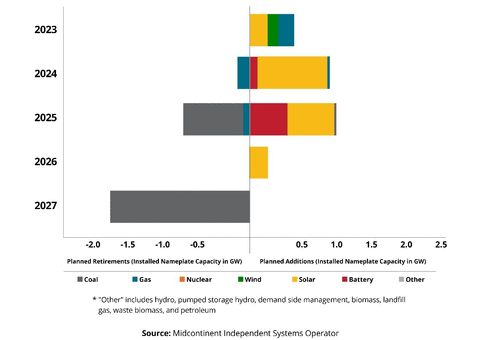

The scale of this problem throughout the Great Lakes region is demonstrated in Graphic 2 below. It shows the planned retirements and additions of nameplate capacity for different areas within the MISO regional grid from 2023 to 2042. These regions cover large portions of five of the Great Lakes states. The chart corroborates the testimony of grid operators: Utilities across the region plan to massively build out wind and solar generation resources while closing significant amounts of existing generation capacity, mostly coal plants.

MISO also modeled future demand and compared that with planned accredited capacity. Graphic 3 shows the gaps between generation supply and two estimates of expected demand load, for 2027 and 2032. Only one of the MISO zones in the Great Lakes region is expected to have enough capacity to meet even the most conservative projection of future demand load in 2027 and none are by 2032.

This so-called energy transition — moving from reliable forms of generation to intermittent ones — is poorly planned. The singular focus on reducing carbon emissions threatens to destabilize the electric grid in an unprecedented way. Building weather-dependent wind and solar generation is a hollow addition to the grid that will cause more problems than it addresses. These energy sources cannot be used as replacements for traditional generation without significant overbuilding of wind and solar and maintaining an entire fleet of reliable, backup generation, such as natural gas. The collective efforts of state officials and utilities all across the country are threatening to short the nation’s electric grids.

[*] In the past, large-scale blackouts, whether in 1965 or 2003, tended to stem from problems in communication, coordination and transmission management. One example is the 2003 Northeast Blackout, which directly affected over 50 million people and cost between $4 and $10 billion. “The Economic Impacts of the August 2003 Blackout” (Electricity Consumers Resource Council, February 9, 2004), https://perma.cc

[†] It is worth noting that coal plants’ capacity factors are lower than they used to be. Capacity factors of 60% to 80% were common before coal plants were forced to “load follow” (provide backing generation for wind and solar) or generate less in response to regulatory mandates. Since these facilities were designed to run a constant baseload of power, load following dramatically reduces their performance.

In this report, we analyzed state policies and the plans of the largest investor-owned utility companies in seven Great Lakes states: Michigan, Indiana, Wisconsin, Minnesota, Ohio, Illinois and Pennsylvania. The electric grids in large portions of these states are connected, and energy suppliers can buy and sell from a common electricity market. Since these states rely on shared energy resources, the actions of one state or even one large utility company could have ripple effects throughout the entire region.

The sections in this report give a brief overview of each of the seven states’ electricity generation and markets, its net-zero policies and the published plans of its large utilities. The first four states profiled — Michigan, Indiana, Wisconsin and Minnesota — are similar in that ratepayers effectively have no choice in whom they purchase their electricity from. Utilities in these states are granted monopoly privileges over electricity generation. The last three states — Ohio, Illinois and Pennsylvania — allow electricity choice, permitting customers the power to choose from whom they buy their electricity.[*]

Despite these differences, a similar picture emerges again and again: State lawmakers, regulators and large electricity utility companies in all seven states are rushing to achieve so-called net-zero climate goals. These are efforts to reduce the greenhouse gas emissions produced by generating the electricity that powers the grid. The plans mostly call for building significantly more wind and solar facilities, with natural gas serving as the primary dispatchable, or backup, resource. Nuclear energy is occasionally included, but it rarely plays a prominent role in these plans.

This report aims to shed more light on the risks of these seven states transitioning their energy generation all in the same direction and all at the same time. Nearly all large utilities across the Great Lakes region are following the same playbook, and this presents a unique threat to grid reliability. It appears, according to projections produced by grid operators, that these states will fall short of meeting their future electricity needs. Consumers will be stuck with unreliable electricity.

The focus of this report is on the looming resource adequacy problem. As a result, though there are other problems with the net-zero transition, they fall outside this paper's scope. These problems include, but are not limited to: (1) the myriad supply chain limitations on the unprecedented buildout of wind turbines and solar panels; (2) the significant increases in transmission and distribution infrastructure required to connect them to the grid, (3) the subsequent delays that planning this buildout causes; (4) the increased complexity of grid operation introduced by these weather-dependent resources; (5) the potential for cascading generation failures caused by vulnerabilities with inverter-based resources, namely wind, solar and batteries; (6) the sheer infeasibility of doubling wind and solar capacities every few years; and (7) siting and property rights issues for wind and solar projects.

The rush to a wind- and solar-based net-zero effort and the financial incentives supporting it affect all the states’ plans. It will result in a declining diversity in generation, leaving the whole region more susceptible to shortfalls. Because wind and solar are incapable of reliably meeting demand, let alone future demand, residents of Great Lakes states are likely to suffer instability and blackouts.

[*] We intentionally use the terms “customer” and “ratepayer” to describe electricity consumers in states with electricity choice and without. In states with electricity choice, electricity purchasers are customers because they can freely decide from whom they want buy service. In states without electricity choice, these consumers are not customers but ratepayers. They have no choice from whom to buy and must simply pay the utility’s rate, as approved by the government.

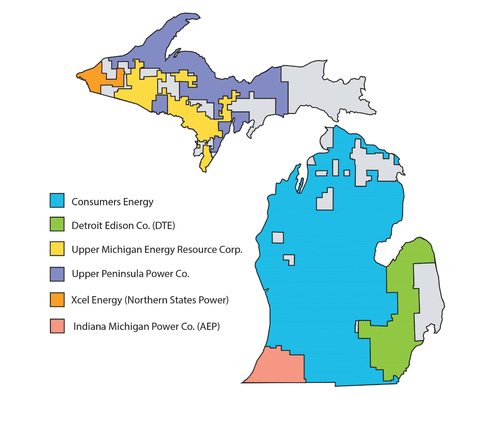

Michigan is the 10th largest state, with a population of about 10 million. Comprising two peninsulas, Michigan is the only state that borders four Great Lakes. Michigan’s Lower Peninsula is surrounded by Lake Michigan to the west, Lake Huron to the east and Lake Erie to the southeast. The Upper Peninsula has Lake Superior to its north, Lake Huron to its southeast, and Lake Michigan forming the rest of its southern shores.

The state’s public utility regulatory body is the Michigan Public Service Commission. Since 2008, 90% of Michigan’s electricity customers have been required to purchase their electricity from monopoly utilities due to a 10% statutory cap on the portion of customers allowed to choose their provider. Michigan’s monopoly utility companies are investor-owned and provided 69% of the state’s electricity needs in 2022.[*] They must file integrated resource plans to the public service commission. These plans outline how the utilities will continue generating and distributing enough electricity to meet projected demand.

