This policy brief discusses how Michigan policymakers might address looming limits to road funding levels. First, it explains the likely shrinkage of fuel tax revenues over the next 30 years, despite the recent fuel tax hike and introduction of automatic, inflation-based rate increases. Second, it discusses how a mileage-based user fee can remedy this deficiency by serving as a replacement for current fuel taxes. This policy brief also discusses common issues raised about MBUFs and shifting away from fuel taxes. Finally, this report proposes a framework for how such a system could be deployed in Michigan.

©2022 by the Mackinac Center for Public Policy and Reason Foundation

The funds to maintain and support Michigan’s roads heavily depend on motor fuel taxes on gasoline and diesel, as well as vehicle registration fees. This policy brief focuses on gasoline and diesel taxes. The per-gallon fuel tax has a lengthy history both in Michigan and across the United States. First implemented in Oregon in 1919, similar taxes were adopted by every state by 1932 as automobiles became ubiquitous.[*] In fact, the formula that dictates how Michigan fuel tax and vehicle registration fee revenue is divided between state trunkline roads (those designated with an “I,” “US,” or “M”), county roads, and city and village roads was established more than 70 years ago.[†] Public Act 51 of 1951 predates the federal Highway Trust Fund, created in 1956 to distribute federal fuel tax revenues to pay for building the Interstate Highway System, and later extended to all roads eligible for federal aid.

Michigan’s inflation-adjusted annual revenues from fuel taxes and vehicle registration fees plateaued from the late 1990s through 2004 and declined after 2004 for about 10 consecutive years. They began slowly increasing around 2013 and then, following a 2015 fuel tax hike that took effect in 2017, larger annual increases began. Graphic 1 shows the historic trends of Michigan’s transportation revenues.

Graphic 1: Michigan Transportation Fund Revenues, 1997-2020 (millions of 2020 dollars)

Source: Schedule A of the “Act 51 Annual Report for 2020,” Michigan Department of Transportation.

The reasons for the temporary decline in annual transportation revenue shown in Graphic 1 are three-fold. First, vehicle miles of travel, or VMT, peaked around the year 2007 in Michigan. They began declining as the Great Recession began and had yet to recover prior to the larger decline during the COVID-19 pandemic. Fewer miles driven means less gasoline purchased and thus less fuel tax paid. Graphic 2 shows historical VMT trends.

Graphic 2: Billions of Vehicle Miles of Travel in Michigan, 1940-2020

Source: Michigan Traffic Crash Facts, https://perma.cc/FW9G-7CV4

Second, the state gasoline tax was increased from $0.15 per gallon to $0.19 per gallon in 1997 but not indexed for inflation, which steadily grew. The gas tax remained unchanged until it was increased to $0.26 per gallon in 2017. The impact of inflation between 1997 and 2017 meant that $0.19 per gallon in 2017 equated to only $0.13 in 1997 dollars, meaning the purchasing power of the fuel tax fell by nearly a third over this period. The diesel tax was set at $0.15 per gallon in 2003 but was not indexed for inflation, either. Michigan’s fuel taxes will now automatically rise with inflation, beginning Jan. 1, 2022, capped at a 5% per year.[‡]

Third, as Graphic 3 illustrates, fuel efficiency rose over this period. The average fuel efficiency for cars increased from 23.2 mpg in 1997 to 29.2 mpg in 2017, a 26% increase. The average for light trucks, such as SUVs, minivans and pickup trucks, increased from 16.9 mpg in 1997 to 21.3 mpg in 2017, also a 26% increase. Better fuel efficiency means less fuel purchased and, all else equal, less fuel tax paid.

Graphic 3: Average Fuel Efficiency, 1997-2017

Source: “2021 EPA Automotive Trends Report,” (U.S. Environmental Protection Agency, November 2021), https://perma.cc/YHZ5-Z3CJ

The fuel tax has traditionally been a benefits tax based on the users-pay/users-benefit principle, meaning the tax is paid in proportion to the benefits received. Someone who drives a lot receives more benefit from the roads than someone who drives only a little. The person who logs many miles also causes more wear to roads. Because taxes that fund these roads are levied on fuel, people who drive more will pay more fuel taxes, which functions as a type of user fee. That’s the users pay/users-benefit principle in action.

However, the user fee aspect of the gas tax will begin breaking down due to continued fuel efficiency improvements and the shift toward electric vehicles, despite the recent fuel tax increase and indexing to inflation.

President Biden signed an executive order on Jan. 20, 2021, to establish “ambitious, job-creating fuel economy standards.” The order reverts to the Obama administration’s requirement of a new-vehicle, fleetwide 55 mpg average fuel efficiency. The Trump administration had revised this target to a 40 mpg average by 2026.[1]

There is also a push by most major car companies to substantially shift vehicle production to electric vehicles. For example, General Motors has a goal of an “all-electric future” by 2035.[2] An electric vehicle does not use gasoline, so its owner will not pay fuel taxes for using the roads, avoiding the users-pay/users-benefit principle of public road use. The more prevalent electric vehicles become, the dimmer the prospect of fuel taxes generating sufficient revenue to maintain and repair roads in Michigan.

This is not a new problem: It was studied by a special committee of the Transportation Research Board of the National Academy of Sciences in 2005. This committee concluded that fuel taxes would not be a viable, long-term road funding mechanism in the 21st century.[3] Congress subsequently appointed a national commission to examine how roads should be funded in the future. The commission considered several alternatives and concluded that payment for the roads should be made in proportion to use, and the best way for road users to pay proportionately is to charge users a fee per mile driven. Importantly, it recommended that these new mileage-based user fees, or MBUFs, be a replacement for fuel taxes, not piled on top of them.[4]

This policy brief discusses how Michigan policymakers might address this looming road funding problem. First, it looks at the likely shrinkage of fuel tax revenues over the next 30 years, despite the recent fuel tax hike and introduction of automatic, inflation-based rate increases. Second, it discusses how an MBUF can remedy this deficiency by serving as a replacement for current fuel taxes. This policy brief also discusses common issues raised about MBUFs and shifting away from fuel taxes. Finally, this report proposes a framework for how such a system could be deployed in Michigan.