Overall, the state’s utilities generated about 10,000 gigawatts of electricity in 2022, serving about five million customers.[19] According to the U.S. Energy Information Administration, about 12% of that electricity was generated by so-called renewable sources.[20]

[*] Local municipal utilities and rural electricity cooperatives meet the needs of the rest of Michigan’s customers. “Michigan Electricity Profile 2022” (Energy Information Administration, November 2, 2023), https://perma.cc

Michigan Gov. Gretchen Whitmer’s Executive Directive 2020-10 committed the state to an “economy-wide carbon neutrality” goal by 2050.[21] She tasked the state’s Department of Environment, Great Lakes, and Energy with developing the MI Healthy Climate Plan.[22]

The plan frames much of the state’s energy policy discussion. It includes several interim goals, such as: reduce greenhouse gas emissions by 28% compared to 2005 levels by 2025 and by 52% by 2030; generate 60% of all electricity from wind, solar and other so-called renewable sources by 2030; and adopt a 50% “renewable energy standard” the same year. Another is to “phase out remaining coal-fired power plants by 2030.”[23]

Michigan’s Legislature passed bills in late 2023 that created legal mandates to many of the goals of the MI Healthy Climate Plan. These statutes require electricity providers to “achieve a renewable energy credit portfolio” of 15% through 2027, 50% by 2030 and 60% by 2035. They must meet a “clean energy portfolio” of 80% in 2035 and 100% by 2040.[24]

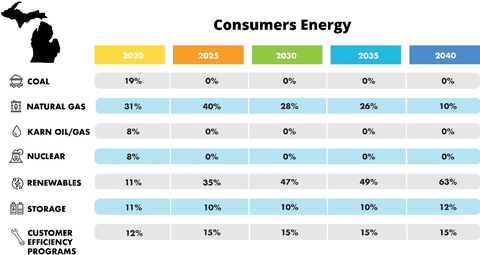

Consumers Energy serves electricity to 1.9 million Michigan ratepayers and has the largest service area of any utility in the state. Consumers is a subsidiary of CMS Energy.[25]

Consumers Energy plans to continue aggressively transitioning to wind and solar generation. In a 2021 plan it described as “sweeping,” the utility announced it aimed to reach net-zero by 2040 and to “end coal use” by 2025. The utility wants a resource mix in 2040 that has only 10% natural gas and 63% wind and solar. Consumers claims it is “a national leader in the clean energy transition.”[26]

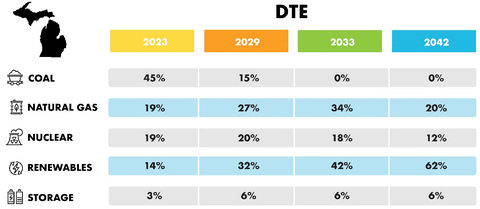

DTE Energy, formerly Detroit-Edison, is the parent company of DTE Gas Company, DTE Gas Storage and DTE Electric. DTE Electric serves 2.3 million ratepayers in Michigan.[27] DTE’s plans include net-zero carbon emissions by 2050, shuttering coal plants by 2032, and adding 15,400 megawatts of wind and solar generation by 2042, making these sources responsible for more than 60% of the utility’s electricity generation. DTE also highlights how it will need to call upon “future 24/7 emerging technologies”— that is, technologies that do not currently exist. The utility says that “[e]nsuring electric reliability is the highest priority at DTE, and the foundation of our plan.”[28]

Upper Peninsula Power Company, or UPPCO, is a small, investor-owned utility in Michigan’s Upper Peninsula, generally operating in the northernmost regions of the state. It serves around 52,000 customers spread over almost 4,500 square miles, or about 12 customers per square mile.[29]

UPPCO has little, if anything, to say on the matter of net zero. The company owns little generation aside from small hydroelectric dams and a single oil-fired plant that it plans to retire. UPPCO notes on its website that, from the period of August 2019 to July 2020, it purchased around 85% of its electricity.[30]

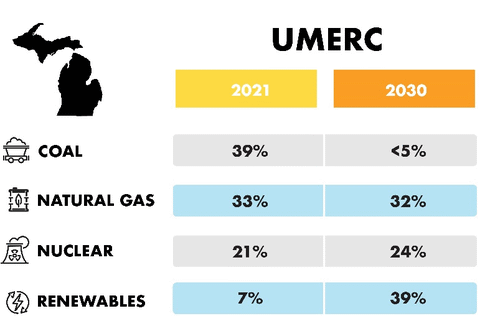

Upper Michigan Energy Resources Corp., or UMERC, is another investor-owned utility operating in Michigan’s Upper Peninsula. UMERC is a subsidiary of WEC Energy Group, a Wisconsin-based company operating in several of the Great Lakes states. WEC serves 1.6 million electric customers, with around 36,500 living in Michigan.[31]

WEC has net-zero plans in line with most other energy companies: net zero carbon emissions by 2050, plans to cease coal generation by 2035 and aggressive renewables expansion. WEC has a significant nuclear presence which it intends to maintain and keeps its anticipated renewables presence at a comparatively reasonable level.

In UMERC’s most recent long-range energy plans submitted to the state, the utility plans to maintain two natural gas plants, which replaced coal-fired generation the utility had used previously. UMERC plans to build more generation from solar facilities by the end of 2026.[32]

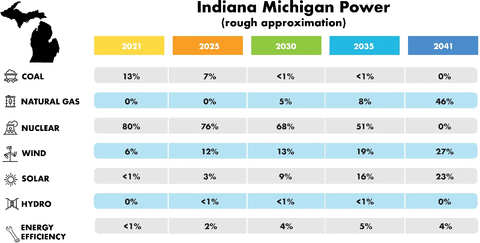

One other investor-owned utility in Michigan is Indiana Michigan Power Company, a subsidiary of American Electric Power. AEP is one of the largest electric utility companies in the country, serving over five million people in 11 states, including 133,000 customers in Michigan.[33]

AEP’s plans for net-zero greenhouse gas emissions are on the bolder side. The company aims for net zero by 2045, 50% wind and solar generation by 2032, and, for Indiana Michigan Power specifically, retiring the last remaining coal plant in 2028.[34] The company plans to close its nuclear plants by 2038, aiming for a resource mix made of mostly wind, solar and natural gas generation.[35]

Most of Michigan falls under the service territory of the Midcontinent Independent Systems Operator, MISO. Below is a chart created by MISO that depicts the various utilities’ publicly stated planned retirements and additions of electricity generation resources in most of Michigan’s Lower Peninsula. These retirements and additions are in nameplate capacity.

The next chart shows the gap between the generation capacity that utilities in Michigan plan to have and the most conservative, or lowest, estimate of demand load that MISO expects on the grid. If MISO’s information is accurate, Michigan will face broad electricity generation shortfalls by 2027 and ever larger deficits by 2032 and 2042.

Michigan’s energy policy sets the state up for failure. The state’s net-zero mandates and requirements for wind and solar strain reliable resources. Michigan’s goals are some of the most aggressive in the Great Lakes region. Meanwhile, the large utilities are mostly marching in lockstep toward similar objectives. The blackouts the state will suffer are inevitable given these poor decisions.

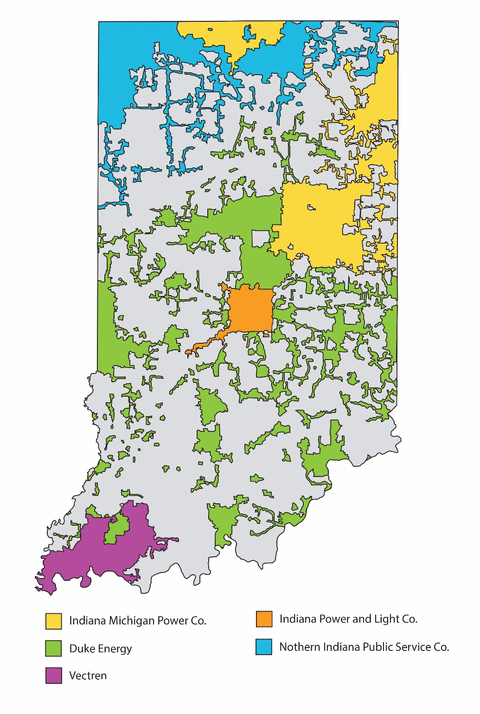

Home to almost seven million people, Indiana is the 17th most populous state and was the 19th to enter the Union. Known as the Crossroads of America, Indiana’s central location means it is within about a day’s drive of an estimated 80% of the population of the country.[36]

Indiana does not have electricity choice — ratepayers must buy from the monopoly utility in their area. As a result, the Indiana Utility Regulatory Commission acts as the public body setting electricity rates. Indiana’s regulated utilities are required to file integrated resource plans detailing their expected fuel mix and generation for the near future.

The state’s investor-owned utilities generate the lion’s share of electricity for consumers, coming in at 77%. Public utilities make up almost 8%, with rural cooperatives providing the remaining 15%.[37]

Overall, the state’s utilities generated about 7,200 gigawatts of electricity in 2022, serving about 3.3 million customers.[38] According to the U.S. Energy Information Administration, about 16% of that electricity was generated by so-called renewable sources.[39]

Net zero is not an official state goal in Indiana. Gov. Eric Holcomb’s stance is an “all-of-the-above” energy strategy, building new wind and solar projects but keeping coal, natural gas and nuclear operating into the foreseeable future.[40]

Despite this, all the major utilities in the state have their own net-zero aims. As in other states, these are monopoly utilities and receive guaranteed profits from building or operating new generation sources like wind and solar. That is, these utilities are allowed by regulators to charge ratepayers more based on their costs to deliver the electricity, regardless of whether those costs were efficient from a ratepayer’s perspective.

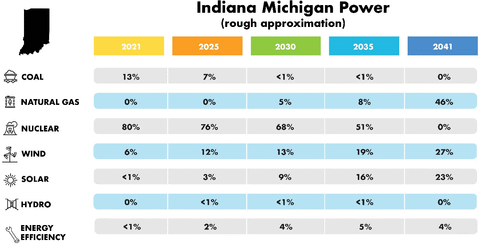

Indiana Michigan Power Company is a subsidiary of American Electric Power, one of the largest electric utilities in the country, serving more than five million people in 11 states and around 480,000 customers in Indiana.[41]

AEP’s plans for net-zero greenhouse gas emissions are on the bolder side. The company aims for net zero by 2045 and 50% wind and solar generation by 2032. Indiana Michigan Power specifically plans to retire the last remaining coal plant in 2028.[42] The company plans to close its nuclear plants by 2038, aiming for a resource mix made of mostly wind, solar and natural gas generation.[43]

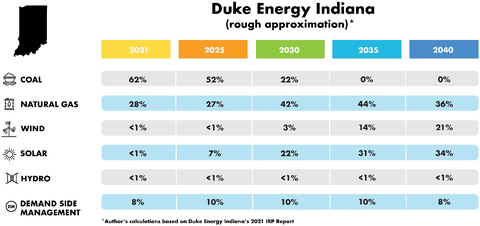

Duke Energy Indiana is a subsidiary of Duke Energy, a North Carolina-based company serving 8.2 million customers around the country. Duke Energy Indiana is the state’s largest utility, serving around 890,000 customers.[44]

Duke Energy plans to reach net zero by 2050, a goal shared by Duke Energy Indiana. Duke Energy Indiana’s resource use plan outlines a few portfolios for electricity generation, with its preferred mix including an accelerated decrease in coal use and abandoning the fuel altogether by 2035. The utility plans to add new natural gas generation and even more wind and solar by 2040.[45]

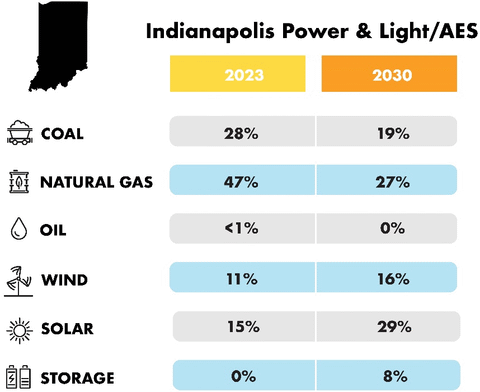

Indianapolis Power & Light Company, or AES Indiana, is owned by the AES Corporation. AES Indiana serves about 517,000 customers around Indianapolis.[46] AES pledges to be net zero in its electricity services by 2040 and to achieve net zero across its entire business portfolio by 2050.[47]

AES Indiana seems to be following a similar path. The 2022 resource plan it published shows the utility plans to shutter all its coal by 2032 and rely on wind, solar and batteries for about 80% of its electricity by 2042.[48] The utility’s website, on the other hand, tells a slightly different story. It shows the utility still generating a fifth of its electricity from coal in 2039 and relying on natural gas for another quarter of its power generation. Wind and solar are expected to account for 44% of generation in 2039, much less than predicted in the utility’s resource planning document.[49]

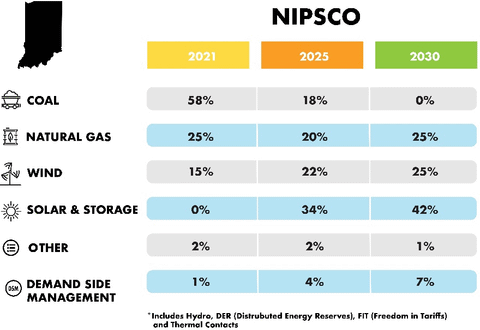

Northern Indiana Public Service Company, or NIPSCO, is a NiSource subsidiary and serves electricity to around 483,000 customers across the state.[50]

The utility has an aggressive plan to shift to wind, solar and battery storage for electricity. Coal generated 58% of its electricity in 2021, but the utility plans to eliminate this fuel source by 2030. Coal generation will be replaced with a massive buildout of wind and especially solar and battery storage. The utility intends to double the portion of its electricity generated by wind, growing from 15% in 2021 to 29% 2030. It expects to expand its use of solar and battery from none in 2021 to a 42% share of all its electricity by 2030.[51]

Formerly known as Vectren and Southern Indiana Gas and Electric Company, this investor-owned utility is now a part of CenterPoint Energy. The utility serves about 150,000 electric customers through its Indiana South division.[52]

CenterPoint Energy makes a particularly bold plan for net zero, aiming to achieve it by 2035. It plans to abandon the use of coal entirely by 2027, despite the fuel source currently making up 85% of the utility’s current generation.[53]

The utility plans to replace its coal generation by adding more solar and wind to its energy portfolio as well as natural gas. By 2030, it aims to grow the solar portion of its generation mix from 4% to 54% and its wind production from 7% to 27%.[54]

Most of Indiana falls under the service territory of MISO. The chart below depicts the various utilities’ publicly stated planned retirements and additions of electricity generation resources in most of the state. These retirements and additions are in nameplate capacity.

The next chart shows the gap between the generation capacity that utilities in Indiana plan to have and the most conservative, or lowest, estimate of demand load that MISO expects on the grid. If MISO’s information is accurate, Indiana will face broad electricity generation shortfalls by 2027 and ever larger deficits by 2032 and 2042.

Indiana’s net-zero concerns stem from its utilities’ voluntary efforts. They are no doubt spurred on by the profits they can make building new electricity generation combined with plentiful federal subsidies and other incentives for using more wind and solar. Unlike several other states in the Great Lakes region, Indiana's governments and regulators appear to have little or no impact on requiring or encouraging electricity producers to shift to wind, solar and battery.

Despite this, all of the utilities will be closing their coal-fired plants, replacing this reliable and cheap form of baseload generation with weather-dependent and unreliable wind and solar. The strain on natural gas generation and the need to import from the regional grid is, unfortunately, still likely in Indiana. If the utilities had kept these in operation, however, the state might have been a new donor to the regional electric grid, instead of becoming dependent on it to meet the state's demand.

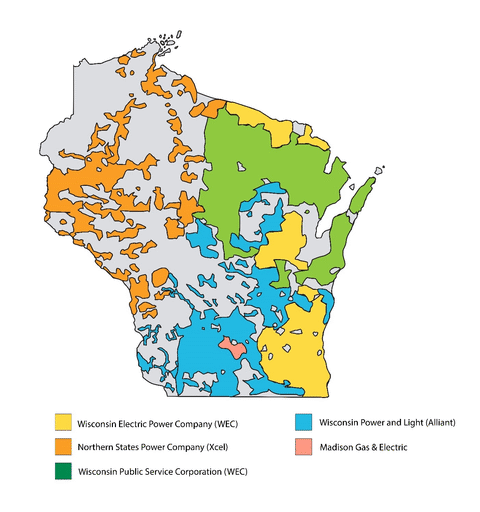

Wisconsin ranks 20th in population, with about 5.9 million people. Known as America’s Dairyland for its farm and milk production, the state covers most of Lake Michigan’s western shore and parts of Lake Superior’s southern shore.