[*] Jeff Davis, “The History of the Gasoline Tax, Part 1” (Transportation Weekly, April 20, 2010).

[†] For an overview of the Act 51 funding formula, see Chris Douglas, “Roads in Michigan: Quality, Funding and Recommendations” (Mackinac Center for Public Policy, 2018), 10-17, 24, https://perma.cc/EX7R-P8LU.

[‡] “Michigan Transportation Fuel-Tax Rates Since 1925” (State of Michigan, Jan. 22, 2022), https://perma.cc/G8NL-6S62.

[1] Joseph R. Biden Jr. “Executive Order on Protection Public Health and the Environment and Restoring Science to Tackle the Climate Crisis” (The White House, Jan. 20, 2021), https://perma.cc/2J52-ADFQ.

[2] “Our Path to an All-Electric Future” (General Motors, 2022), https://perma.cc/U2Q4-VC86; David Shepardson, “GM Aims to End Sale of Gasoline, Diesel-powered Cars, SUVs, Light Trucks by 2035,” (Reuters, Jan. 28, 2021), https://perma.cc/MER9-2BJA.

[3] “The Fuel Tax and Alternatives for Transportation Funding, Special Report 285,” (Transportation Research Board of the National Academies, 2006), https://perma.cc/M7VT-8GJQ.

[4] Martin Schultz and Robert D. Atkinson, “Paying Our Way: A New Framework for Transportation Finance,” National Surface Transportation Infrastructure Financing Commission, Feb. 24, 2009, https://perma.cc/N7ZT-BXBG.

Michigan’s fuel tax revenues are projected to begin a long-term decline due to improved vehicle fuel efficiency and the increasing use of electric vehicles. This is despite the recent increase in the fuel tax rate and the indexing of that rate to inflation that began in 2022.

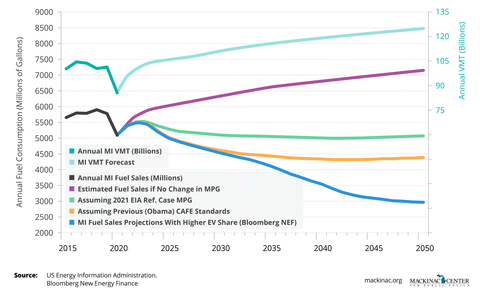

Ed Regan, a long-time transportation analyst recently retired from CDM Smith, a global engineering and construction firm that works on transportation and public infrastructure projects, developed the projection of Michigan fuel consumption shown in Graphic 4. Regan modeled three forecast scenarios. The first is used as a reference and based on a 2021 Energy Information Administration estimate of future fuel economy. EIA projects increasing average fuel economy as older, less fuel-efficient vehicles are replaced with newer, more fuel-efficient ones between now and 2050. This projection is based on the Trump administration’s light vehicle fuel efficiency standards.

The second scenario assumes that the Obama-era fuel efficiency standards are restored by the Biden administration. These are more aggressive than those imposed by the Trump administration, so the impact on average fuel efficiency should be greater.

The third scenario assumes an increased use of electric vehicles over-and-above the Obama-era fuel efficiency standards. This scenario is adapted for U.S. conditions from Bloomberg New Energy Finance’s global projections.[5] This assumes that electric vehicles grow so that they comprise nearly half of all vehicles on the road by 2050. In contrast, the EIA’s projection assumes only 8% of the vehicles on the road will be electric by then. The Bloomberg forecast is more in line with the stated goals of the Biden administration and most of the auto industry.

Finally, a baseline scenario is also calculated that assumes, counterfactually, that there would be no change in average fuel efficiency between now and 2050. This hypothetical case is presented only for purposes of comparison and calculation of net impacts. There is little likelihood that there will be no increases in fuel efficiency.

Graphic 4 also includes a projection of vehicle miles of travel for Michigan, in addition to the projected annual fuel consumption under the previously described scenarios. After several years of recovery from depressed travel levels in 2020 due to COVID-19, Michigan VMT is assumed to increase by less than 1% a year through 2050.

If there were no change in average mpg (the red line), annual fuel consumption would rise from five billion gallons now to about seven billion in 2050. Under the EIA reference case (the green line), annual fuel use remains largely unchanged between now and 2050, with only a slight increase in 2022 and 2023 as VMT recovers from the pandemic. This is consistent with EIA announcements related to their 2021 Annual Energy Outlook report, noting that the 2019 level of fuel sales would likely never again be achieved in the United States, at least not through 2050.[6]

If the previous Obama-era fuel efficiency standards are restored (the orange line), annual fuel consumption falls from five billion gallons now to less than 4.5 billion gallons in 2050. If the adapted Bloomberg EV projection is accurate, and electric vehicles comprise 47% of vehicles on the road by 2050, fuel consumption falls to three billion gallons. If fuel consumption falls as in the initial three scenarios, fuel tax revenue will be constrained.

Graphic 4: Estimated Michigan Travel and Fuel Consumption

Michigan’s fuel tax rates are now adjusted annually based on inflation. The 2022 rate was increased by 3.3%, to $0.272 per gallon. Our projections for future years assume further inflationary adjustments of 3.1% in 2023, with annual increases then gradually declining to 2.1% per year by 2025. Annual inflation increases in 2026 and beyond are conservatively assumed to average 2% per year. Actual inflation has many ups and downs, but there is no way to simulate those in a 30-year projection. The long-term trend appears to be for modest annual inflation.