In Wisconsin, ratepayers are forced to buy electricity from the appointed investor-owned, monopoly utility. The Public Service Commission of Wisconsin regulates these utilities. The commission does not require them to file integrated resource plans, which force utilities to report their plans for generating sufficient electricity to meet demand in the near future. Utilities in Wisconsin do have to report on their progress toward renewable portfolio standards set by the state. Utilities are required to increase their use of wind and solar by a certain percentage above their baseline. The statewide standard is a goal of 10% “renewable energy” generation.[55]

Overall, the state’s utilities generated about 4,800 gigawatts of electricity in 2022, serving about 3.2 million customers.[56] According to the U.S. Energy Information Administration, about 11% of that electricity was generated by so-called renewable sources.[57]

Decarbonization efforts seem to be a high priority in Wisconsin’s state government. Gov. Tony Evers’ 2019 Executive Order 38 set Wisconsin on the path to “ensuring all electricity consumed within the State of Wisconsin is 100 percent carbon-free by 2050.”[58] It also established the Office of Sustainability and Clean Energy and charged it with creating a “clean energy plan” for the state.[59] However, such aspirations have not been codified into law and remain executive fiat.

A 2005 state law mandated that 10% of the electricity sold by utilities be generated from so-called renewable energy sources by 2015.[60] It required all utilities to grow their use of weather-dependent electricity sources, such as wind and solar, even if they are already using more than the state standard of 10%. Individual utility requirements in 2021 ranged from 6% to 35%.[61]

The utilities in the state are on board with full-scale decarbonization as well, each having its own ambitious net-zero plans. As in other states, these monopoly utilities gain guaranteed profits from building or operating new generation sources, like wind and solar.

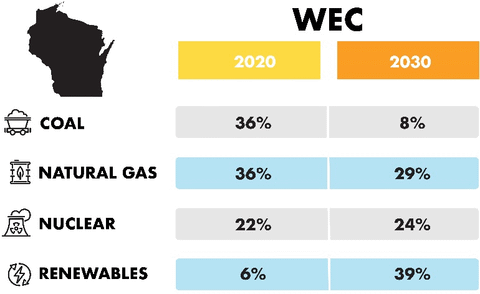

WEC Energy owns two of the largest investor-owned utilities in Wisconsin. One is We Energies, formerly known Wisconsin Energy, and before that, Wisconsin Electric Power Company, or WEPCO. The second is Wisconsin Public Service Corporation. They deliver electricity to more than 1.6 million people in Wisconsin.[62]

WEC Energy has committed to net-zero carbon electricity generation by 2050, to phase out coal entirely by 2035 and to significantly increase wind and solar generation. It calls its goals “aggressive targets.”[63]

WEC relies on nuclear power more than most utilities in the region — it generated one-fifth of its power from nuclear in 2021. It intends to maintain its nuclear source and relies less on wind and solar than most other utilities with net-zero plans. They will make up less than 40% of its energy mix in 2030.

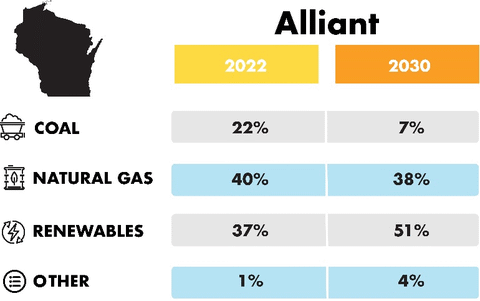

Wisconsin Power and Light, now owned by Alliant Energy, delivers electricity to almost half a million customers in Wisconsin.[64] Alliant Energy is working to eliminate all of its coal generation by 2040 while planning to close its coal-fired plants in Wisconsin by mid-2026.[65] Alliant also plans to build gigawatts of wind and solar, despite slightly lowering its reliance on natural gas as a source of electricity.

Compared to many other utilities in the region, Alliant is maintaining a relatively large portion of natural gas generation. In 2030, the utility plans to generate nearly 40% of its output through natural gas, with wind and solar supplying just over half.[66]

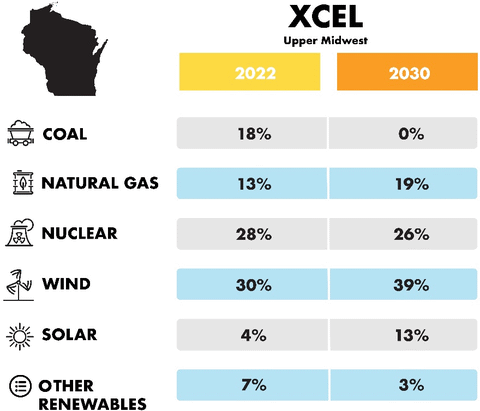

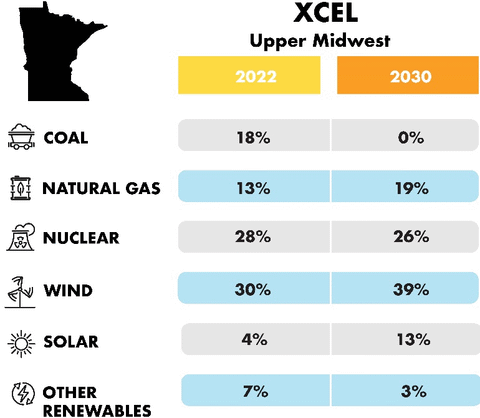

Xcel Energy serves around three million customers in eight states, including about 260,000 in Wisconsin.[67] Northern States Power Company is a subsidiary of Xcel. Xcel boasts that it is “transforming our industry-leading clean energy goals into action,” and that it was “the first U.S. energy provider with the goal of delivering 100% carbon-free electricity by 2050.”[68] It plans to end coal use by 2030 in five states, including Wisconsin, Minnesota and Michigan. Xcel also has plans to add to its natural gas generation, a less aggressive means of attempting decarbonization.[69]

Like WEC, Xcel’s plan maintains nuclear generation as an important part of its future electricity mix. It will continue to use nuclear energy to meet about a quarter of its demand in Wisconsin. Wind and solar will contribute a relatively smaller share than most other utilities, making up just over half of Xcel’s projected energy mix in 2030.[70]

Madison Gas & Electric serves around 200,000 Wisconsin customers in the greater Madison region.[71] The utility is investor-owned and pushes for net-zero by 2050, elimination of coal by 2032 and heavy dependence on and investment in wind and solar.[72] The utility claims that all of its customers "will have eliminated their carbon footprint associated with their electricity use” by 2050.[73]

Despite creating a webpage devoted to its net-zero goals, the utility does not specify the energy resource mix it plans to use to achieve these goals. It only commits to “greater use of renewable resources,” “reduced carbon emissions,” “increased energy efficiency and conservation,” “new products and services, and deepening of community engagement.”[74]

Wisconsin falls under the service territory of MISO. Below is a chart created by MISO that depicts the various utilities’ publicly stated planned retirements and additions of electricity generation resources in the MISO region containing the eastern half of Wisconsin as well as Michigan’s Upper Peninsula. These retirements and additions are in nameplate capacity.

The next chart shows the gap between the generation capacity that utilities in Wisconsin plan to have and the most conservative, or lowest, estimate of demand load that MISO expects on the grid. If MISO’s information is accurate, Wisconsin will face broad electricity generation shortfalls by 2027 and ever larger deficits by 2032 and 2042.