Graphic 5 applies these assumed fuel tax rates to the fuel sales shown in Graphic 4, taking into account both the projected growth in Michigan VMT and annual inflation adjustments. Hypothetically, if there were no change in average fuel efficiency, Michigan fuel tax revenue would increase from $1.3 billion now to about $3.3 billion in 2050. Under the EIA reference scenario, fuel tax revenue increases to only $2.4 billion. With restored Obama-era mpg standards, fuel tax revenue would be only $2.25 billion by 2050. Under the Bloomberg EV scenario, fuel tax revenue hardly grows at all between now and 2050.

The vertical arrows in Graphic 5 show the annual difference in fuel tax revenue under this scenario compared to if there were no change in fuel efficiency, at five-year intervals. Especially for the Bloomberg, high-EV projection, these are worst-case estimates compared with the hypothetical case of overall fuel efficiency remaining unchanged and no growth in EV market share. The actual difference in fuel tax revenue will fall somewhere within the range marked by these arrows. The arrows diverge rather quickly, likely due to the reinstatement of the more aggressive Obama-era CAFE standards.

Graphic 5: Estimated Michigan Fuel Tax Revenue Under Alternative Scenarios, 2020-2050

Regan’s calculations can be used to calculate how high the fuel tax rate would need to be to make up for the reduced revenue resulting from fuel efficiency improvements and EV growth. Given the indexing to inflation, Michigan’s fuel tax is projected to be $0.32 per gallon in 2030, $0.39 in 2040 and $0.48 in 2050. If policymakers wanted to prevent a decrease in road funding as a result of increased fuel efficiency and EV use, they would have to raise the fuel tax to $0.40 per gallon in 2030, $0.53 in 2040 and $0.68 in 2050, based on the EIA 2021 projection.

Under the scenario where Obama-era fuel economy standards are restored, the fuel tax would have to increase to $0.42 per gallon in 2030, $0.52 in 2040 and $0.73 in 2050. Under the scenario where electric vehicles comprise 47% of all cars on the road by 2050, the fuel tax would have to increase to $0.43 per gallon in 2030, $0.70 in 2040 and $1.08 in 2050.

Raising fuel tax rates that high would likely be difficult politically. In addition, it would leave electric vehicle drivers, by 2050 accounting for nearly 50% of VMT, not paying their share of the cost of maintaining Michigan’s roads. Attempting to remedy this, Michigan introduced an increased electric vehicle registration fee. Beginning in 2017, it established supplemental rates for four categories of EVs:

The rate is recomputed each year based on the new indexed fuel tax rates, with the full-battery rates increasing by $5.00 for each one cent increase in the fuel tax rate. The plug-in hybrid rate increased half as much, by $2.50. This resulted in an annual rate of $135 for light full-battery electrics and $47.50 for light plug-in hybrids in 2021. The rate will continue to increase in proportion to indexed fuel tax hikes in future years.[7]

The program will likely generate $4-5 million in supplemental revenue in 2022, but this could increase rapidly over the next several decades if EV usage rapidly increases. Under the Bloomberg scenario, electric vehicles in Michigan are estimated to reach almost one million by 2035 and almost four million by 2050. If these levels of EV penetration are reached, revenue from the annual fee could exceed $150 million by 2035, reach almost $500 million by 2040 and top $900 million by 2050.

While the supplemental EV fee is well-designed, its revenues will only partly offset the impact on fuel tax revenue from fuel efficiency gains and increased EV use. The $900 million from EV fees in 2050 amounts to slightly less than half the total difference in projected fuel tax revenue if policymakers aim to hold road funding harmless from declining fuel sales.

Equally important, the EV fee structure does not reflect actual vehicle miles traveled. If EV drivers use the roads more, the registration fees they pay, even with indexed increases, are unlikely to keep pace with the corresponding wear that these vehicles cause Michigan roads. This is further removed from the basic users pay/users benefit principle of the fuel tax — the more a vehicle travels, the more it pays toward the cost of the roadway system.

Many Americans seem to have a negative impression of charging drivers based on how much they use the roads. When asked by survey researchers about possible future highway funding sources, only one quarter of the public view MBUFs as a good idea.[8] One reason for this is likely privacy concerns — some easily accessible articles suggest that the government might mandate a device in every vehicle that “tracks” when and where someone travels, which some characterize as “Big Brother in your car.”[9] It is difficult to interpret these concerns considering most drivers already allow their movement to be logged or shared to some degree by their own vehicle’s electronic systems, as well as their insurance company and smart phone applications.

Interest groups focused on preventing unwarranted tax increases tend to have an additional concern: that a per-mile charge would be levied on top of the fuel taxes taxpayers already pay.[10] This concern is understandable given the history of taxation in the United States, where taxes rates can be raised quickly and where new taxes rarely replace existing ones. For instance, the original top marginal income tax rate was only 7% when it was first levied in 1913. Only five years later it was increased to 77%.[11] Further, some have proposed that an MBUF be used to discourage driving — set at such a costly rate that drivers will opt not to use their vehicles. Americans who appreciate the freedom made possible by cars and driving might see the switch from a fuel tax to an MBUF as a threat to their mobility.