Wisconsin’s utilities are largely following the same path as their peers: rushing to close all coal generation sources, massively building out wind and solar and making these new sources the primary means of generating electricity. Several utilities, however, such as Xcel, WEC and Alliant are making less dramatic shifts to wind and solar compared to similar companies in neighboring states. Nuclear and natural gas will remain significant sources of energy production for these utilities, and wind and solar are projected to make up just half of their energy mix by 2030. This may enable the state to deal with challenges presented by the weather-dependent and unreliable nature of wind and solar, especially as these sources grow in use.

Minnesota is the 22nd most populous state with around 5.7 million residents. Known as the Land of 10,000 Lakes, Minnesota is also the northernmost state in the lower 48 states and makes up the westernmost shore of Lake Superior.

Minnesota has no customer choice. Its investor-owned utilities are monopolies under the supervision of the Minnesota Public Utilities Commission. The state requires its investor-owned utilities to submit a plan about future energy use to the commission every two years.

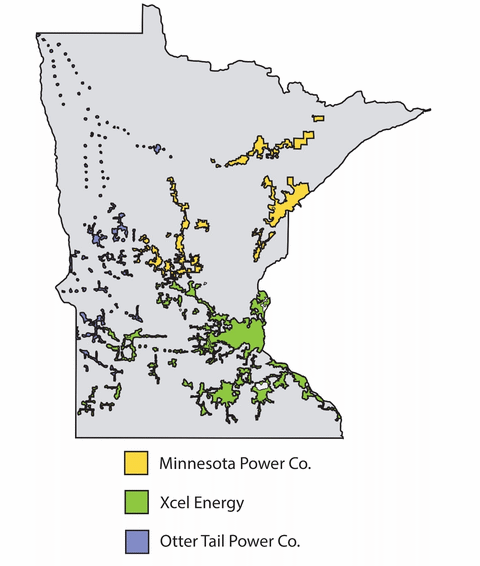

Minnesota’s largest investor-owned utility is Xcel Energy’s Upper Midwest division. The next largest is ALLETE, but it serves only about one-tenth the customers Xcel does. The remaining share of electricity supply is provided by smaller utilities, including Otter Tail Power Company and the state’s myriad rural cooperatives and municipal utilities.

Overall, the state’s utilities generated about 4,500 gigawatts of electricity in 2022, serving about 2.8 million customers.[75] According to the U.S. Energy Information Administration, about 36% of that electricity was generated by so-called renewable sources.[76]

The state of Minnesota has pledged itself to net zero by 2050, with the goal of “100% carbon-free electricity and 55% renewable electricity by 2040.”[77] The Walz administration’s “Minnesota Climate Action Framework” lays out some more specifics of the plan. It aims not only for decarbonization in electricity generation and transportation, but for a carbon-neutral economy writ large, similar to Michigan Gov. Whitmer's plan. Some goals include having electric vehicles make up 20% of traffic on Minnesota roads by 2030, reducing greenhouse gas emissions on farms by 25% by 2035 (from 2018 baseline) and “achiev[ing] 30% overall tree canopy cover in Minnesota communities by 2030 and 40% by 2050.”[78]

In addition, the state of Minnesota has a renewable portfolio standard. The law mandates that utilities use 55% of their energy from solar, wind, hydroelectric, hydrogen or biomass by 2035.[79]

Minnesota Power, now a division of ALLETE, is an investor-owned monopoly utility serving around 150,000 customers.[80] The utility boasts that its “bold vision centers on our commitment to climate, customers and communities ... already delivering 50% renewable energy ahead of other Minnesota utilities.” It is now “doubling down on that with a vision to deliver 100% carbon-free energy.”[81] Its parent company, ALLETE, claims that it currently delivers 50% renewable energy to customers and is proud of its plans to power its customers with 70% “renewable energy” in 2030.[82]

In its planning document submitted to the state, Minnesota Power acknowledges a potential shortfall of 500 megawatts after closing “a critical component of reliability for northern Minnesota” and “significant source of generation,” a coal plant called Boswell Energy Center.[83] The utility claims that it can make up some portion of that deficit by adding wind and solar, but notes that “it would take an additional 2,200 megawatts of solar or 3,000 megawatts of wind to replace the Boswell capacity, which does not factor in the energy that also needs to be replaced.”[84]

Xcel Energy, headquartered in Minneapolis, is the largest utility in the state, serving more than 1.3 million people.[85] Xcel boasts that it is “transforming our industry-leading clean energy goals into action,” and that it was “the first U.S. energy provider with the goal of delivering 100% carbon-free electricity by 2050.”[86] It plans to end coal use by 2030 in five states, including Wisconsin, Minnesota and Michigan. Xcel also has plans to add to its dispatchable natural gas generation and maintains nuclear energy for a quarter of its generation in 2030, a less drastic approach to decarbonization.[87]

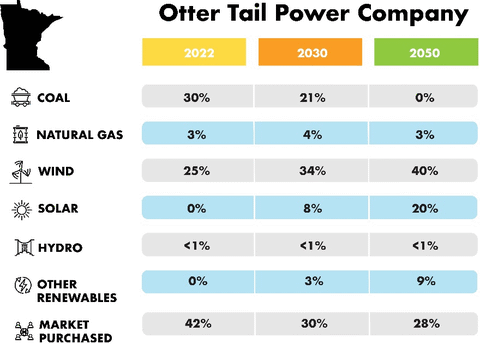

Otter Tail Power Company is a utility operating in western Minnesota, eastern North Dakota and northeastern South Dakota. Its presence in the state is not huge, though it is still significant, serving almost 63,000 customers in Minnesota.[88]

The utility’s coal removal plans are more modest than its peers, waiting until 2050 to completely phase out the use of the fuel. Otter Tail already relies on wind for 25% of its energy mix and plans to increase that portion to 40% by 2050. It currently has no solar generation but aims to make it one-fifth of its resource mix by 2050.[89]

Otter Tail appears to rely on the regional grid more than the larger, investor-owned utilities featured in this report. It currently purchases more than 40% of its electricity from the market. Despite building more wind and solar, in 2050, it still plans to purchase almost a third of its electricity from the regional markets.[90]

Minnesota falls under the service territory of MISO. Below is a chart created by MISO that depicts the various utilities’ publicly stated planned retirements and additions of electricity generation resources in the MISO subdivision containing Minnesota. That subdivision also contains the entirety of North Dakota, the western half of Wisconsin, and portions of eastern Montana, northeastern South Dakota, and a sliver of northwestern Illinois. These retirements and additions are in nameplate capacity.

The next chart shows the gap between the generation capacity that Minnesota utilities plan to have and the most conservative, or lowest, estimate of demand load that MISO expects on the grid. If MISO’s information is accurate, Minnesota will have enough electricity generation in 2027 but will face a shortfall by 2032. This deficit is expected to get worse by 2042.

Minnesota’s broad net-zero goals will likely put additional stress on the state’s electric grid. All utilities operating in the state will be forced to rely on weather-dependent resources like wind and solar to an increasing degree. In times of need, customers may be left to the mercy of whatever supply is available from the regional grid. Given that many of the other states in the region are pursuing a similar course of action, Minnesotans may soon experience the negative consequences of rushing toward net-zero policies.

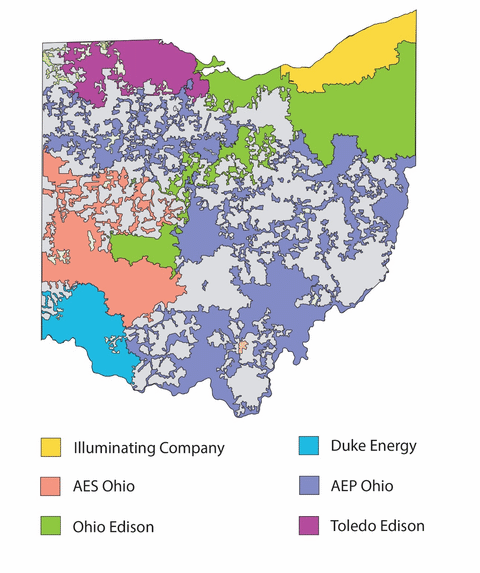

The nation’s seventh most populous state, Ohio, is home to around 11.8 million residents. The Buckeye State borders Lake Erie, having historically benefited from the trade opportunities the lake provided.

Ohioans enjoy electricity choice and are not subject to monopolies in electricity generation if they live in the service area of the largest utilities. If they desire, Ohioans may purchase electricity from those utilities but have the option of buying from elsewhere. These utilities do have the exclusive right to transmission and distribution in their respective areas, however.[91] The Public Utilities Commission of Ohio is the state’s utility regulatory body and does not require utilities to file resource planning reports.

The major utility companies in Ohio may own transmission and or distribution but cannot also own generation.[92] As a result, there are several dozen smaller generation companies for customers to choose from.[93]

Overall, the state’s utilities generated about 11,100 gigawatts of electricity in 2022, serving about 5.7 million customers.[94] According to the U.S. Energy Information Administration, about 5% of that electricity was generated by so-called renewable sources.[95]

Ohio has no net zero mandates of any kind but does have a renewable portfolio standard of 8.5% by 2026, which is one of the lowest in the nation.[96] The state is accepting of natural gas and categorizes it as a form of “green energy,” given its relatively lower carbon emissions compared to coal.[97]

AEP Ohio is a subsidiary of American Electric Power Company. AEP Ohio serves 1.5 million customers around the state.[98] Ohio Power Company and Columbus Southern Power Company fall under AEP Ohio.

Given that AEP Ohio is a part of AEP, it shares the latter’s goal of net zero carbon emissions by 2045.[99] Because Ohio has electricity choice, the utility doesn’t handle generation and has no specific plans for a preferred resource mix. It instead advocates for electric vehicle adoption or rooftop solar.[100]

AES Ohio, formerly Dayton Power & Light, serves around 537,000 customers in western central Ohio.[101] The company recommends customers to install solar panels or to purchase an electric vehicle.[102] It does not, however, advertise any plans for net-zero goals, unlike many other similar utilities, including AES Ohio’s counterpart in Indiana.

Duke Energy Ohio is a subsidiary of Duke Energy. Duke Energy Ohio operates in parts of Ohio and Kentucky and serves around 350,000 customers in Ohio. It generates all of its electricity from two coal plants and has zero wind or solar generation.[103]

Being a subsidiary of Duke Energy, Duke Energy Ohio is tied to its parent company’s net-zero commitments. Duke Energy claims it has “one of the most ambitious clean energy transformations in our industry, with the largest planned coal retirement program in the U.S. electric utility industry.”[104] It aims to “exit from coal generation by 2035,” to reduce carbon emissions by 50% by 2030 (from a 2005 baseline), rising to 80% by 2040, and to be net zero by 2050.[105] Presumably, this means that Duke Energy Ohio’s coal power plants will be shuttered.

FirstEnergy owns three Ohio-based distribution utilities: Ohio Edison, Toledo Edison, and the Cleveland Electric Illuminating Company. Combined, they serve about 700,000 customers.[106]

FirstEnergy has similar net-zero goals as many other large utilities. It plans to “achieve carbon neutrality by 2050.” It recently decided to ditch its 2030 goal to reduce greenhouse gas emissions by 30%, however. The utility explained that “achieving it is not entirely within our control.”[107] FirstEnergy also appears concerned about reliability, highlighting “the significant retirements of base load generation scheduled through 2030” across the electric grid as one factor in this decision. It further notes that it is “more economical than historically projected to run our coal plants.” Despite these factors, FirstEnergy still plans to retire its last two coal-fired power plants by 2040.[108]

Unlike the previous states profiled, Ohio falls under the service territory of PJM, not MISO. PJM does not provide the kind of granular analyses of planned generation capacity and future demand load that MISO does. Therefore, this information is not available for Ohio.

Although the state of Ohio leaves energy generation open to a competitive market that operates on traditional, reliable generation, the major transmission and distribution utilities in the state are pushing net-zero goals. These utilities’ support of net-zero may lead to conflict with electricity generators and suppliers, especially those maintaining the use of coal. Still, Ohio is far better situated than other states in regard to resource adequacy. Thanks to electricity choice, customers will have the option to buy from more reliable generation utilities if they experience the effects of grid instability. The lack of net-zero mandates from the state gives utilities flexibility in meeting future demand.

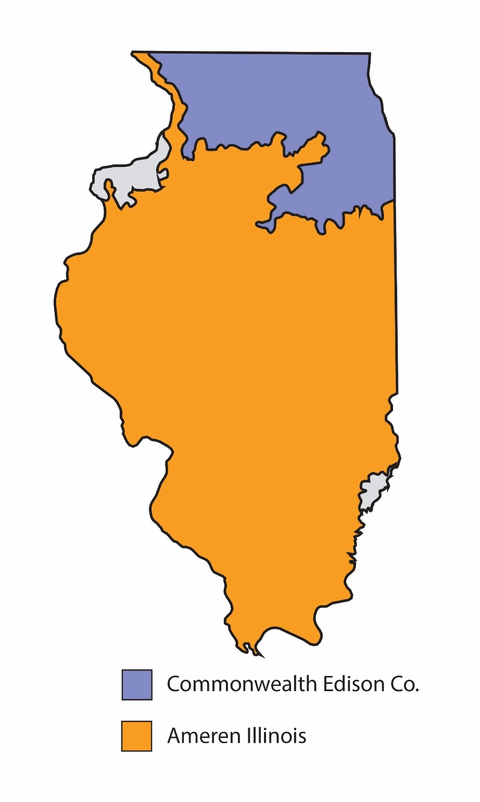

Home to around 12.5 million people, Illinois is the sixth most populous state. Situated solidly in the American Midwest, Illinois’ largest city, Chicago, sits on Lake Michigan in the Northeast corner of the state.

Illinois has electricity choice, allowing options for customers in the service areas of the largest utilities in the state: Ameren Illinois and Commonwealth Edison, or ComEd. These utilities provide transmission services but not generation. As a result, Illinoisans have the choice to buy their electricity from one of dozens of companies.[109] Ameren Illinois and ComEd must act as a “provider of last resort” for customers as well, and purchase electricity through regional grid markets.[110]

The Illinois Commerce Commission and the Illinois Power Agency regulate utilities in the state. The commission acts similarly to most public service commissions, requiring utilities to file resource plans every four years. The agency prepares “annual electricity procurement plans” and is charged with implementing the state’s renewable portfolio standard.[111]

Overall, the state’s utilities generated about 14,500 gigawatts of electricity in 2022, serving about six million customers.[112] According to the U.S. Energy Information Administration, about 18% of that electricity was generated by so-called renewable sources.[113]

In Illinois, net-zero policies are set in state law. In 2021, Gov. J.B. Pritzker signed the Climate and Equitable Jobs Act. This legislation built upon Illinois’ renewable portfolio standard and tasked the Illinois Power Agency with implementing credits for nuclear and solar projects, changing then-current regulation and other “numerous crucial implementation activities.”[114]

The law mandates that all private coal- and oil-fired power plants reach zero emissions by 2030. Since there is no way to achieve zero emissions from operating these plants, this effectively means they must close by that date. Municipal coal plants and all natural gas plants will have until 2045 to reach zero emissions, or close. The law also doubles state spending on “renewable energy,” and boasts that it makes Illinois “the first state in the Midwest to set an aggressive timetable for reaching 100% renewable energy by 2050.”[115]

The law does have a few important caveats. It includes a provision permitting “a [power plant] to stay open if it is determined that ongoing operation is necessary to maintain power grid supply and reliability.” This may allow traditional forms of generation, like coal and natural gas, to stay online as long as there is a need. The law also subsidizes existing nuclear plants.[116]