Perhaps in reaction to these types of concerns, MBUFs may not be a regular feature of policy discussions about the future of road funding in Michigan. The 2017 fuel tax increase and subsequent indexing of it to inflation may be viewed by some policymakers as a sufficient solution to road funding concerns. The historic defeat — 80% voter disapproval — of former Gov. Rick Snyder’s 2015 plan to raise taxes for more road funding may still be fresh on the lawmakers’ minds. This memory combined with the failed attempt by Gov. Gretchen Whitmer to raise the gas tax by $0.45 per gallon in 2019 likely left little appetite among Michigan policymakers to consider new road funding sources.[12]

A number of other states are experimenting with MBUF programs. Many of them address the concerns that people appear to have around protecting their privacy. Nearly all pilot projects:

Several of the pilot projects actively recruited public officials to be among the participants, which gave those officials firsthand experience with how the MBUF worked and how it compared to their expectations. In general, most participants in the pilot projects came away with a positive view of the switch to an MBUF.[13]

Of course, the vast majority of Americans have not participated in such a pilot program and may remain skeptical about MBUFs. This skepticism may be fueled by the fact that some state departments of transportation and policymakers have focused solely on using MBUFs to fix an impending fuel-tax revenue shortfall rather than supporting the overall benefits of transitioning to such a program. When taxpayers hear that the government needs more revenue, they understandably tighten their grip on their wallets. This is particularly true in Michigan, following the 2017 fuel tax increase and the subsequent proposed tax increase in 2019. Nevertheless, there are several advantages to replacing fuel taxes with a MBUF system that policymakers should consider.

[8] Asha Weinstein Agrawal, Hilary Nixon and Ashley M. Hooper, “Public Perception of Mileage-Based User Fees” (Transportation Research Board, 2016), https://perma.cc/6XTS-4RHR.

[9] For example, see Katy Grimes, “Big Brother in your car?” (CalWatchdog.com, April 8, 2010), https://perma.cc/X89G-V4Q2.

[10] For example, see Carl DeMaio, “New Tax on Your Mileage,” email blast to California taxpayers, May 22, 2019.

[11] “Historical Highest Marginal Income Tax Rates” (Tax Policy Center, Feb. 4, 2020), https://perma.cc/BWL6-Y9UK.

[12] Paul Egan and Kathleen Gray, “Michigan Voters Soundly Reject Proposal 1 Road Tax Plan” (Detroit Free Press, May 5, 2015), https://perma.cc/Z5ZT-V99P.

[13] Kathryn Jones and Maureen Bock, “Oregon’s Road Usage Charge: The OReGO Program, Final Report” (Oregon Department of Transportation, April 2017), chapter 8, https://perma.cc/HK5U-34G5.

While the coming revenue shortfall for road funding is real, motorists and others who rely on a well-maintained road system, such as trucking companies, need to see and understand a genuine value proposition to support making a major change in road funding. In a 2019 Reason Foundation policy paper, a co-author of this policy brief suggested two elements of such a value proposition:

[14] Robert W. Poole, Jr., “How a State Could Transition from Per-Gallon Taxes to Per-Mile Charges,” Reason Foundation, Sept. 17, 2019), https://perma.cc/JK24-XUR7.

Most proposals to replace the fuel tax with an MBUF only focus on the fuel tax’s declining revenues, since a large fraction of vehicles will be using less or no fuel in the coming decades. But this hundred-year-old tax has other shortcomings. If Michigan and other states are going to replace it with a better funding source, the MBUF should be designed to fix the shortcomings of the fuel tax. Here is a brief explanation of those shortcomings.

As discussed in a previous section, it is likely that Michigan’s fuel tax revenue will face downward pressure that will intensify with time. Average fuel efficiency is expected to continue to increase, driven by a combination of consumer demand and federal mandates on automakers. All else equal, increased fuel efficiency leads to less fuel tax revenue. More electric vehicle use will put additional downward pressure on this revenue, as owners of these vehicles pay nothing in fuel taxes. The higher registration fees the state charges for electric vehicles will not make a substantial difference to this future revenue decline.

As the projections generated for this report show, Michigan policymakers would need to hike the fuel tax rate substantially to maintain a sufficient and dedicated revenue stream that would enable the state to put roads back together faster than they fall apart. Recent history suggests that such tax hikes are likely to be unpopular with voters. Given these limitations of the current fuel tax, state policymakers should look to MBUFs to secure a long-lasting and stable source of road funding for the future.

When you pay for utility services, such as electricity, water, telecommunications, etc., you get a bill from your provider that reports how much you used, the rate charged per amount used and the total you owe. You know how much you used and the basis on which you were charged, as well as the identity of the service provider. With road funding, however, how much you paid and the identity of the provider are not easy to keep track of.

In “Rethinking America’s Highways,” a co-author of this policy brief showed that several years ago the average U.S. household paid just $46 per month in federal plus state fuel taxes — far less than it paid for other utilities. For instance, electricity for the average household cost $107 per month at that time.[15] Further, drivers often do not know what entity owns which roadways and therefore whom to hold accountable for problems. Many people think the federal government owns the Interstate highways rather than the states, or that cities own roads that are owned by the county road commission. In Michigan, all township roads, including subdivision roads, are owned and maintained by the county road commission, not the township government. The township government often erroneously gets blamed when the road doesn’t get plowed or potholes don’t get filled.

[15] Robert W. Poole, Jr., “Rethinking America’s Highways” (University of Chicago Press, 2018), 182.

In Michigan, the average state gas tax works out to about one cent per mile, assuming the typical vehicle gets an average of 24.9 mpg, which is the nationwide average. This cost is the same whether someone drives mostly on county roads, city streets or major highways. However, the cost of building and maintaining a lane-mile of an expressway is several times more than that for a lane-mile of county road or local city street.[16]

The gas tax and diesel tax rates are also the same in Michigan, despite semitrucks doing considerably more pavement damage than passenger vehicles. According to the Congressional Budget Office, a passenger car causes minimal pavement damage compared to a semitruck, which is estimated to cause $0.21 in pavement damage per mile to rural roads and $0.66 in pavement damage per mile to urban roads.[17] Semitrucks in Michigan do pay a higher vehicle registration fee and purchase larger quantities of fuel, but they pay the same fuel tax rate as everyone else. A better user fee would charge heavier vehicles, such as semitrucks, more than passenger cars, as they do considerably more damage to roads. Different rates could be applied to roads based on the cost to build, maintain and eventually replace them. Driving on an expressway would carry a higher per-mile charge than driving on a county road or city street.[*]

[*] Rates could also be differentiated based on peak use of roads. Higher rates could be charged, for instance, when using an expressway during rush hour. This would encourage drivers to use alternative routes or modes of travel during these periods, reducing congestion on the roadways.

[16] “24th Conditions & Performance Report” (U.S. Department of Transportation), pages “TypRurPvmtCostsPerLM_2018-07-26” and “TypRurCapcCostsPerLM_2018-09-28.”

[17] “Alternative Approaches to Funding Highways,” Congressional Budget Office, March 2011), 8, https://perma.cc/8L3A-FUBK. Note that amounts were originally reported in 2000 dollars but were converted to September 2021 dollars.

As previously discussed, the original premise of state fuel taxes was that payment of them would be made in proportion to the benefits received from the roads. This assumes that fuel tax revenues would be used solely to build, maintain, expand and repair public roads. This principle has eroded over the last 40 years, at both the state and federal level.

About 23% of the federal Highway Trust Fund is used for purposes other than the roads.[18] In Michigan, fuel tax revenue is siphoned off for a variety of purposes, such as the Comprehensive Transportation Fund. It funds local public transit, functions of the Secretary of State and the Economic Development Fund, which in turn sponsors narrow transportation improvements for various special interests.[19] Michigan collected a total of $3.17 billion in fuel taxes and vehicle registration fees in 2020, yet only $2.92 billion was distributed to fund state, county, city or village roads.[20] Thus, Michigan diverts 8% of its gas tax and vehicle registration revenue for purposes other than publicly accessible roads, leading Michiganders to think of the gas tax as “just another tax” they pay. A revenue source such as this meets the legal definition of a tax, not a user fee, and this is one of the fuel tax’s biggest faults.

Michigan also collects a sales tax on gasoline purchases, which is not a user tax. A large fraction of that revenue is spent on public schools. Making motorists pay a portion of their taxes to public schools is far removed from an efficient, user-based tax system, and policymakers should consider eliminating it. Further, when gasoline consumption declines, so will the sales tax revenue from those sales, so legislators may want to come up with a replacement. Since public schools exist throughout the state, it would be more appropriate to use revenue from a broader based tax for this purpose, rather than continuing to single out motorists to financially support public education.

[18] Robert Poole and Adrian T. Moore, “Restoring Trust in the Highway Trust Fund” (Reason Foundation, Aug. 3, 2010), https://perma.cc/9WLB-LX2L.

[19] Chris Douglas, “Roads in Michigan: Quality, Funding and Recommendations” (Mackinac Center for Public Policy, 2018), 11-12, https://perma.cc/EX7R-P8LU.

[20] “Schedule A of the Act 51 Annual Report for 2020” (Michigan Department of Transportation), https://perma.cc/Q42J-3CZB.

When you pay a utility bill, you are paying for the costs of the services used, and no more. Utility bills are true user fees, as the revenue raised comes from the users of the service, and it is spent only on the capital and operating costs of the service provided by the utility. The “bill” for road repairs and maintenance, on the other hand, does not get paid solely by users of roads. The state forces people who never drive to nevertheless support them by devoting resources to roads that could be used for other public purposes. In addition, a portion of what drivers pay at the pump does not support roads — for instance, portions go to support public transportation, subsidies for certain businesses and public schools.

Imagine starting with a clean sheet of paper to design a MBUF model that addresses all the above shortcomings, making it more like paying a utility bill than just another tax. It would have the following attributes:

State transportation agencies, such as the Michigan Department of Transportation, are understandably concerned about the coming decline in fuel tax revenues, and legislators will share that concern once the magnitude of the problem becomes apparent. Taxpayers, especially Michiganders who are paying more than they used to in fuel taxes, may not be receptive of a new system for securing and increasing government revenue. In some states where MBUF pilot programs have been carried out, some grassroots groups have attacked the idea as “yet another tax increase.”[21]

MDOT and others concerned about the future of Michigan’s roads should not make revenue shortfalls the primary rationale for the transition from taxing gallons of fuel purchased to charging per mile driven. Instead, the focus should be on maintaining a steady source of revenue for roads into the future. With recent increases in road funding over the last several years, the state is getting close to point where it can put roads together faster than they fall apart. This achievement, however, is threatened by the prospects of future declines in fuel tax revenue.

In the 2015 FAST Act, Congress asked the Transportation Research Board of the National Academy of Sciences to convene an expert committee to study the future of the Interstate Highway System. The committee’s 596-page report was released in December 2018.[22] Among its main findings were the following:

In its recommendations, the TRB committee suggested a repeat of the original 90% federally funded program that built the Interstate system, which would require raising and spending an average of $57 billion per year for the next 20 years (totaling about $1.1 trillion). This would require a substantial increase in federal gasoline and diesel taxes, which is highly unlikely to be politically popular. The committee’s report also discussed the possibility of financing this huge set of projects with toll revenues, which would require amending the 1956 federal law to permit the use of tolls on the 90% of the Interstate system where tolling is generally not allowed, since those Interstates were constructed using federal funds instead of state toll revenues (such as the Indiana Toll Road and the Ohio Turnpike).

A 2019 Reason Foundation policy study responded to the TRB committee’s report, recommending the toll-financed approach to rebuilding and selective widening of the Interstates.[23] It also proposed that each state that decided to take this approach could use it to begin the transition from per-gallon taxes to per-mile charges.

As fuel tax revenues decline in the future, Michigan and other states should begin to phase this tax out and replace it with per-mile charges to fund these projects. The limited-access system (Interstates and freeways) would be the easiest place to begin this transition, because (1) electronic tolling, such as the 16-state E-ZPass system, is widely used and widely accepted, and (2) per-mile charges on these specific corridors would provide a bondable revenue stream to pay for the reconstruction and modernization of these aging highways.