Illinois’ renewable portfolio standard was upped from 25% wind and solar generation by 2025 to 40% by 2030 and 50% by 2040. Annual state spending on developing more “renewable energy” has more than doubled from $235 million to over $580 million, and various solar projects receive subsidies, among other changes.[117]

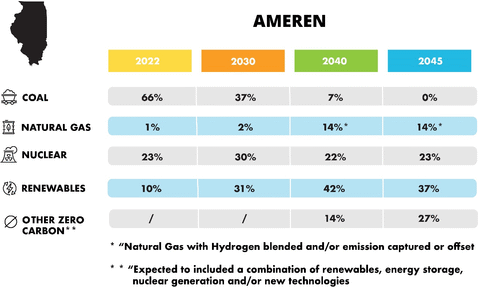

Ameren Illinois is one of the two large investor-owned utilities in Illinois, serving electricity to 1.2 million customers in the state.[118]

Ameren has one of the milder net-zero plans of utilities in the region. It aims to reach net zero by 2045 and to convert its entire light-duty fleet to electric vehicles by 2030. It maintains a significant role (between a quarter and a third) for nuclear generation, however, and plans to use natural gas at what might be an increasing rate.[119] Of course, Ameren doesn’t own any generation resources in Illinois, so this is more of a reflection of what it provides through transmission and distribution.

Commonwealth Edison Company, or ComEd, is owned by Exelon Corporation. It is the largest investor-owned utility in Illinois, providing electricity to 3.8 million residential customers in the state.[120]

Exelon, like its peers, advocates for net-zero by 2050. It “promotes public policies at both the national and state levels in support of a clean energy transformation that achieves … levels of climate change mitigation and adaptation sufficient to meet a 1.5°C pathway ambition.”[121] The utility does recognize the value of nuclear energy, calling it “America’s largest and most reliable source of zero-carbon energy.”[122]

ComEd’s generation profile is overwhelmingly thermal generation: 93% of its generation in 2023 was from nuclear, coal or natural gas. To meet state “renewable energy” mandates, however, the utility had to purchase a variety of credits for 89% of the electricity it delivered to customers.[123]

Most of Illinois falls under the service territory of MISO. Below is a chart created by MISO that depicts the various utilities’ publicly stated planned retirements and additions of electricity generation resources in the MISO region containing central and southern Illinois. These retirements and additions are in nameplate capacity.

The next chart shows the gap between the generation capacity that utilities plan to have and the most conservative, lowest estimate of demand load that MISO expects on the grid. If MISO’s information is accurate, Illinois will face significant electricity generation shortfalls by 2027 and ever larger deficits by 2032 and 2042.

Illinois’ Climate and Equitable Jobs Act will significantly hamper the grid reliability benefits of electricity choice in the state. Illinois joins the ranks of the states that appear most vulnerable to electricity supply shortfalls. Its aggressive renewable portfolio standard requirements will strain its electric grid. Since all utilities are forced into the mold the law mandates, the net-zero mandates take the freedom to switch to more reliable generating companies away from customers. Still, Illinois’ large nuclear generation fleet offers a stable source of reliable generation that may prove enough to keep Illinois’ grid afloat.

Pennsylvania is the fifth most populous state in the country with 12.9 million residents calling it home. The state was one of America’s original 13 colonies, and its pivotal role in the nation’s founding earned it the nickname Keystone State. Pennsylvania borders Lake Erie and the Delaware River, but not the Atlantic Ocean.

Pennsylvania has electricity choice, so customers can choose their utility provider. As a result, Pennsylvania has a more diverse electricity market and broader selection of providers for consumers to pick from. There are 11 electric distribution companies regulated by the state, for instance.[124] But the biggest difference is the decentralized generation market in the state: Customers may choose to buy from more than 100 electricity companies.[125]

The Pennsylvania Public Utilities Commission is the primary regulator for utility companies in the state. The commission also facilitates electricity choice in the state, hosting PAPowerSwitch, the state’s “official electric shopping website.”[126] Pennsylvania’s utilities all operate under the PJM Interconnection, the regional transmission organization for the area.

Overall, the state’s utilities generated about 19,800 thousand megawatts of electricity serving about six million customers.[127] According to the U.S. Energy Information Administration, about 4% of that electricity was generated by so-called renewable sources.[128]

Pennsylvania currently has no net zero mandates in law or regulation. Former Gov. Tom Wolf, however, joined the state to the Regional Greenhouse Gas Initiative.[129] Member states set a regional limit on carbon emissions from power plants and then trade credits, or allowances, based on how much they emit.[130] Former Gov. Wolf’s move was challenged on its legality, however, and his successor, Gov. Josh Shapiro, has faced similar challenges on the constitutionality of participating in this program.[131]

The state does have a renewable portfolio standard.[132] This mandate requires utilities to generate electricity from a certain mix of sources. Pennsylvania’s standard is less strict than most, accepting biomass and coal mine methane as alternative energy sources.[133]

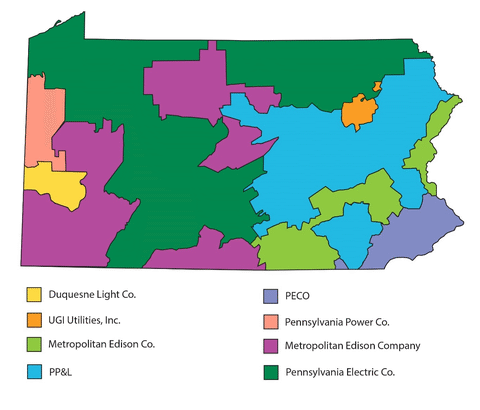

FirstEnergy owns large utility companies in the Midwest and Mid-Atlantic regions, including four of the 11 electric distribution companies the state utility commission regulates: Pennsylvania Power Company, West Penn Power Company, Pennsylvania Electric Company and Metropolitan Edison Company. These FirstEnergy subsidiaries serve about two million customers in Pennsylvania, covering a majority of the state’s territory.[134]

FirstEnergy, while light on details, endorses the wind and solar energy transition and pledges to be net-zero by 2050.[135] Its webpage dedicated to reliability welcomes “a future of renewable energy” and aims to usher in “the global energy transition to renewable resources.”[136] The company owns no generation in the state of Pennsylvania, however, so its projects are limited to transmission lines.[137]

PPL Electric Utilities, formerly Pennsylvania Power & Light, is an investor-owned utility serving 1.5 million customers in central-eastern Pennsylvania.[138] The utility is one of four owned by PPL Corporation — the others are Louisville Gas and Electric Company, Kentucky Utilities Company and Rhode Island Energy.[139]

The PPL Corporation supports net-zero goals, aiming to decrease emissions by 70% by 2035, 80% by 2040 and 100% by 2050.[140] In addition, the utility plans to have 100% electric light-duty vehicles by 2030.[141] The utility owns no generation in Pennsylvania but plans to shutter its 2,000 megawatts of coal generation in Kentucky gradually over the next 15 years and “replace it with non-emitting generation.”[142]

Duquesne Light Company serves more than 600,000 customers in and around Pittsburgh in southwestern Pennsylvania. Despite owning no generation, the utility pushes hard in the decarbonization direction, committed to “playing a leading role in our region’s clean energy transition.”[143] It plans to electrify its vehicle fleet, encourages customers to install their own solar panels, offers small financial incentives to customers for owning or leasing an electric vehicle, and supports legislation that would mandate more solar generation.[144]

To its credit, the Duquesne Light Company does not appear to lose sight of the importance of grid reliability. In fact, the utility notes it performs in the top quartile in Pennsylvania on the Service Average Interruption Frequency Index, outperforming the state utility commission’s benchmark. The utility plans to spend $1.9 billion between 2023 and 2027 on “infrastructure reliability upgrades and grid modernization.”[145]

Pike County Light & Power is an investor-owned utility, serving approximately 5,300 customers in northeastern Pike County. The utility is small and appears to make no promises about net-zero decarbonization plans.[146]

UGI Utilities, Inc. is an investor-owned utility that serves about 62,000 customers living in the counties of Luzerne and Wyoming in northeastern Pennsylvania. The company is owned by UGI Corporation, which is heavily involved in natural gas transportation, distribution and use in electricity generation.[147]

The company says it will meet its emissions goal primarily by increasing its use of natural gas (in the utility’s heating operations, not in electricity generation). The utility boasts of the emissions reductions that its natural gas use has achieved so far and plans to continue on that path. It makes no sweeping commitments to any net-zero goals, however.[148]

Wellsboro Electric Company is a small, investor-owned utility operating in Tioga County. It serves 5,125 residential customers, 1,244 commercial customers and 12 industrial customers.[149] The company is a subsidiary of C&T Enterprises, a subsidiary of Claverack and Tri-County Rural Electric Cooperatives. Wellsboro seems not to promise any net-zero goals or other so-called renewable energy projects.