Michigan’s state trunkline road system — roads designated with an “I,” “US” or “M” — make up 8% of the route miles in Michigan, but they carry 53% of all passenger traffic and 70% of all truck traffic.[24] Interstate highways and freeways in Michigan are limited access, where vehicles can conveniently travel at higher speeds given the lack of intersections and potential interruptions. Some US and M roads are also limited access, and the remaining roads are at-grade, open-access surface streets. Michigan does not have tolls except for several toll bridges, such as the Ambassador and Mackinac bridges.

However, tolling is currently being studied for rebuilding Michigan’s Interstates.[25] MDOT is examining the feasibility of using toll-revenue financing to rebuild and modernize its Interstates. When the study is completed in 2022, MDOT should have an inventory of the condition and performance of each of its Interstate highways, an estimate of the likely traffic and revenue that would result from them being tolled, and the costs and benefits of having an updated Interstate system as a result. Individual Interstates could be rebuilt one by one, and as each corridor or segment was completed, per-mile charging could begin.[*]

Consistent with the premise that a state MBUF will replace Michigan’s current fuel taxes, those who use the rebuilt and newly tolled interstates would receive a rebate on the fuel taxes they would still pay at the pump, based on how much they drove on the rebuilt corridors. This should eliminate concerns about “double taxation” that are raised by highway user groups, especially the trucking industry. And by demonstrating that the first roads converted to MBUFs will not be subject to fuel taxes, this approach will yield public confidence that future conversions of other roads will also replace the paying of fuel taxes.

Fuel tax rebates could be calculated using the same data used to charge the per-mile rate to drivers, perhaps using a system similar to E-ZPass. The number of miles driven on the rebuilt Interstate for which the MBUF was charged could be divided by the average fuel economy for the vehicle make and model. That would calculate the estimated number of gallons purchased to drive on an MBUF-charged roads. Multiplying that number by the fuel tax rate would result in the rebate amount due to each driver who paid a MBUF. The total rebate for the year could be sent to the motorist at once per year or on a more frequent basis, such as quarterly. Something much like this is already available to trucking companies using the Massachusetts Turnpike and the New York Thruway, both of which are tolled. A trucking service company called Bestpass handles processing rebates of the highway usage taxes as part of its management of companies’ toll accounts.[26]

Graphic 6 uses data from the Federal Highway Administration to identify how much of Michigan’s vehicle miles of travel is provided by limited-access highways (such as Interstates and freeways), state highways and arterials, and local roadways. As the table shows, 32% of all VMT in Michigan occurs on limited-access highways; thus, converting those roads to per-mile charges would shift 32% of all Michigan travel from the state fuel tax to per-mile charges.

Graphic 6: Michigan Vehicle Miles of Travel by Type of Roadway, 2019

| Roadway Type | VMT (millions) | Percent of Total |

| Limited-Access Highways | ||

| Interstates, rural | 5,784 | |

| Interstates, urban | 17,727 | |

| Other freeways & expressways, urban | 6,485 | |

| Other freeways & expressways, rural | 2,827 | |

| Subtotal, Limited-Access Highways | 32,823 | 32.1% |

| State Highways & Arterials | ||

| Other principal arterials, rural | 4,357 | |

| Other principal arterials, urban | 17,630 | |

| Minor arterials, rural | 6,920 | |

| Minor arterials, urban | 15,945 | |

| Major collectors, rural | 8,307 | |

| Subtotal, State Highways & Arterials | 53,159 | 52.0% |

| Local Roads | ||

| Minor collectors, rural | 866 | |

| Local roads, rural | 2,222 | |

| Major collectors, urban | 5,205 | |

| Minor collectors, urban | 102 | |

| Local roads, urban | 7,797 | |

| Subtotal, Local Roads | 16,192 | 15.8% |

| Total Michigan VMT | 102,174 | 100.0% |

Source: Federal Highway Administration, Highway Statistics, Table VM-2.

[*] Revenue bonds would have been issued in advance, to pay for reconstruction and any needed lane additions, such as possibly dedicated truck lanes on those interstates with the highest projected truck traffic.

[21] For example, see Carl DeMaio, “New Tax on Your Mileage,” email blast to California taxpayers, May 22, 2019.

[22] “Renewing the National Commitment to the Interstate Highway System” (Transportation Research Board, December 2018), https://perma.cc/PJY6-TLRD.

[23] Robert W. Poole, Jr., “The Case for Toll-Financed Interstate Replacement” (Reason Foundation, March 2019), https://perma.cc/94TS-2CTM.

[24] “Fast Facts 2021” (Michigan Department of Transportation, February 2021), https://perma.cc/V3CX-SPS6.

[25] Chanel Stitt, “Whitmer Gives Michigan Department of Transportation Green Light to Study Toll Roads” (Detroit Free Press, July 9, 2020), https://perma.cc/RH9R-CBCF.

[26] For more information, see “Toll Management for Fleets” (BestPass, Inc., 2022), https://perma.cc/5T4Y-CQ9A.

Converting limited-access highways first will provide breathing room for Michigan policymakers, because as each Interstate and freeway segment is converted to per-mile charges, that portion of the overall roadway system will become self-supporting, no longer depending on fuel tax revenue. Therefore, the state highway funding system will not have to draw as much on the shrinking fuel tax revenue to rebuild and maintain those costly and indispensable highways.

This breathing room will permit policymakers to learn from the successes and failures of states that might seek to convert their entire roadway system and all vehicles to MBUFs at the same time. By the time Michigan is ready to design an MBUF system for all other roads, far more information about what works and what doesn’t will be available. Moreover, 15 or 20 years from now, better technology may exist to collect, store and report miles traveled at much lower cost and with enhanced privacy protections.

Nevertheless, since the need to transition from per-gallon to per-mile is still a relatively new idea in Michigan, it would make sense for the state to take part in one of the partially federally funded MBUF pilot projects, as a growing number of other states are doing. These programs have shown what features work well, specifically by acquainting roadway users to MBUFs and addressing some of the concerns noted earlier. Here are a few of the characteristics that have proven successful:

Among the ways to record miles of travel that have been offered to participants in state pilot projects are the following:

It is important to note that satellite-based GPS does not “track” anyone. GPS signals permit the vehicle’s computer or its operator to know where the vehicle is at any given time. That information can be stored on the vehicle, but it would only be uploaded, along with total miles driven, if that is what the customer signed up for. It would operate like a GPS receiver in a smartphone, which lets the phone’s owner know his or her device location at any time but does not transmit that information to anyone else without the owner’s permission. A separate communications capability (cellular, Wi-Fi) would have to be connected to the GPS receiver in order to transmit location information to another party wirelessly.

Regardless of what reporting method is used, stringent privacy protection for that data must be ensured by statute. Adrian Moore, vice-president of the Mileage-Based User Fee Alliance, suggests these key privacy provisions:

Ideally, MBUFs would be different for miles traveled on different types of roads — with higher charges for the costly, limited-access highways and lower charges for other roads which cost far less to build and maintain. However, a system like this would require very precise data, such as that provided by GPS. An alternative system using less precise data could involve calculating the funding needed for the roads of each type and dividing that by the projected miles traveled on them in a year to arrive at an average per-mile fee that is then assessed via an odometer reading or other method.

The idea is to provide a transparent system under which motorists know who provides which set of roads they use and what the per-mile charge is for each type of road, like a utility bill that everyone is familiar with. Figure 6 provides a sample Roadway Utility Statement. This concept assumes an annual statement comparable to a property tax bill, but it would also be possible for people to pay their road bills in quarterly or monthly installments.

Graphic 7: Sample Roadway User Fee Statement

The hypothetical bill in Graphic 7 shows different per-mile rates for limited-access highways (perhaps operated by roadway utility companies franchised by the state), state highways provided by MDOT and county roads provided by a county road commission. Motorists would be billed directly by the utility companies, and the rates might differ for different limited-access highways. State-provided highways generally cost more than local roads, so MDOT’s rate depicted here is higher than that for county roads. For this hypothetical example, the bill shows total miles driven in the year, but since the utility companies are assumed to do their own billing (as do toll road utilities in Illinois, Indiana and elsewhere), the amount due on this bill is only for use of state and county roads.

[27] Adrian Moore, email correspondence with Robert W. Poole, Jr., Feb. 24, 2022.

A transition from per-gallon fuel taxes to a mileage-based user fee system should be considered as a strategy to ensure adequate road funding for Michigan’s future. This shift would apply to both gasoline taxes and diesel taxes. The objective should be not only to replace the former fuel tax revenue but also to remedy a number of other fuel tax shortcomings: their lack of transparency, lack of accountability of road providers to road users, and the fact that the current fuel tax works less like a user fee and more like just a conventional tax. The transition should focus on the benefits of improving Michigan’s aging and ailing highways as critically important to the state’s economic competitiveness.

The shift from fuel taxes to per-mile charges should be gradual. The best place to start is with the limited-access highways, such as Interstates and other urban freeways. They could be converted to the MBUF system as a way to finance their reconstruction and modernization, via issuing revenue bonds based on the projected user-fee revenues. The charges would be collected using a system such as the widely used and accepted E-ZPass, which uses prepaid accounts linked to windshield-mounted transponders in most cases. Customers would receive rebates based on the estimated fuel taxes they paid for the miles driven on roads using a MBUF. This would demonstrate that MBUFs are to be the replacement for fuel taxes, not an additional charge.

Converting the limited-access highways first would avoid many of the problems likely to be encountered by the pioneer states that attempt to convert all roads to MBUFs at the same time. Converting limited-access roads first would enable MDOT to avoid having to use decreasing fuel tax revenues for the very important tasks of rebuilding and then maintaining its Interstates and freeways. Over the next decade or two, MDOT could use most of its gas tax revenue on non-limited-access state and county roads, to bring them up to a state of good repair.

By temporarily deferring conversion of these other roads to per-mile charges, Michigan could learn from the successes and failures of other states, as they use current MBUF technologies to convert all their roads. A decade or two from now, there will likely be better technologies and processes available for recording and reporting miles driven. In addition, much larger numbers of participants in other states should lead to reductions in the unit cost of processing mileage-based transactions.

In the near term, it would be wise for the state Legislature and MDOT to plan for Michigan to take part in one of the federally funded MBUF pilot projects. It would be timely to have such a pilot project under way in the months following the release of the forthcoming MDOT study on toll-financed reconstruction of interstates and other limited-access highways. The pilot project would introduce a cross section of the population (and potentially some elected officials) to the case for transitioning from the gas tax to per-mile charges. It would also support the case for starting the transition with proven technology and the modernization of Michigan’s most important highways.

©2022 by the Mackinac Center for Public Policy and Reason Foundation

Reason Foundation advances a free society by developing, applying, and promoting libertarian principles, including individual liberty, free markets, and the rule of law.

The Mackinac Center for Public Policy is dedicated to improving the understanding of economic and political principles among citizens, public officials, policymakers and opinion leaders. The Center has emerged as one of the largest and most prolific of the more than 50 state-based free-market “think tanks” in America. Additional information about the Mackinac Center and its publications can be found at www.mackinac.org.

Additional copies of this report are available for order from the Mackinac Center.

For more information, call 989-631-0900, or see our website, www.mackinac.org.