Citizens’ Electric Company is an investor-owned utility. Like Wellsboro, the company is a subsidiary of C&T Enterprises.[150] It also makes no promises about net-zero goals.

PECO, formerly the Philadelphia Electric Company, is a subsidiary of Exelon Corporation. Exelon advocates for wind, solar and other decarbonization efforts. But the company also acknowledges nuclear energy as “America’s largest and most reliable source of zero-carbon energy.”[151]

Exelon does not own electricity generation capacity in Pennsylvania. The utility nevertheless advocates for net-zero goals. It “promotes public policies at both the national and state levels in support of a clean energy transformation that achieves … levels of climate change mitigation and adaptation sufficient to meet a 1.5°C pathway ambition.”[152]

Furthermore, Exelon notes that “PECO has been a leader in supporting transportation electrification initiatives in Pennsylvania,” including financial incentives and advocating for legislation on the matter.[153] PECO is pushing the state’s Legislature to “increase Pennsylvania’s commitment to solar energy substantially while making solar programs more accessible, affordable and equitable for all.”[154]

Unlike other states profiled, Pennsylvania falls under the service territory of PJM, not MISO. PJM does not provide the kind of granular analyses of planned generation capacity and future demand load that MISO does. Therefore, this information is not available for Pennsylvania.

Pennsylvania’s utilities have far more diversity of action than most other states examined in this report. Four of the states’ 11 regulated, investor-owned utilities have no net-zero plans and another is generally supportive but does not commit to anything specific. The remaining six push hard for decarbonization in their holdings.

The state’s relatively expansive electricity choice market allows for a diverse set of electricity generators, with more than 100 available to Pennsylvania residents. The competitiveness of this market may discourage individual generators from making grand plans about their future resource use. With generation shared among so many providers, any individual generator’s net-zero plans will likely have only a limited impact on the state’s electricity consumers. The market may provide a sort of discipline on generators in Pennsylvania. The state’s history as a large coal producer may also impact the eagerness of generation companies to transition to wind and solar.

Lars Schernikau and William Hayden Smith open chapter five of their book, “The Unpopular Truth about Electricity and the Future of Energy,” with an especially pertinent point: "Electricity is to modern civilization what blood is to the human body."[155] Electricity powers our lives, from essential household appliances to advanced medical facilities, ensuring our daily comfort and safety. Reliable and affordable electricity forms the backbone of a developed society, enabling economic growth and alleviating poverty.

Recognizing this fact, our energy policy should prioritize the affordability and reliability of electricity to ensure we produce more of it. The electric grid is a marvel of modern engineering, a massive and interconnected network that sustains our way of life every second of the day. It is, as Emmet Penney describes it, a type of “commons,” a vast infrastructure inherited from our ancestors and that must be preserved for future generations. Society's strength and the economy's robustness are rooted in a reliable electric grid.

The proliferation of net-zero policy goals and so-called green energy mandates, however, jeopardize the nation's ability to generate reliable and affordable electricity. In doing so, these policies threaten the health and well-being of Americans and the American economy. Federal and state policies, driven by a desire to mitigate the effects of a changing climate, push for a swift transition to energy sources like wind and solar. Supporters often portray these generation sources as the obvious and inevitable future of producing electricity. But increasingly, their deficiencies pose significant challenges to grid reliability.

The most obvious of these challenges is the misguided notion that we “must” transition the grid. As modeling done for the Mackinac Center indicates, even if the state of Michigan went to absolute zero carbon dioxide emissions, the state’s total influence on global climate would amount to a paltry 1/1000th of a degree Celsius by the year 2100.

Despite the apparent shortcomings of wind and solar, the push for a net-zero carbon future continues, driven forward by the perverse incentives and structures governing public utilities. These entities, often operating as regulated monopolies, are incentivized by state-guaranteed profits they earn by building more and more new generation infrastructure, such as wind turbines, solar panels and battery storage. Those resources would be better spent on maintaining or upgrading existing infrastructure to make it more reliable and resilient, protecting the grid from threats such as natural disasters or cyber-attacks. As energy expert Meredith Angwin notes in her book, “Shorting the Grid,” this situation encourages utilities to spend more to earn more (at the expense of the taxpayer) rather than serve the needs of their customers.[156]

Increasingly, this situation resembles a type of prisoner's dilemma, where the individually rational option for each utility is to pursue wind and solar and increase the rate base as a means of farming subsidies. While reliable generation still operates, utilities can address shortfalls by purchasing electricity from the wider regional grid. However, when utilities across the Midwest all choose to implement the same dangerous net-zero plans, there is no market on which to rely during shortfalls.

Public utility commissions, established to protect consumers from the monopolistic tendencies of utilities, also play a role. State mandates and political pressure ensure these commissions approve the construction of extensive new wind and solar projects. As a result of those approvals, utilities receive further approvals from utility commissioners to pass increased costs on to ratepayers.

This situation leaves customers of monopoly utilities in an untenable position. State law often forces them to rely on the electricity services provided by these utilities; there are no other competitive options. However, the services these monopoly utilities provide are increasingly expensive and unreliable. For example, Michigan residents have the nation's second least reliable electricity service, and the state's plans to mandate a transition to weather-dependent electricity will ensure that record becomes even worse. To the extent that state and utility officials seriously believe that climate change entails increasingly erratic weather patterns, the least obvious option is to transition the nation’s energy infrastructure to weather-dependent energy sources.

Warnings from electric grid operators and regulatory bodies are stark and growing louder by the day. These electricity experts highlight the growing risks posed by the premature retirement of reliable, dispatchable generation sources such as coal, natural gas and nuclear in favor of intermittent wind and solar. The mismatch between the nameplate capacity (theoretical maximum output) and accredited capacity (reliable output) of renewables underscores the danger. As more reliable power plants retire, the grid's ability to meet demand diminishes. Furthermore, as more utilities and generators across the Great Lakes region implement the same dangerous net zero plans, people across the region and the nation are put at risk.

A mandated transition to renewable energy cannot be allowed to sacrifice grid stability and reliability. Policymakers must balance environmental goals with basic energy needs. They must ensure our grid remains robust and capable of meeting demand under all conditions.

Many will argue for a diversified or "all-of-the-above" energy portfolio. However, focusing on reliable and affordable energy sources will prioritize dispatchable forms of generation that operate regardless of the weather. Policymakers should reevaluate incentive structures for utilities, promoting investments that enhance reliability and efficiency rather than merely expanding capacity.

Included here is a collection of a few key terms used in this report.

Generation: This involves the actual production of electricity from various means, such as coal boilers, gas turbines, nuclear reactors, solar panels, wind turbines, etc.

Transmission: This refers to bringing electricity over long distances from generation sources to substation transformers that convert the electricity into usable voltages for consumers.