Chris Douglas is an associate professor of economics at the University of Michigan Flint, where he has been on faculty since 2007, and a member of the Mackinac Center for Public Policy’s Board of Scholars. He earned his B.S. in electrical engineering and his B.S. in economics from Michigan Technological University in 2001, and his Ph.D. in economics from Michigan State University in 2007. Dr. Douglas teaches Principles of Microeconomics, Principles of Macroeconomics, International Economics, Public Finance, Quantitative Methods, and Sports Economics. His research has been published in several academic journals as well as by the Mackinac Center.

Robert Poole is director of transportation policy at the Reason Foundation. He received his B.S. and M.S. in mechanical engineering from MIT. His 1988 Reason policy study invented the concept of express toll lanes, and he helped Caltrans introduce the first such project during 1990-95. Today there are more than 60 such facilities in operation nationwide. He has advised the U.S. Department of Transportation and half a dozen state DOTs on transportation issues. In 2003-04, he was a member of the Transportation Research Board’s special committee on the long-term viability of fuel taxes for highway funding. He served many years on the TRB standing committees on congestion pricing and managed lanes. Poole writes a monthly column on transportation policy for Public Works Financing and publishes the monthly Reason e-newsletter Surface Transportation Innovations. His book, “Rethinking America’s Highways,” was published in 2018 by the University of Chicago Press, with a paperback edition released in 2021.

[1] Joseph R. Biden Jr. “Executive Order on Protection Public Health and the Environment and Restoring Science to Tackle the Climate Crisis” (The White House, Jan. 20, 2021), https://perma.cc/2J52-ADFQ.

[2] “Our Path to an All-Electric Future” (General Motors, 2022), https://perma.cc/U2Q4-VC86; David Shepardson, “GM Aims to End Sale of Gasoline, Diesel-powered Cars, SUVs, Light Trucks by 2035,” (Reuters, Jan. 28, 2021), https://perma.cc/MER9-2BJA.

[3] “The Fuel Tax and Alternatives for Transportation Funding, Special Report 285,” (Transportation Research Board of the National Academies, 2006), https://perma.cc/M7VT-8GJQ.

[4] Martin Schultz and Robert D. Atkinson, “Paying Our Way: A New Framework for Transportation Finance,” National Surface Transportation Infrastructure Financing Commission, Feb. 24, 2009, https://perma.cc

[5] “Electric Vehicle Outlook 2021” (Bloomberg New Energy Finance, 2021), https://perma.cc/4WTX-8BTC.

[6] “Annual Energy Outlook 2021” (U.S. Energy Information Administration, Feb. 3, 2021), https://perma.cc/MVQ4-8VGA.

[7] MCL § 257.801(7)-(8).

[8] Asha Weinstein Agrawal, Hilary Nixon and Ashley M. Hooper, “Public Perception of Mileage-Based User Fees” (Transportation Research Board, 2016), https://perma.cc/6XTS-4RHR.

[9] For example, see Katy Grimes, “Big Brother in your car?” (CalWatchdog.com, April 8, 2010), https://perma.cc/X89G-V4Q2.

[10] For example, see Carl DeMaio, “New Tax on Your Mileage,” email blast to California taxpayers, May 22, 2019.

[11] “Historical Highest Marginal Income Tax Rates” (Tax Policy Center, Feb. 4, 2020), https://perma.cc/BWL6-Y9UK.

[12] Paul Egan and Kathleen Gray, “Michigan Voters Soundly Reject Proposal 1 Road Tax Plan” (Detroit Free Press, May 5, 2015), https://perma.cc/Z5ZT-V99P.

[13] Kathryn Jones and Maureen Bock, “Oregon’s Road Usage Charge: The OReGO Program, Final Report” (Oregon Department of Transportation, April 2017), chapter 8, https://perma.cc

[14] Robert W. Poole, Jr., “How a State Could Transition from Per-Gallon Taxes to Per-Mile Charges,” Reason Foundation, Sept. 17, 2019), https://perma.cc

[15] Robert W. Poole, Jr., “Rethinking America’s Highways” (University of Chicago Press, 2018), 182.

[16] “24th Conditions & Performance Report” (U.S. Department of Transportation), pages “TypRurPvmtCostsPerLM_2018-07-26” and “TypRurCapcCostsPerLM_2018-09-28.”

[17] “Alternative Approaches to Funding Highways,” Congressional Budget Office, March 2011), 8, https://perma.cc/8L3A-FUBK. Note that amounts were originally reported in 2000 dollars but were converted to September 2021 dollars.

[18] Robert Poole and Adrian T. Moore, “Restoring Trust in the Highway Trust Fund” (Reason Foundation, Aug. 3, 2010), https://perma.cc/9WLB-LX2L.

[19] Chris Douglas, “Roads in Michigan: Quality, Funding and Recommendations” (Mackinac Center for Public Policy, 2018), 11-12, https://perma.cc/EX7R-P8LU.

[20] “Schedule A of the Act 51 Annual Report for 2020” (Michigan Department of Transportation), https://perma.cc/Q42J-3CZB.

[21] For example, see Carl DeMaio, “New Tax on Your Mileage,” email blast to California taxpayers, May 22, 2019.

[22] “Renewing the National Commitment to the Interstate Highway System” (Transportation Research Board, December 2018), https://perma.cc/PJY6-TLRD.

[23] Robert W. Poole, Jr., “The Case for Toll-Financed Interstate Replacement” (Reason Foundation, March 2019), https://perma.cc/94TS-2CTM.

[24] “Fast Facts 2021” (Michigan Department of Transportation, February 2021), https://perma.cc/V3CX-SPS6.

[25] Chanel Stitt, “Whitmer Gives Michigan Department of Transportation Green Light to Study Toll Roads” (Detroit Free Press, July 9, 2020), https://perma.cc/RH9R-CBCF.

[26] For more information, see “Toll Management for Fleets” (BestPass, Inc., 2022), https://perma.cc

[27] Adrian Moore, email correspondence with Robert W. Poole, Jr., Feb. 24, 2022.